Neuroeconomics/Neurofinance from a Trader’s Perspective

*This image is taken from the book Neuroeconomics: Decision Making and the Brain

In spite of many advancements in economic theories from neoclassical to behavioral economics/finance, since the 1990s and until recently, it seemed like the investment world had finally settled into computerized trading. Computerized systematic trading, also known as quants, algorithmic and automated trading, has grown in popularity since the ‘90s and is now more common and popular than the traditional/manual method of trading. Automated trading has been proving successful for many fund managers and investors for decades. However, according to a Bloomberg article, “Humans Beating Robots Most Since ‘08 as Trends Shift: Currencies,” currency funds that use computer models for trading decisions made 0.7 percent in 2013, compared with 2.3 percent for those that don’t– the biggest margin since 2008, according to data from Parker Global Strategies LLC. This research data opens the door for a reassessment of the current investing landscape.

There are many arguments against the traditional, discretionary method of trading. The most common and valid argument is that computerized trading eliminates the human emotion factor, which can negatively affect one’s trading decisions. A randomly stressful day, for example, can make a trader overly cautious. On the other hand, research on the brain chemical dopamine also indicates that a joyful day can make a trader more willing to place risky trades. But now, advances in neuroscience are allowing investors to have more insight into the brain chemistry and psychology behind trading decisions.

