Let’s start this piece by getting you in the right mind set. Think of how you buy and occasionally sell anything in your life. Once your mind is in there, continue reading…

Wal – Mart, Tesco, Costco, Sam’s Club, just to name a few. These are some of the biggest retailers in the world, huge operations that make fortunes in revenue. How do they do it? What is their big secret? Simple, at the end of the day, they have mastered two simple things. First, buying at wholesale prices and selling at retail prices. Second, they have mastered the marketing game. Wait, this is supposed to be an article on investing so why write about the retail world of gadgets, clothes, and appliances? It’s an important topic if you want to understand how to be a consistently profitable investor and achieve your financial goals. Their buying and selling actions in the markets they operate in are no different than the actions of the astute investor buying stock. For you to be successful, you need to learn to properly think the market place you’re buying and selling in, just like Costco does.

Let’s get more specific so that you can become a better investor by the end of this article. For Costco to profit, they have to make sure that there are many willing buyers to pay the retail prices they are charging. When we invest our hard-earned money into the stock market, we must do exactly the same thing to take profits. We need buyers who are willing to buy stock from us at the retail (supply) price levels we are charging. How does Costco get you to pay their retail prices? There are many ways, but let’s start with a look at the Costco sign above. This sign is in huge letters at the front of every Costco and on every piece of marketing material. Notice the word in blue that is a part of every Costco sign, “wholesale”. Why do you think that word is there? There is one reason and one reason only… To get you to think you are paying wholesale prices so that you actually walk in the store and pay their retail prices. In short, the word “Wholesale” is an invitation to get you to pay a retail price. Never forget, they buy at Wholesale prices and sell at retail prices, not the other way around. As an astute investor, you need to understand how to do this in the markets. Costco is really good at buying at wholesale prices which is why they perform so well as a company. Do you focus on buying stocks for your portfolio at deep discount wholesale prices? If not, why not? Wall Street certainly does and you can too.

