XRP whales are scooping up Ripple ecosystem’s native token like the bottom is in, what to expect

-

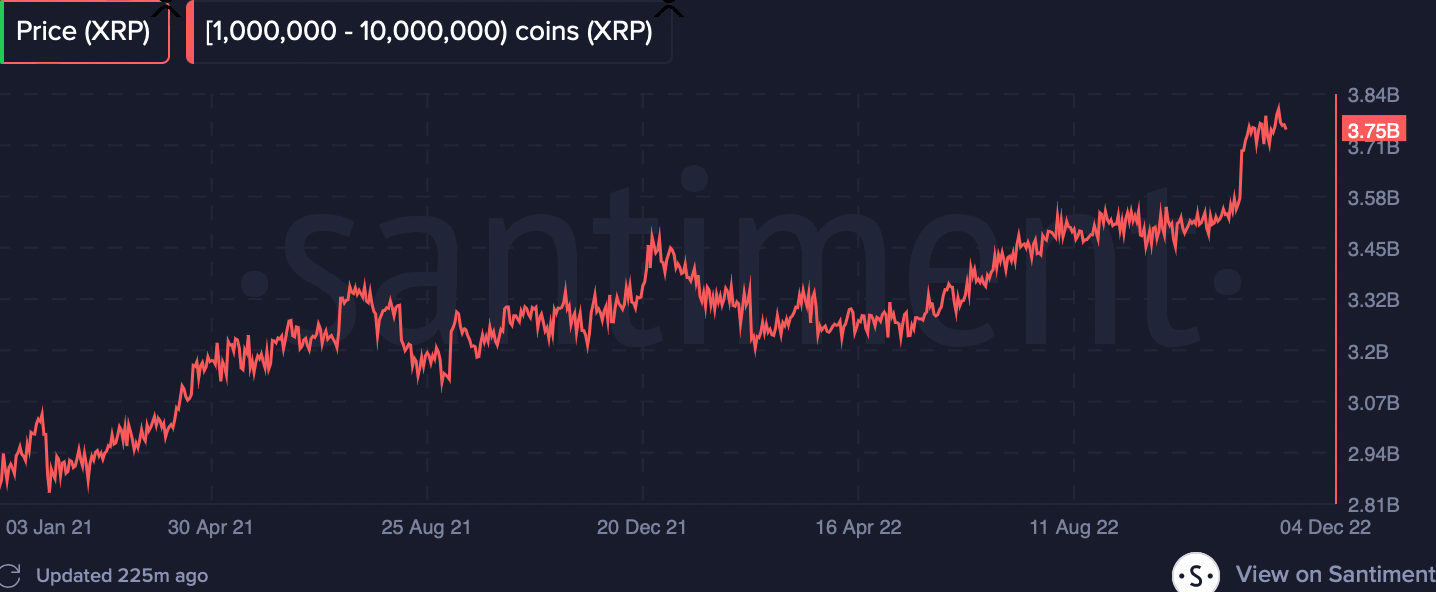

XRP holders who own between 1 million and 10 million tokens have increased their holdings of the altcoin by 25% to 4.09 billion.

-

The level of accumulation by whales is similar to what is seen at market bottoms and this group of holders has an influence on XRP price.

-

On-chain metrics reveal signs of exhaustion among sellers, signaling a recovery in XRP price.

XRP network’s large wallet investors have increased their holdings by 25%, similar to what was seen during the altcoin's bottom in previous cycles. The altcoin’s price has fluctuated between $0.28 and $0.54 for the second half of 2022. On-chain metrics indicated a bullish trend reversal in XRP is incoming.

Also read: Ethereum v. Bitcoin battle continues as ETH offers more investment opportunities to traders

XRP whales increased their holdings of Ripple ecosystem’s native token by 25%

XRP network’s large wallet investors holding between 1 million and 10 million XRP have increased their holdings by 25%, bringing the total to 4.09 billion tokens. This is the level of accumulation seen at market bottoms.

XRP holders with 1 million to 10 million tokens

Interestingly, based on data from crypto aggregator Santiment, this level of accumulation is often seen at market bottoms. This group of holders typically has a significant influence on XRP price with the exception of the fear, uncertainty and doubt (FUD) generated by the SEC v. Ripple lawsuit in December 2020.

