When it comes to create a financial portfolio, investors may have varying views and strategies based on their unique perspectives and goals. To choose financial instruments for a portfolio involves a combination of careful planning, diversification, and risk management. Therefore, here are some steps to help you create a solid financial portfolio:

Six steps to create a solid investment portfolio

-

Define your financial goals: Start by clearly defining your short-term and long-term financial goals. This could include saving for retirement, purchasing a home, funding your children’s education, or achieving financial independence. Also your goals will shape your investment strategy.

-

Assess your risk tolerance: Understand your risk tolerance by considering factors such as your age, income, time horizon, and personal comfort with market volatility. In other words, risk tolerance will guide your asset allocation decisions.

-

Diversify your investments: Diversification is crucial for managing risk. Spread your investments across different asset classes such as stocks, bonds, real estate, commodities, etc. Additionally, diversify within each asset class by investing in various industries, sectors, and geographic regions.

-

Choose suitable investments: Select individual investments that align with your asset allocation strategy. This could involve investing in mutual funds, exchange-traded funds (ETFs), individual stocks, bonds, or other investment vehicles. Consider factors such as historical performance, fees, fund managers’ expertise, and the investment’s fit within your portfolio.

-

Monitor and rebalance regularly: Regularly review your portfolio’s performance and make adjustments as needed. Besides, some investments may outperform others, causing your asset allocation to drift from your desired targets. Rebalancing involves selling overperforming assets and reinvesting in underperforming ones to maintain your desired allocation.

-

Consider a long-term perspective: Investing should be viewed as a long-term endeavor. Avoid making impulsive decisions based on short-term market fluctuations. Stay informed about market trends and economic factors, but make investment decisions based on your long-term financial goals.

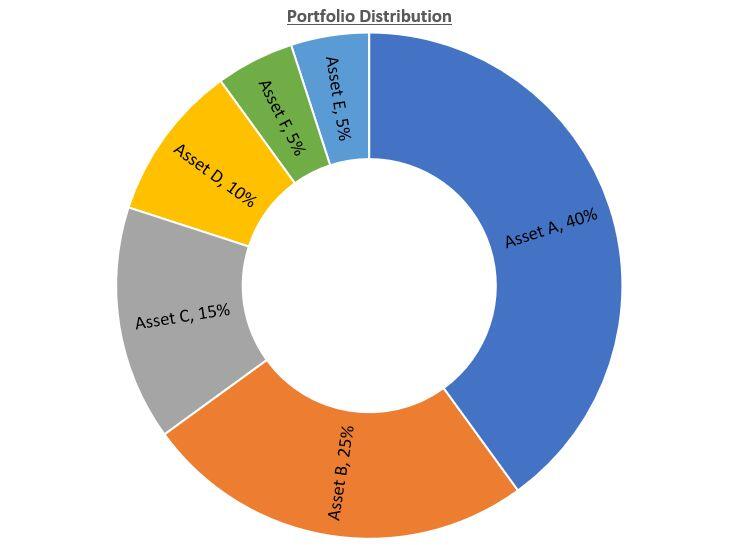

Example of an investment portfolio

Asset A:

Asset class: U.S. Large-Cap Stocks (e.g., S&P 500 Index Fund) provides exposure to the U.S. stock market.

Allocation: 40%

Asset B:

Asset class: International Stocks (e.g., MSCI EAFE Index Fund) offers exposure to global equity markets outside the U.S.

Allocation: 25%

Asset C:

Asset class: Bonds (e.g., U.S. Aggregate Bond Index Fund) provides stability and income

generation.

Allocation: 15%

Asset D:

Asset class: Real Estate Investment Trusts (REITs) offers exposure to the real estate sector.

Allocation: 10%

Asset E:

Asset class: Commodities (Broad Commodity Index Fund) provides diversification and also potential hedge against inflation.

Allocation: 5%

Asset F:

Asset class: Cash provides liquidity allowing you to cover unexpected expenses or take advantage of investment opportunities that may arise. Also, It provides flexibility to navigate market fluctuations without being forced to sell investments at unfavorable prices.

Allocation: 5%

The specific asset allocations can be adjusted based on an individual’s risk tolerance, investment objectives, and time horizon. Therefore, this allocation example aims to strike a balance between growth potential (stocks, real estate, commodities) and stability (bonds).