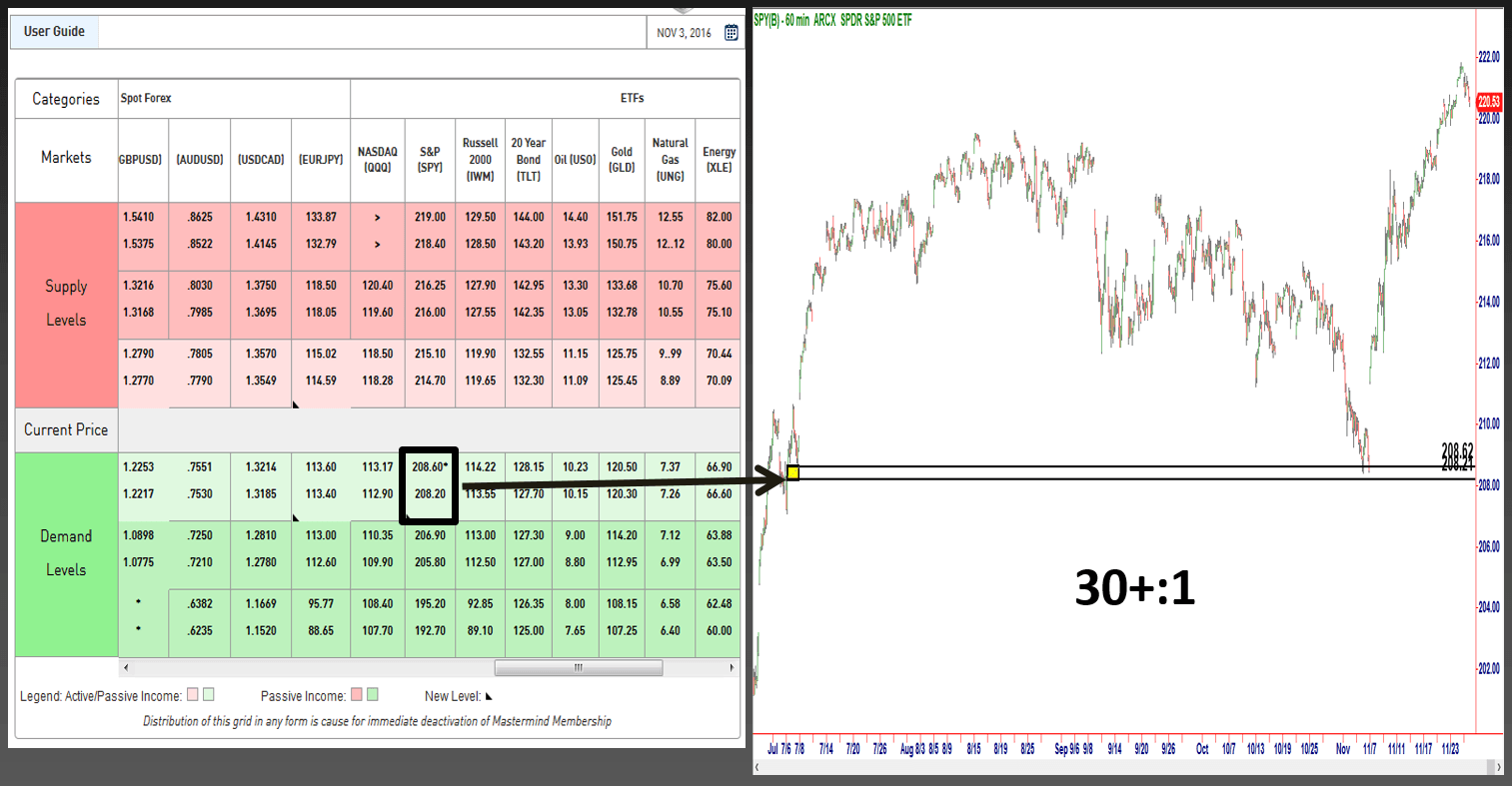

Take the opportunity below from our OTA Global Supply and Demand Grid. This was a recent buying opportunity the grid offered us in the US Stock market (S&P). The yellow box is a demand zone. This is a price level that according to our rule based strategy had much more demand than supply, banks were buying there. Another word for a demand is “wholesale” and for supply, is “retail”. Shortly after identifying that level, price declined down to our pre-determined demand (wholesale) level which means people were convinced S&P was worth selling at our wholesale price. After they sold at demand (our buying opportunity), price rallied as it should and we were able to sell higher, profiting from this trade or investment.

OTA Supply/Demand Grid: S&P (SPY) Buying Opportunity

Take a good look at the chart, and specifically look at the demand level and then the decline into it followed by the rally. We are looking at S&P prices. That picture is the same picture of price movement as Costco buying something and then selling to the retail public at retail prices, higher. Whether we are talking the S&P or a Costco product, the chart is identical. Just like the retail store, you must know what wholesale prices look like on a price chart (our rule based strategy) and then have the patience and discipline to wait for price to decline to that level to buy stock.

As a market speculator, you really do have a retail operation going at your home if you think about it. Good traders and investors know price levels that are too low (demand/wholesale) and price levels that are too high (supply/retail). They buy at wholesale prices from people who are trained, conditioned and willing to sell at wholesale prices. They also sell at retail prices to buyers who are trained, conditioned and willing to buy at retail prices. Then, they just repeat the same simple process over and over for the entire life of their trading or investing career. Try not to over think this and keep it simple.

Hope this was helpful, have a great day.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

Gold plunges on sudden US Dollar demand

Gold drops markedly on Thursday, challenging the $4,900 mark per troy ounce following a firm bounce in the US Dollar and amid a steep sell-off on Wall Street, with losses led by the tech and housing sectors.

EUR/USD turns negative near 1.1850

EUR/USD has given up its earlier intraday gains on Thursday and is now struggling to hold above the 1.1850 area. The US Dollar is finding renewed support from a pick-up in risk aversion, while fresh market chatter suggesting Russia could be considering a return to the US Dollar system is also lending the Greenback an extra boost.

GBP/USD change course, nears 1.3600

GBP/USD gives away its daily gains and recedes toward the low-1.3600s on Thursday. Indeed, Cable now struggles to regain some upside traction on the back of the sudden bout of buying interest in the Greenback. In the meantime, investors continue to assess a string of underwhelming UK data releases released earlier in the day.

LayerZero Price Forecast: ZRO steadies as markets digest Zero blockchain announcement

LayerZero (ZRO) trades above $2.00 at press time on Thursday, holding steady after a 17% rebound the previous day, which aligned with the public announcement of the Zero blockchain and Cathie Wood joining the advisory board.

A tale of two labour markets: Headline strength masks underlying weakness

Undoubtedly, yesterday’s delayed US January jobs report delivered a strong headline – one that surpassed most estimates. However, optimism quickly faded amid sobering benchmark revisions.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.