The following 3 ideas that boosted my trading career are probably not the only ones, but have played a significant part in improving me as a trader. They have been instrumental in laying the foundations out for me being successful in trading. I have outlined them below (definitely NOT in a sequence of importance), so you can better understand my trading. These methods are the ones that first stand out when I am thinking of successful trading. Please feel free to share your own perspective of what helped you improve your trading in the comments below this article. Check out in the end of the article what are the 3 P’s of Trading…

1) Timeframe confluence

The first of the three factors that helped me improve and stay consistent was time-frames. When trading (as the ones that took my professional trading course know already) I am looking at timeframes. My analysis starts from the Daily timeframe and then narrows down to the 4 Hour and sometimes 1 Hour. I am also looking at the Weekly and Monthly charts for the general direction of the market. Let’s say I am seeing a pinbar on the daily timeframe, I am always going to go down to the 4 Hour chart and check what is the setup there.

- Important Tip: I do start with the Daily timeframe before I go down to the 4 Hour chart.

Once I establish the setup, I am looking for a confluence of factors. I am looking for the same or similar pattern on the different timeframes. Let’s say I am seeing a pinbar on the Daily timeframe. What I am looking for on the 4 Hour chart is a Pinbar, Bullish Engulfing or another price action confirmation. Very often this is the case and if I want even more precise confirmation, I can scale down to the 1 Hour chart.

- Important Tip: If there is no confluence of timeframes, I am not taking the trade.

2) Avoid Day Trading

Having a trading plan is the best advice I can give you. One of the ways it is helping me is by keeping me away from day trading. The second point in the 3 ideas that boosted my trading career is “Day trading”. Why is it so? Most traders are too eager to jump in and trade whenever any opportunity arises. This is probably due to our human nature and the eagerness to make a “quick buck”. But if there is one thing that ensures a high probability of winning, it is having the patience to grasp all the necessary information before you trade. This apparently will take time as there are many factors involved in it, such as the forming of trends, trend corrections, highs and lows. Impatience to look at these matters could result in loss of money. It could be helpful sometimes to take a break, allow oneself to have the time to look at the bigger picture, instead of focusing too much on one aspect. Remember that a single transaction might resonate in a series of future losses if executed at the wrong moment. It takes time and patience to wait for the market correction, before you commit to a trade.

Day trading is probably the hardest of all ways to make money and requires the highest of trading skills and discipline. No wonder 95% of retail traders lose 95% of initial capital in the first few months of live trading. Day trading sounds like an easy and fun way to make money, but this statement cannot be further away from reality. I know more people who made money from a 9-5 job than day traders who made enough to pay their bills. Hopefully, this is not too discouraging for you, but aims to ring a few warning bells against over-trading (especially if you are not extremely experienced).

Important Tip: Having your rules written down helps you stay away from day trading (or over-trading)

3) Looking at Higher Timeframes and PA

A) Higher Timeframes – The third factor that boosted my trading career and trading in general is my affinity with higher timeframes. As I mentioned earlier, I am starting my analysis with the Daily timeframe. I am also using Weekly and Monthly charts for the general direction. The higher timeframes are less noisy and are less random than the intraday charts. Usually, they are the ones that the larger institutions like Hedge Funds and Bank traders are using for their analysis and trading activities. This could be quite indicative of why you should avoid the smaller timeframes.