FURTHER DISCLOSURES AND DISCLAIMER CONCERNING RISK, RESPONSIBILITY AND LIABILITY Trading in the Foreign Exchange market is a challenging opportunity where above average returns are available for educated and experienced investors who are willing to take above average risk. However, before deciding to participate in Foreign Exchange (FX) trading, you should carefully consider your investment objectives, level of xperience and risk appetite. Do not invest or trade capital you cannot afford to lose. EME PROCESSING AND CONSULTING, LLC, THEIR REPRESENTATIVES, AND ANYONE WORKING FOR OR WITHIN WWW.ELLIOTTWAVE- FORECAST.COM is not responsible for any loss from any form of distributed advice, signal, analysis, or content. Again, we fully DISCLOSE to the Subscriber base that the Service as a whole, the individual Parties, Representatives, or owners shall not be liable to any and all Subscribers for any losses or damages as a result of any action taken by the Subscriber from any trade idea or signal posted on the website(s) distributed through any form of social-media, email, the website, and/or any other electronic, written, verbal, or future form of communication . All analysis, trading signals, trading recommendations, all charts, communicated interpretations of the wave counts, and all content from any media form produced by www.Elliottwave-forecast.com and/or the Representatives are solely the opinions and best efforts of the respective author(s). In general Forex instruments are highly leveraged, and traders can lose some or all of their initial margin funds. All content provided by www.Elliottwave-forecast.com is expressed in good faith and is intended to help Subscribers succeed in the marketplace, but it is never guaranteed. There is no “holy grail” to trading or forecasting the market and we are wrong sometimes like everyone else. Please understand and accept the risk involved when making any trading and/or investment decision. UNDERSTAND that all the content we provide is protected through copyright of EME PROCESSING AND CONSULTING, LLC. It is illegal to disseminate in any form of communication any part or all of our proprietary information without specific authorization. UNDERSTAND that you also agree to not allow persons that are not PAID SUBSCRIBERS to view any of the content not released publicly. IF YOU ARE FOUND TO BE IN VIOLATION OF THESE RESTRICTIONS you or your firm (as the Subscriber) will be charged fully with no discount for one year subscription to our Premium Plus Plan at $1,799.88 for EACH person or firm who received any of our content illegally through the respected intermediary’s (Subscriber in violation of terms) channel(s) of communication.

Editors’ Picks

EUR/USD holds firm near 1.1850 amid USD weakness

EUR/USD remains strongly bid around 1.1850 in European trading on Monday. The USD/JPY slide-led broad US Dollar weakness helps the pair build on Friday's recovery ahead of the Eurozone Sentix Investor Confidence data for February.

USD/JPY keeps the red below 157.00 on intervention risks

The Japanese Yen sticks to its modest intraday recovery gains against a broadly weaker US Dollar on the back of speculations that authorities will step in to stem weakness in the domestic currency. In fact, Japanese officials stepped up intervention warnings and confirmed close coordination with the US against disorderly FX moves. This, in turn, triggered an intraday USD/JPY turnaround from the 157.65 region, or a two-week top, touched in reaction to Prime Minister Sanae Takaichi's landslide win in Sunday's election.

Gold remains supported by China's buying and USD weakness as traders eye US data

Gold struggles to capitalize on its intraday move up and remains below the $5,100 mark heading into the European session amid mixed cues. Data released over the weekend showed that the People's Bank of China extended its buying spree for a 15th month in January. Moreover, dovish US Fed expectations and concerns about the central bank's independence drag the US Dollar lower for the second straight day, providing an additional boost to the non-yielding yellow metal.

Cardano steadies as whale selling caps recovery

Cardano (ADA) steadies at $0.27 at the time of writing on Monday after slipping more than 5% in the previous week. On-chain data indicate a bearish trend, with certain whales offloading ADA. However, the technical outlook suggests bearish momentum is weakening, raising the possibility of a short-term relief rebound if buying interest picks up.

Japanese PM Takaichi nabs unprecedented victory – US data eyed this week

I do not think I would be exaggerating to say that Japanese Prime Minister Sanae Takaichi’s snap general election gamble paid off over the weekend – and then some. This secured the Liberal Democratic Party (LDP) an unprecedented mandate just three months into her tenure.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.