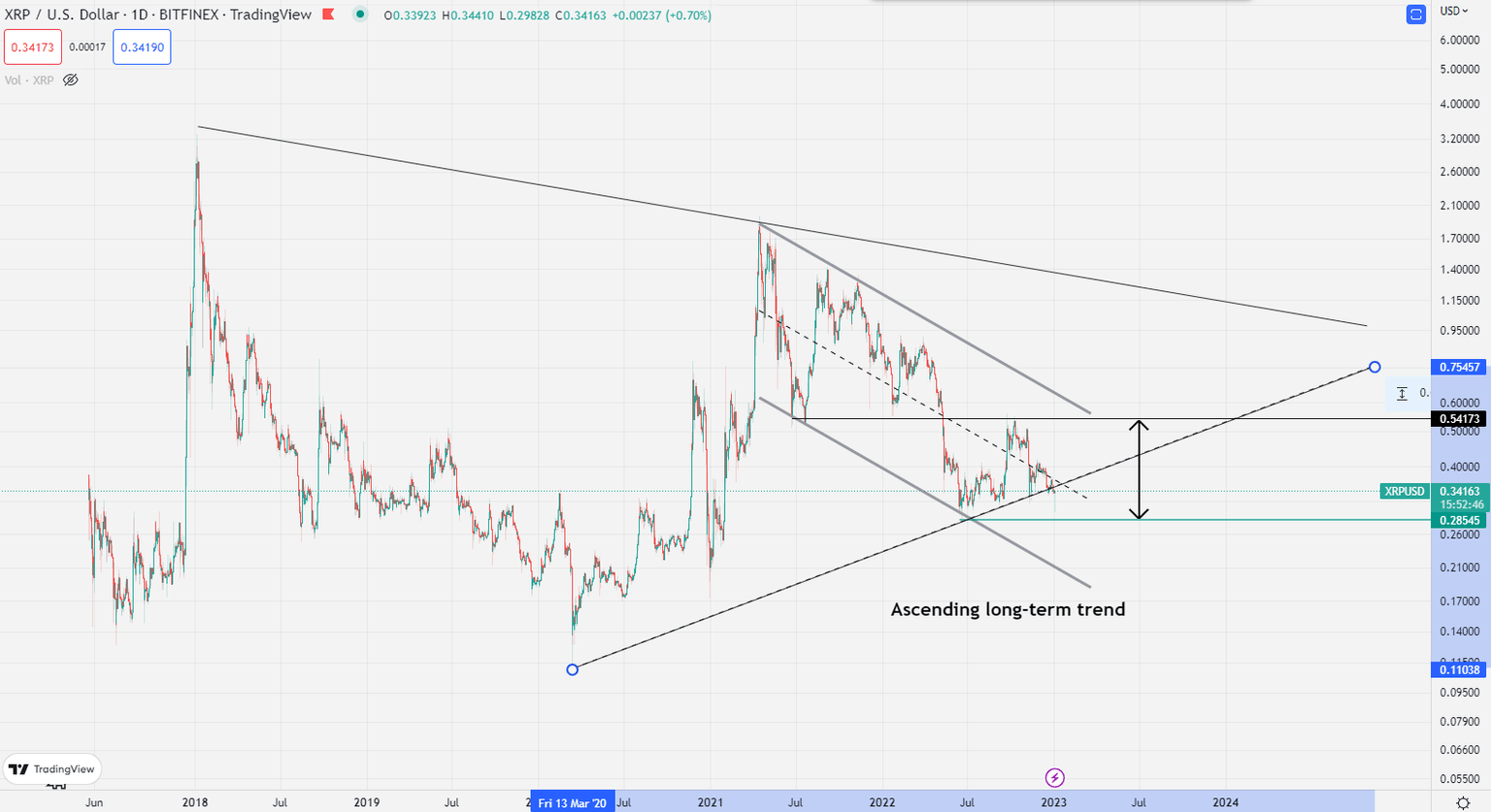

Throughout the second half of 2022, XRP price fluctuated between $0.28 and $0.54. Sanr_king, a crypto analyst, identified a triangle pattern formed in the XRP price chart.

XRP/USD price chart

The altcoin has been in a downtrend since 2021, however the triangle formation reveals a larger upward trend that could potentially complete it. Currently, XRP price is at the bottom of the triangle, investors consider this an opportunity with potential for both low risk and high reward.

According to the Weighted Sentiment metric, the overall sentiment towards the altcoin has been negative over the last two months of 2022. However, despite the negative sentiment, the price of XRP has held its ground. The technical expert considers it a sign of “seller exhaustion.” Sanr_king therefore believes there is a likelihood of a recovery in XRP price.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.