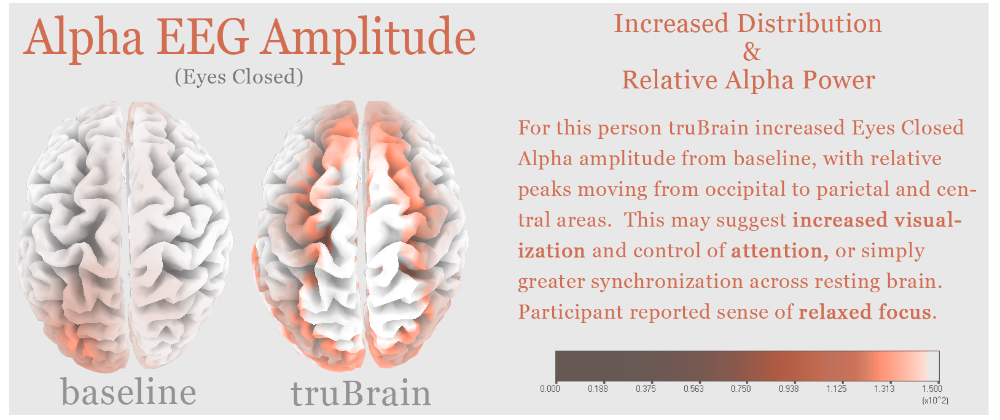

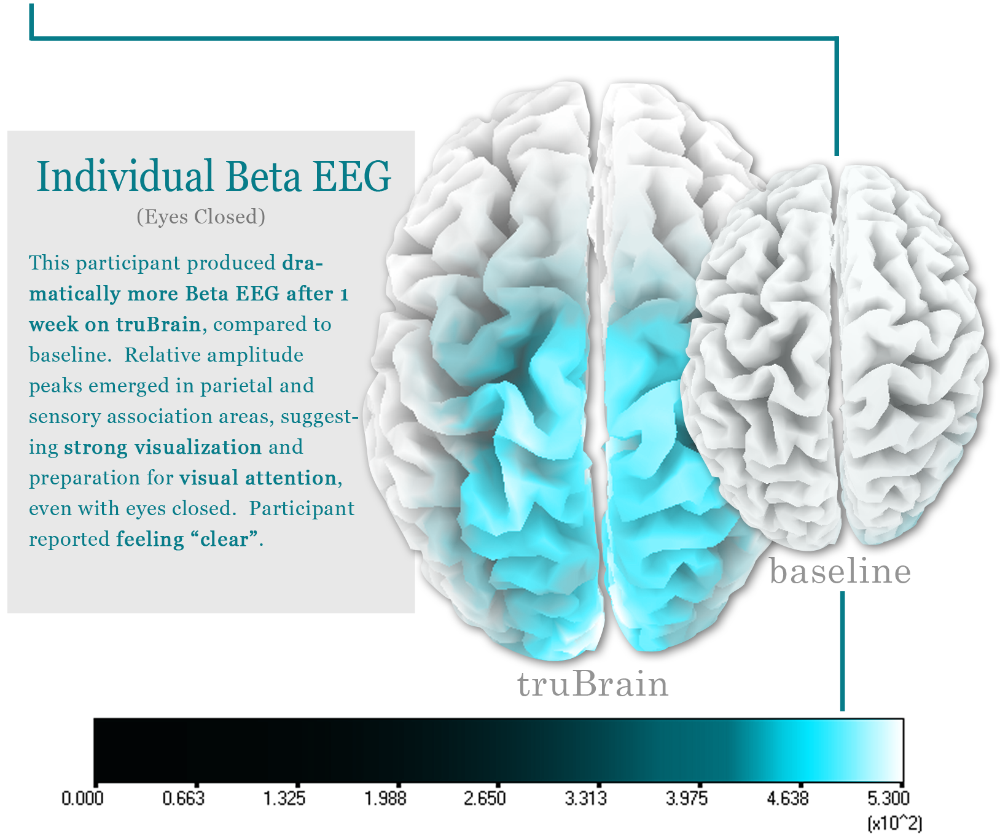

In the hunt for trading profits through neuroscience, a team of traders from Sang Lucci Capital Partners in New York flew out to the Alternative Brain Institute in LA, California last year to wear EEG electrodes. They went through two 90-minute sessions of simulated buying and selling while consuming a supplement blend by truBrain containing piracetam, a type of nootropic, or product that is reputed to enhance cognitive performance. There are no official final results from the study of those traders yet, but through truBrain’s website, we were able to access some brain imaging information regarding the effect their supplement has on the brain:

The cerebral cortex is composed of neurons that are interconnected to each other in networks and also receive inputs from other areas of the brain. Electrical activity in the form of nerve impulses being sent and received to and from cortical neurons. The electrical activity you are measuring reflects both the intrinsic activity of neurons in the cerebral cortex and the information sent to it by subcortical structures and the sense receptors. This composite activity is called an electroencephalogram or EEG.

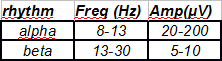

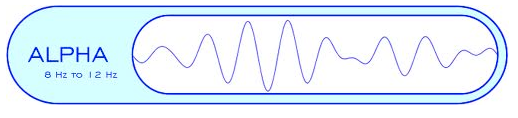

Alpha: Each region of the brain had a characteristic alpha rhythm but alpha waves of the greatest amplitude are recorded from the occipital and parietal regions of the cerebral cortex.

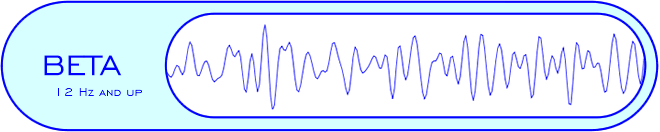

Beta: Beta rhythms occur in individuals who are alert and attentive to external stimuli or exert specific mental effort. So, the beta wave represents arousal of the cortex to a higher state of alertness or tension. It may also be associated with “remembering” or retrieving memories.

*Sources: www.psych.westminster.edu/psybio/BN/Labs/Brainwaves.

Based on the brain imaging, one can see the effect of the supplement on the brain, but it’s uncertain whether these increased neural activities could ultimately translate into successful trading results. According to experts, EEG and brain imaging can show changes and electrical activities in the brain, but it does not mean the mind is working better. Still, understanding the neural and psychological processes can help us answer this question and put things in perspective as it pertains to neuroeconomics or neurofinance.

