It is hard to tell where to invest in unsettled markets. There have rarely been times as unsettled as these, as a perusal of any day’s news will show. Markets soar and sink with every headline and tweet. Trying to punt by keeping all our money in cash seems to be a self-defeating option with the historically low interest rates we are experiencing.

The nearest parallel to today’s economic environment is the late 1920s and early 1930s, when a rolling thunder of competitive currency devaluations and retaliatory tariffs led to the collapse of the international trade system and eventually much worse. Could it happen again? There is no way to know for sure.

Which Assets Will Hold Value in Volatile Markets?

What we do know is that some assets will retain some value as long as there is a civilization; and that their prices will fluctuate differently. Unfortunately, we can’t know in advance which ones will be the best at holding or increasing their values. However, a long history does suggest that in combination, the big four asset classes, as I’ve just decided to call them – cash, stocks, bonds, and gold – have held up remarkably well as a group, even when some of them have had big drops.

Holding a portfolio with a combination of cash, stocks, bonds and gold, when properly re-balanced periodically, has proven to be a good strategy for maintaining value through all kinds of economic situations.

Pros and Cons of Holding Cash

Pros: There is no price risk with cash and it offers the ultimate amount of liquidity and returns rise in times of rising interest rates, with little lag.

Cons: Cash typically offers low returns, especially in times of low interest rates. Often, after taxes, returns are actually negative.

Pros and Cons of Holding Stocks

Pros: Stocks typically offer the highest average return of all asset classes. Though stocks may suffer losses, corporate influence and the way the system is designed makes likely that drops in the stock market will only be temporary.

Cons: Sometimes temporary drop in the stock market is a long time, on the time scale of an individual investor and there can be extreme volatility in the short run which could wreak havoc on returns as well.

Pros and Cons of Holding Long-term U.S. Government Bonds

Pros: U.S. Government Bonds have little to no risk of default, values often are counter-cyclical with stocks and they can generate some cash flow.

Cons: U.S. Government Bonds usually only offer only modest returns compared to stocks and are subject to some volatility.

Pros and Cons of Holding Gold

Pros: Historically (over 2,000+ years of history), gold has preserved its purchasing power through good times and bad, and the rise and fall of currencies and governments. The price movements in the gold market have no persistent correlation to those of stocks or bonds. Gold is convenient and liquid if held in the form of ETF shares.

Cons: Gold has no cash flow and there are costs associated with storage and security if it is held physically.

A Simple Portfolio for Volatile Markets

A simple and low-intensity way to invest is initially to combine the Big Four in equal parts, by selecting an exchange-traded fund (or mutual fund if in an employer’s 401(k) representing each one; and then leave them alone for a year. At the end of the year, add up the total values of the four funds and divide by four. Re-balance each fund to that value by selling or buying shares as necessary. Go away for another year. Rinse and repeat.

This strategy has the virtues of simplicity, ease of use, and low transaction costs. If we believe in it and resist the temptation to fuss over it, we could completely avoid the day-to-day anxiety of market gyrations.

So, can we believe in it?

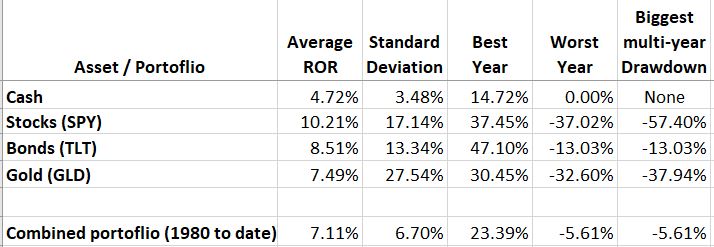

Over the last forty years, for which we have good detailed historical data, a portfolio like this had these characteristics. The individual assets’ own values are also shown for comparison.

For the period, the combined portfolio never had more than one losing year in a row. The one big losing year was 1981, when it lost 5.61%. That year was bracketed by years in which it gained 13% and 23%; and in no other year did the combined portfolio ever drop by more than 2.75%.

This lack of drama for the portfolio as a whole is in stark contrast to the worst-year and multiyear-drawdown figures for the individual components, which individually had worst-year drops of 13% to 37%. This is the power of diversification.

There are more exciting, and potentially more profitable, approaches to investing. But for ease, simplicity and a low stress level, this one could be hard to beat.

Read the original article here - A Simple Portfolio for Uncertain Times

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

EUR/USD bounces off lows, back to 1.1860

EUR/USD now manages to regain some balance, retesting the 1.1860-1.1870 band after bottoming out near 1.1830 following the US NFP data on Wednesday. The pair, in the meantime, remains on the defensive amid fresh upside traction surrounding the US Dollar.

GBP/USD rebounds to 1.3660, USD loses momentum

GBP/USD trades with decent gains in the 1.3660 region, regaining composure following the post-NFP knee-jerk toward the 1.3600 zone on Wednesday. Cable, in the meantime, should now shift its attention to key UK data due on Thursday, including preliminary GDP gauges.

Gold stays bid, still below $5,100

Gold keeps the bid tone well in place on Wednesday, retargeting the $5,100 zone per troy ounce on the back of humble gains in the US Dollar and firm US Treasury yields across the curve. Moving forward, the yellow metal’s next test will come from the release of US CPI figures on Friday.

Ripple Price Forecast: XRP sell-side pressure intensifies despite surge in addresses transacting on-chain

Ripple (XRP) is edging lower around $1.36 at the time of writing on Wednesday, weighed down by low retail interest and macroeconomic uncertainty, which is accelerating risk-off sentiment.

US jobs data surprises to the upside, boosts stocks but pushes back Fed rate cut expectations

This was an unusual payrolls report for two reasons. Firstly, because it was released on Wednesday, and secondly, because it included the 2025 revisions alongside the January NFP figure.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.