XRP utility expands in Middle East as SEC v. Ripple case intensifies in US

- Ripple continues to make headway, partnering with the second-largest bank in Oman, BankDhofar.

- The Ripple v. SEC lawsuit continues to rage as the respondent is requesting to depose six more witnesses.

- XRP price continues to rally higher but approaches an inflection point due to a stiff resistance zone.

Ripple partnerships in Asia continue to pour in despite its ongoing lawsuit with the US Securities & Exchange Commission (SEC). XRP price rally will face a formidable supply barrier that could make or break it.

Partnerships with Ripple sprout up despite US court case

The latest development with the payments company Ripple is its collaboration with Oman’s BankDhofar. This tie-up will open up a cross-border transfer channel between the bank in Oman and IndusInd, a private bank in India via the RippleNet.

The announcement blog further reads,

This partnership will enable cross-border transactions made via the BankDhofar Mobile Banking App to be processed instantly, reliably, cost-effectively and with end-to-end visibility anywhere in the world.

While Ripple continues to make headway by building value and paving a path toward facilitating efficient payments, the lawsuit brought forth by the SEC continues to take new turns.

In a recent development, the SEC is requesting Magistrate Judge Sarah Netburn to provide an order to depose a fresh batch of Ripple’s ex and current employees, despite the ten that are already set to testify on several matters related to the case.

To be specific, the recent requests include Ripple’s former CFO, Ron Will; Ethan Beard, the former senior vice president of Xpring; and a company representative to cross-verify and fill in the gaps in the testimony provided by these individuals.

XRP price approaches key zone

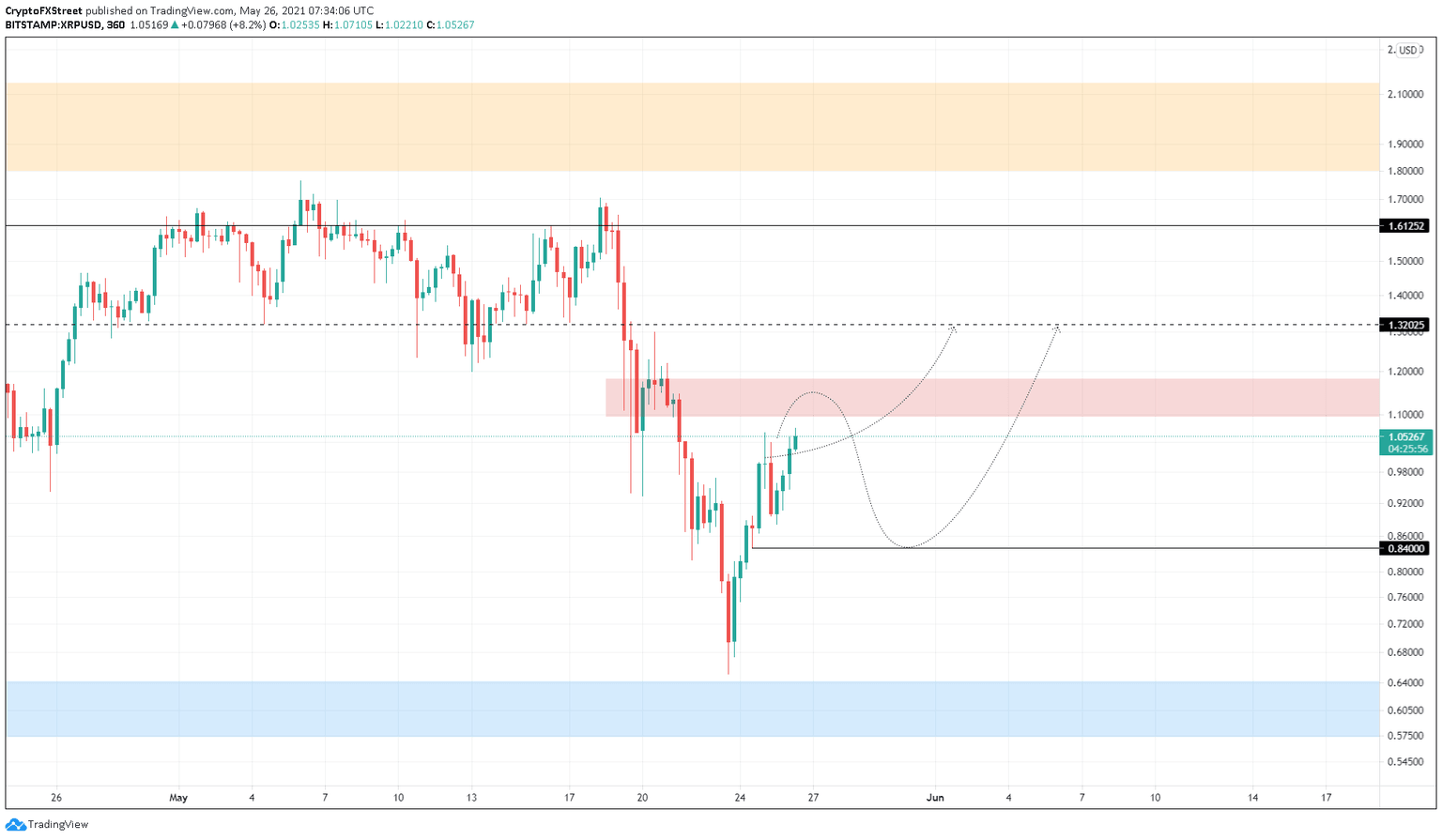

XRP price rallied nearly 22% over the past 18 hours, creating a swing high, but this move will be for nothing if it fails to slice through the supply zone that is present above it. This barrier extends from $1.094 to $1.183. Considering how the altcoins, including XRP, have rallied continuously by more than 50%, it is likely that a retracement will arrive soon.

If this hypothesis were to manifest, XRP price might likely face rejection from the resistance area at $1.094 and reverse its trend. In that case, investors can expect the remittance token to drop roughly 20% to the support level at $0.840.

XRP/USD 6-hour chart

On the flip side, if XRP price manages to produce a decisive close above this ceiling, it will invalidate the bearish narrative and push Ripple up by 11% to tag the subsequent resistance wall at $1.320.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.