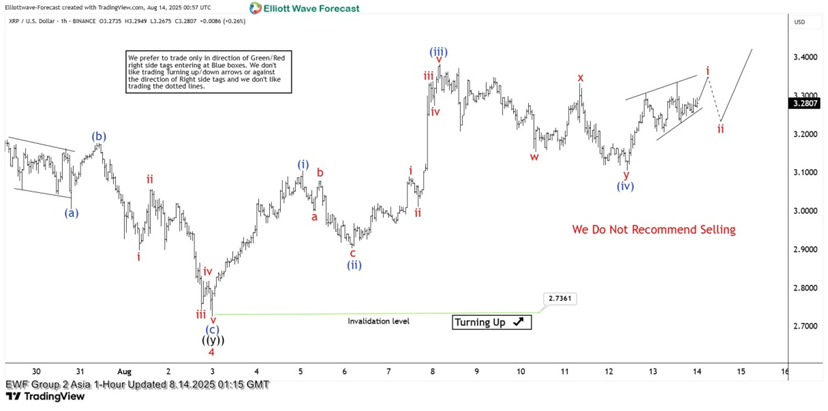

XRP Ripple Elliott Wave forecast: Wave 5 eyes $3.88 target

XRPUSD’s bullish cycle, starting from the April 7, 2025 low, unfolds as a five-wave impulse. Wave 1 peaked at $2.655. Pullback in wave 2 ended at $1.9112. Wave 3 surged to $3.66. Wave 4 found support at $2.736. Now, XRPUSD advances in wave 5, targeting $3.88, based on the 123.6% inverse retracement of wave 4. A break above $3.66 is needed to rule out a double correction and confirm the bullish trend.

Within wave 5, a lower-degree impulse is forming. Wave (i) hit $3.105. Dip in wave (ii) ended at $2.9033. Wave (iii) reached $3.382. Wave (iv) corrected to $3.1053. XRPUSD should rally in wave (v) to complete wave ((i)). A corrective wave ((ii)) will likely follow, adjusting the cycle from the August 3, 2025 low. Afterward, the uptrend should resume. As long as the $2.736 pivot holds, dips will likely find support in a 3, 7, or 11-swing structure, supporting further upside.

XRP/USD (Ripple) – 60 minute Elliott Wave technical chart:

Ripple – Elliott Wave technical video:

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com