What’s next for ApeCoin after Bored Ape Yacht Club dethrones NFT collections to rank first

- ApeCoin price yields double-digit gains over the past two weeks, as Bored Ape Yacht Club dethrones blue-chip NFT collections.

- Bored Ape Yacht Club closed 2022 as the NFT collection with the highest market capitalization despite 38% declines.

- APE is at risk of decline as technical indicators reveal the NFT token is currently overbought.

ApeCoin, an Ethereum-based NFT token, yielded nearly 10% gains for holders over the past 14 days. APE is the native token of the Bored Ape Yacht Club (BAYC) ecosystem. BAYC hit a new milestone in 2022 dethroning other blue-chip NFTs like CryptoPunks to rank first in terms of market capitalization.

Also read: Ethereum whales scoop up Shiba Inu tokens; here’s what to expect

ApeCoin outlook turns bullish as Bored Ape Yacht Club hits new milestone

ApeCoin is the native token of the Bored Ape Yacht Club universe. BAYC is an NFT collection that features 10,000 digital art pieces and competes with blue-chip collectibles in the ecosystem.

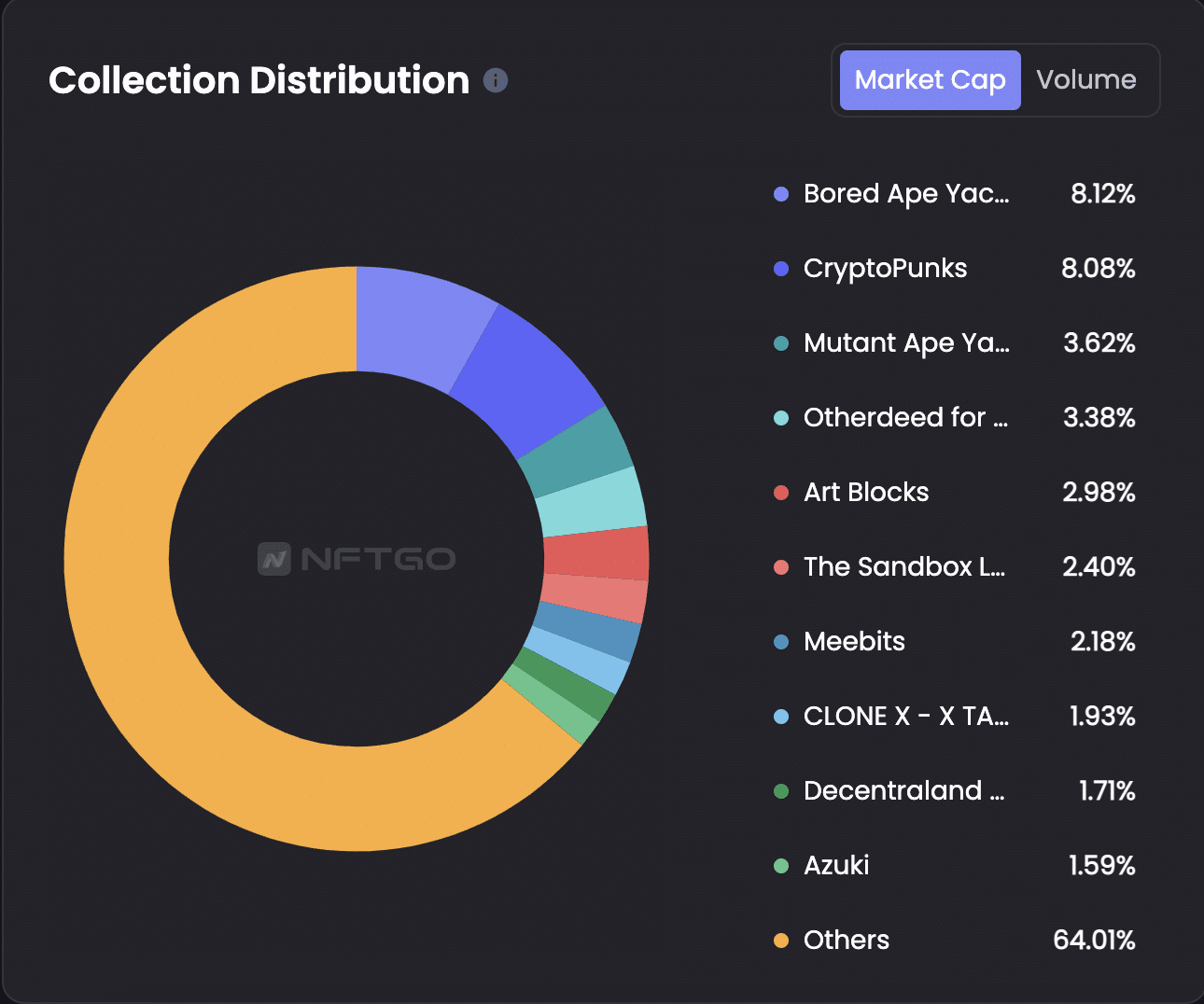

Based on data from NFTGo, CryptoPunks, a collection of 10,000 algorithmically generated pixel NFTs ranked first in terms of market capitalization at the start of 2022 when the pixelated collectibles held 10% of the entire NFT market cap share. This changed in the second half of the year with Bored Ape Yacht Club taking the lead.

BAYC closed 2022 with a market cap of $830 million. This makes the 10,000 Ape collection the highest grossing in the ecosystem. Despite a steady decline in its value throughout 2022, BAYC replaced CryptoPunks as number one, at 8.12% of the NFT ecosystem, against CryptoPunks 8.08%.

NFT collection distribution at the end of 2022

Since the beginning of 2023, BAYC has recorded 17 sales and sales volume is up 51% over the last 24 hours. The sales totaled $1.37 million, with the Ape collection’s revenue coming second to Otherdeed.

Whilst BAYC is doing well the ApeCoin token is struggling to recoup its losses. ApeCoin has offered holders nearly 10% gains in the past two weeks, unlike mainstream cryptocurrencies like Bitcoin and Ethereum.

The NFT token is currently in an uptrend, however technical indicators reveal ApeCoin is overbought and thus ready for a pull back or reversal.

ApeCoin is overbought, APE price is at risk of decline

The Relative Strength Index, a momentum indicator used to determine whether a token is overbought or oversold and indicates trend reversals reads 81.44 for ApeCoin. A reading above 70 implies that the asset is overbought and there is a likelihood of a correction in its price.

ApeCoin price is therefore at the risk of a decline as seen in the chart below. The signal for traders to open short positions is traditionally given when the RSI exists overbought after having entered the area.

APE/USDT price chart

Interestingly, the 50-day Exponential Moving Average (EMA) recently crossed below the 200-day EMA, in a “death cross.” The death cross is a chart pattern that signals weakness in the asset’s price. These technical indicators suggest ApeCoin price could plummet to support at the 200-day EMA at $3.723.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.