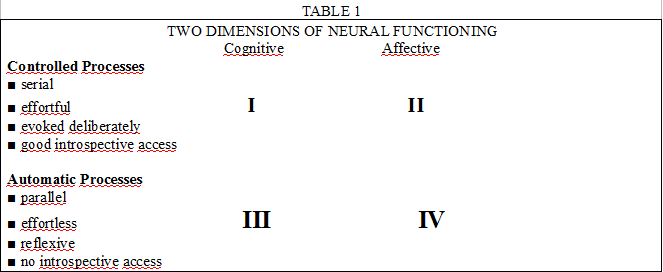

The chart above was taken from the Journal of Economic Literature, Vol. XLIII (March 2005). It demonstrates that brain mechanisms are a combination between controlled and automatic processes, operating on the cognition and affect processes. Controlled processes are deliberate mental computations: thinking about situations, evaluating and making decisions. On the other hand, automatic processes are opposite to controlled processes and are almost consciously inaccessible.

Then there are the cognitive and affective processes. The best way to describe these two in laymen’s terms is that cognitive is related to thinking and affective is related to feeling states, because at a certain threshold most affective states are feelings states. The affective processes answer the “go/no go” questions, while the cognitive processes relate to the “true/false” questions. (It is important to note that the affective processes not only relate to emotions like fear but also to motivational states like pain and anger.)

Controlled processes are performed with intention, and are used to process information when unexpected events occur, or some kind of novel challenge appears. These processes are associated with perception, attention and working memory. In other words, controlled processes are step-by-step logic computations. In contrast, automatic processes (cognitive or affective) are like the ‘default mode’ of brain operation. These processes are fast, parallel, efficient, require little cognitive effort, and do not require active control or attention. An automatic process, for instance, occurs when you have an unconscious/automatic knee-jerk reaction to touching a hot pan. Automatic processes constitute most of the electrochemical activity in the brain. The automatic and controlled processes can be illustrated by the alpha frequency range shown in the image above. Alpha waves are capable of connecting the gap between our conscious and subconscious mind. Too much alpha allows us to be too relaxed, while too little makes us anxious and stressed. The optimal amount of alpha has us in a state of mild relaxation. Beta waves, on the other hand, have high frequency and low amplitude (as shown above). The right amount of beta allows us to be consciously focused, solve problems, and have a better memory. Too little beta diminishes cognition and too much beta causes stress and anxiety. The ideal scenario is being somewhere in the middle, in a resting state where a very fast alpha is suppressed to bring beta so that your cortex can work effectively. According to Dr. Andrew Hill, the neuroscientist from the Sang Lucci study, preliminary/unofficial reports are showing that the traders in the study tended to have a lot of beta frequencies, more than the normal population. A higher beta is generally associated with people who do furious thinking and concentration for a living, like traders.

Alpha Waves are seen when we are in a relaxed state, daydreaming or visualizing state

Beta Waves are the brainwaves of our "normal" waking consciousness, of our outward attention, of logical, conscious and analytical thinking. Beta waves occur when when thinking feels clear, alert, creative and to the point.

The best way to describe controlled and automatic processes as they pertain to trading is to think of the controlled processes, when a trader first looked at a trading chart or platform. Initially, the controlled processes were needed to understand and make sense of what the numbers going up and down the chart meant, and at the same time what is a good buy or sell (true/false). At this point, the conscious mind begins to assemble data about the market. One can argue that at this stage the alpha waves become the predominant waves among the 4 other brainwaves and the trader’s alpha waves are very low (depending on the person or personality). However, after much practice, trading becomes more familiar. The unconscious mind notices the patterns from the data assembled consciously, makes the connections and guide your judgment. The proper responses have become mental/behavioral habits and automatic responses are used to perceive and interpret trading situations (go/no go or buy/sell). At this level, one can also argue that the trader’s beta waves come into action. (It is important to note that the controlled, automatic processes and alpha/beta/theta/delta waves are NOT mutually exclusive and independent. All these components work together in the decision-making process through electrochemical interactions between neurons.)

