XRP Price: This needs to happen for explosive rally in Ripple

- David Gokhstein took to Twitter to stress the possibility of Ripple's win in the SEC v. Ripple lawsuit.

- Crypto proponents have considered scooping up XRP tokens and adding this to their portfolio ahead of the bullish catalyst event.

- Analysts believe XRP price could climb 20% by mid-October, revealing a bullish outlook.

David Gokhstein, crypto proponent and podcaster believes Ripple is poised for a win in the SEC v. Ripple lawsuit. The podcaster stressed on XRP accumulation and the condition for a rally in the altcoin.

Also read: Shiba Inu price: Ethereum whale swallows 272 billion SHIB, becomes investors’ favorite

Ripple’s win in SEC v. Ripple is likely

Payment giant Ripple’s win in the SEC v. Ripple lawsuit is considered a bullish catalyst for the altcoin. Crypto proponent and podcaster David Gokhstein took to Twitter to stress the importance of Ripple’s win. The payment giant is the single largest public holder of XRP, therefore the outcome of the SEC v. Ripple lawsuit could make or break the altcoin’s potential for a price rally.

Gokhstein expressed his bullish outlook on XRP, he was quoted as saying:

I want to push the XRP buy button.

Brad Garlinghouse, Ripple’s CEO, is optimistic about the SEC v. Ripple case and did not see the need for it to go to trial. The executive argues that there is enough evidence for a judge to decide whether XRP is a security, without a jury. Garlinghouse believes that the submission of both motions by the SEC and payment giant Ripple should be enough for Judge Analisa Torres to decide. Garlinghouse believes the facts of the case are undisputed and in his appearance on Fox Business, the Ripple CEO shared his conviction with XRP holders.

The former US congressional candidate Gokhstein believes if Ripple scores a win, it might influence the impeccable rise of the entire cryptocurrency market. The decision on the SEC’s objection is still pending, Judge Torres will decide on expert motions and summary judgment on or before March 31, 2023.

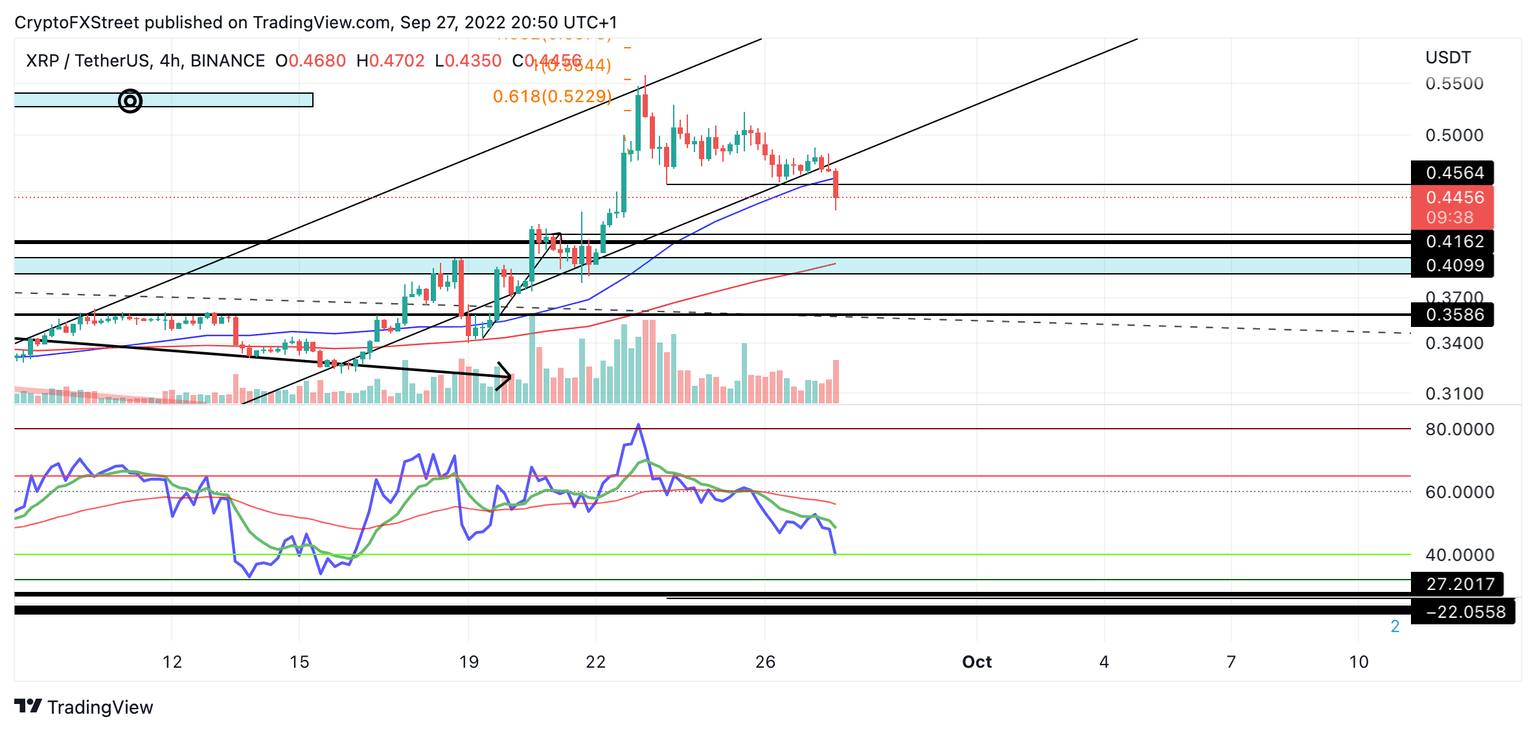

Tony Montpeirous, technical analyst at FXStreet evaluated the XRP price chart and identified that the asset has invalidated the triangle-looking consolidation pattern. Tony argues that the RSI shows Ripple auctioning a definitive line in the sand for a bull market correction. Therefore, a bearish outlook on XRP could be problematic.

The analyst has predicted XRP price to rally to a new high near the $0.61 level in the short-term.

XRP USDT price chart

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.