- Pro Tip: Avoid timeframes smaller than 1 Hour

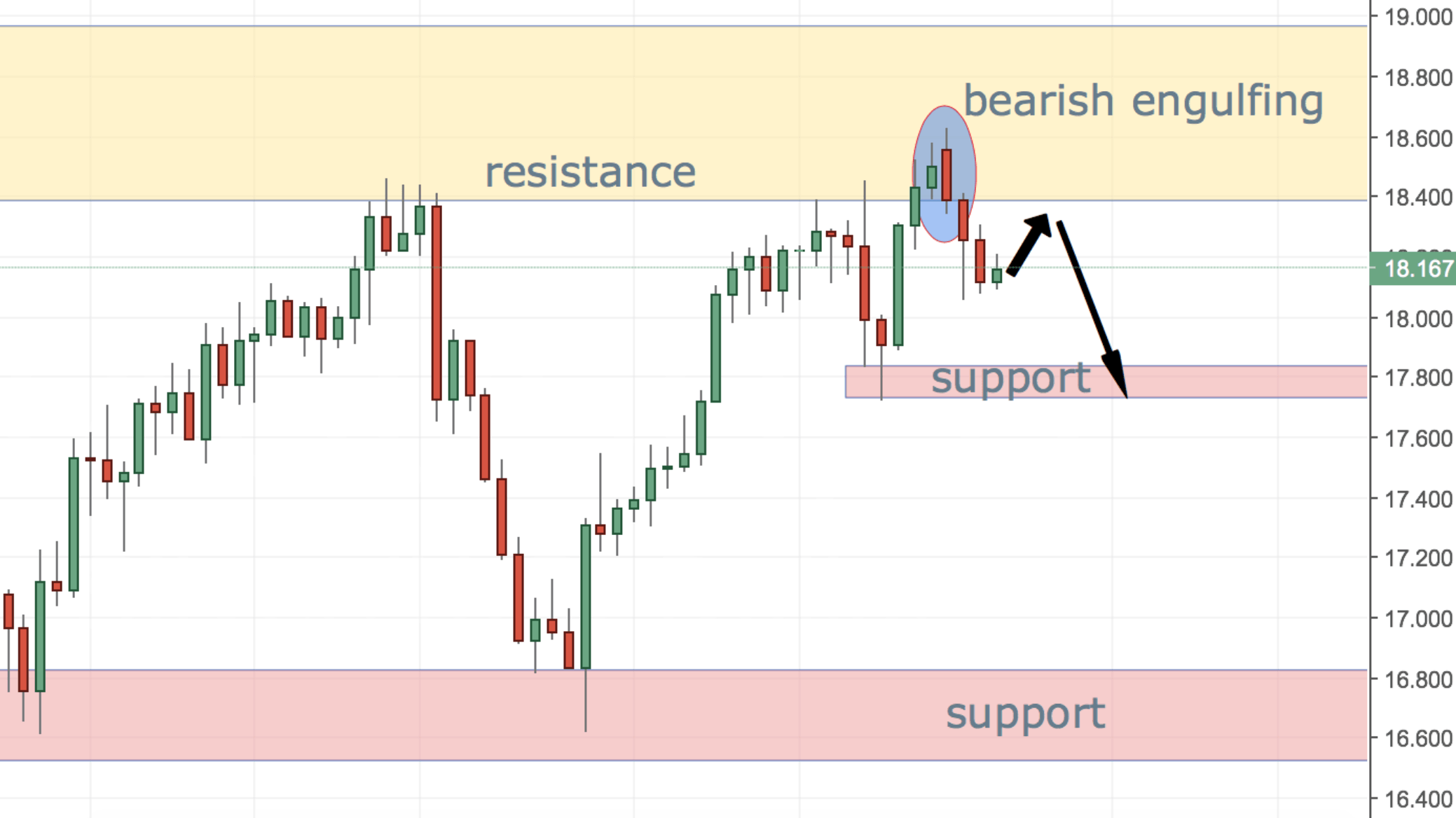

B) PA (Price Action) – When checking the higher timeframes, I am looking for a confluence of a higher timeframe important level and a confluence of price action. For example, if I am seeing a major support or resistance on the Daily timeframe, I am looking for a price action confirmation. Have a look at the example below. It was taken from an article I wrote about a couple of weeks before.

As you can see from the screenshot above, the level of 18.50 was a major resistance level on the Daily timeframe. The candlestick pattern that formed there was a bearish engulfing. This is what I call a confirmation by price action.

Important Tip: Before I trade, I need to have a price action confirmation of a major level