Nootropics in investing/trading

Nootropics are supplements, also known as smart drugs, that enhance cognitive performance. Piracetam is officially the world’s first known and most popular nootropic. It is widely used as a cognitive enhancer and to treat neurological diseases. Nootropics generally affect traders’ focus, concentration and memory. One of the purposes of nootropics is to act as an active agent between the automatic and controlled processes that intervenes when an extreme state of the neural processes requires an override by balancing the interaction between cognitive and affective processes like supply and demand, while keeping alpha

and beta frequency ranges optimal. As previously mentioned, alpha frequency range connects the automatic and controlled processes, which can be key to trading and investing. Most experienced, seasoned traders/investors would argue that their best trading decisions happen on the subconscious, intuitive levels, as discussed in the book The Intuitive Trader and to some extent in the popular investing book Market Wizards. Managing beta is also an important attribute that nootropics can offer to traders. A high beta, generally found in traders, is related to stress and anxiety, which ultimately results to overly cautious trading (not to mention negative health affects). Neuroscience through nootropics perhaps may allow traders to “deliberately” tap in into their intuition and automatic processes while allowing them to measure their feelings and thoughts.

Many in the financial world are skeptically curious about neuroscience. Though automated trading seems to be the norm and is currently offering some level of stability, there are still some unanswered questions and theories regarding market price fluctuations and why traders/investors make certain decisions. Perhaps the new field of neuroeconomics/neurofinance, which has barely been around for a decade, may help us answer some of those questions and some cognitive dilemmas traditional investors face when making decisions, such as impulse, fear, overconfidence, and anxiety. For instance, neuroscientific studies and research found that neural activities are different when interacting with a live person versus a machine.

The neural circuitry that is specialized in human interactions – what another human feels, believes or intends to do – is more active when interacting with another person than with a computerized system. With the influx of automated trading systems in the market, it is possible that most of the axioms and theories traditional economists or investors used to analyze market behaviors and make trading decisions, such as as greed/fear (i.e., Elliot Wave) no longer apply.

Perhaps a new form of “mental rewiring” empowered by neuroscience is required to keep up with the technological/computerized advancements in the markets. And while nootropics may not necessarily help investors or traders make successful trades, these drugs may help provide the mental sharpness needed to compete in the fast-changing market landscape driven by information technology. For example, our cerebral cortex is divided in two - the left and right cortex. The left hemisphere is considered the dominant hemisphere in most of us. We tend to favor one hemisphere over the other (mainly the left). The dominant hemisphere is generally more electrically active and the non-dominant hemisphere relatively more silent during certain difficult tasks. The two cortical hemispheres are connected by a group of nerve fibres (the corpus callosum and the anterior commisure), which functions are to unite the two hemispheres.

However, these nerve fibres tend to act more like a wall separating the left and right hemisphere because of the dominance of one over the other. According to neuroscientists, the cognitive basis of a well-functioning and balanced brain is when neither hemispheres are dominant but are effective, complementary, simultaneous integrated. So the corpus callosum and the commisure are supossed to optimize the electrical flow between the hemispheres. Piracetam has shown and proven to help the fiber nerves facilitate this interhemispheric flow transfer.

The general conclusion from all this is that neuroscience is needed to help us find new ways to test old, traditional economic/financial models to help us understand our decision-making process, which can help us manage our own drives in order to provide us the expertise to deal with the increasing complexity of the economic and financial markets landscape.

Editors’ Picks

EUR/USD: Yes, the US economy is resilient – No, that won’t save the US Dollar Premium

Some impressive US data should have resulted in a much stronger USD. Well, it didn’t happen. The EUR/USD pair closed a third consecutive week little changed, a handful of pips above the 1.1800 mark.

Gold: Metals remain vulnerable to broad market mood Premium

Gold (XAU/USD) started the week on a bullish note and climbed above $5,000 before declining sharply and erasing its weekly gains on Thursday, only to recover heading into the weekend.

GBP/USD: Pound Sterling remains below 1.3700 ahead of UK inflation test Premium

The Pound Sterling (GBP) failed to resist at higher levels against the US Dollar (USD), but buyers held their ground amid a US data-busy blockbuster week.

Bitcoin: BTC bears aren’t done yet

Bitcoin (BTC) price slips below $67,000 at the time of writing on Friday, remaining under pressure and extending losses of nearly 5% so far this week.

US Dollar: Big in Japan Premium

The US Dollar (USD) resumed its yearly downtrend this week, slipping back to two-week troughs just to bounce back a tad in the second half of the week.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.