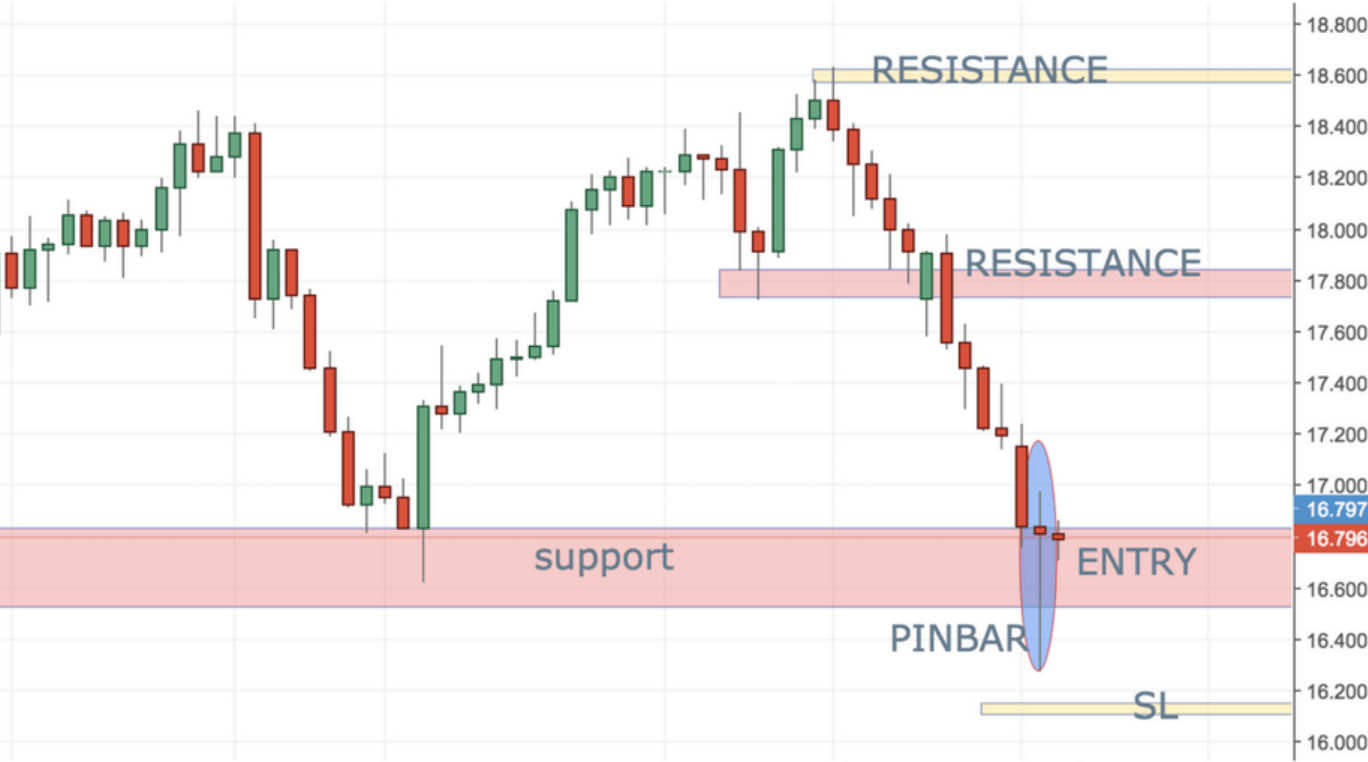

The example above is showing what I mean by a price action confirmation of a major level. Let’s see what happened after this pattern appeared.

From the daily chart above, you can see the a confirmation of what I have just said. That is why it is so important that you try to use price action confirmation of major support/resistance levels.

Putting it All Together

The aim of this article is to reveal another angle of the way I look at the charts. I am showing why is it important to have a confluence of timeframes. I am then explaining the importance of avoiding day trading. Finally, I am tying it up with the importance of using price action with higher time frames. In the end, we are coming up to the conclusion that no matter what you do, what matters is to follow a strictly written-down plan and have the patience to wait for all the factors to align. So, if I am to sum up this article in 3 words, I would use the 3 P’s of trading:

–Plan

-Patience

Price Action

This material is written for educational purposes only. By no means do any of its contents recommend, advocate or urge the buying, selling or holding of any financial instrument whatsoever. Trading and Investing involves high levels of risk. The author expresses personal opinions and will not assume any responsibility whatsoever for the actions of the reader. The author may or may not have positions in Financial Instruments discussed in this newsletter. Future results can be dramatically different from the opinions expressed herein. Past performance does not guarantee future results.

Editors’ Picks

AUD/USD bulls pause amid post-NFP USD rebound

AUD/USD is trading with a mild negative bias during the Asian session on Thursday, below a three-year high set the previous day. The US Dollar looks to build on Wednesday's upbeat US NFP-inspired bounce from an over one-week low, acting as a headwind for spot prices. However, the divergent Fed-RBA expectations, along with the underlying bullish sentiment, should help limit any meaningful corrective fall for the risk-sensitive Aussie.

USD/JPY strengthens above 153.00 despite stronger US jobs data

The USD/JPY pair attracts some sellers to around 153.20 during the early Asian session on Thursday. The Japanese Yen strengthens against the US Dollar in the aftermath of Prime Minister Sanae Takaichi's landslide election victory. The attention will shift to the US Consumer Price Index inflation report, which is due later on Friday.

Gold posts modest gains above $5,050 as US-Iran tensions persist despite strong labor data

Gold price trades in positive territory near $5,060 during the early Asian session on Thursday. The precious metal edges higher despite stronger-than-expected US employment data. The release of the US Consumer Price Index inflation report will take center stage later on Friday.

Bitcoin holds steady despite strong US labour market

Bitcoin briefly bounced from $66,000 to above $68,000 but slightly reversed those gains following Wednesday's US January jobs report. The top crypto is hovering around $67,000, down 2% over the past 24 hours as of writing on Wednesday.

US jobs data surprises to the upside, boosts stocks but pushes back Fed rate cut expectations

This was an unusual payrolls report for two reasons. Firstly, because it was released on Wednesday, and secondly, because it included the 2025 revisions alongside the January NFP figure.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.