Ripple Price Forecast: Breakout to $3 could be imminent as XRP holds bullish structure

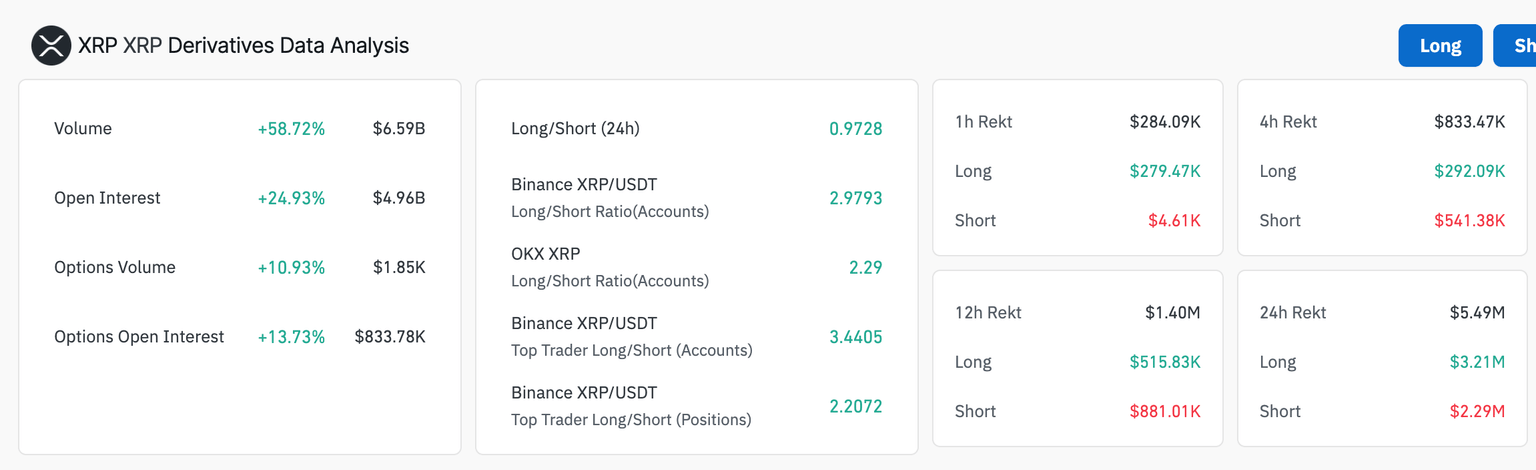

- XRP's uptrend gains steam, supported by a major comeback in Open Interest to $4.96 billion.

- Volatility Shares will debut XRP futures ETF on NASDAQ, allocating 80% of net assets to XRP instruments.

- XRP upholds a higher low pattern with the RSI at 56, signaling room for more growth before reaching overbought conditions.

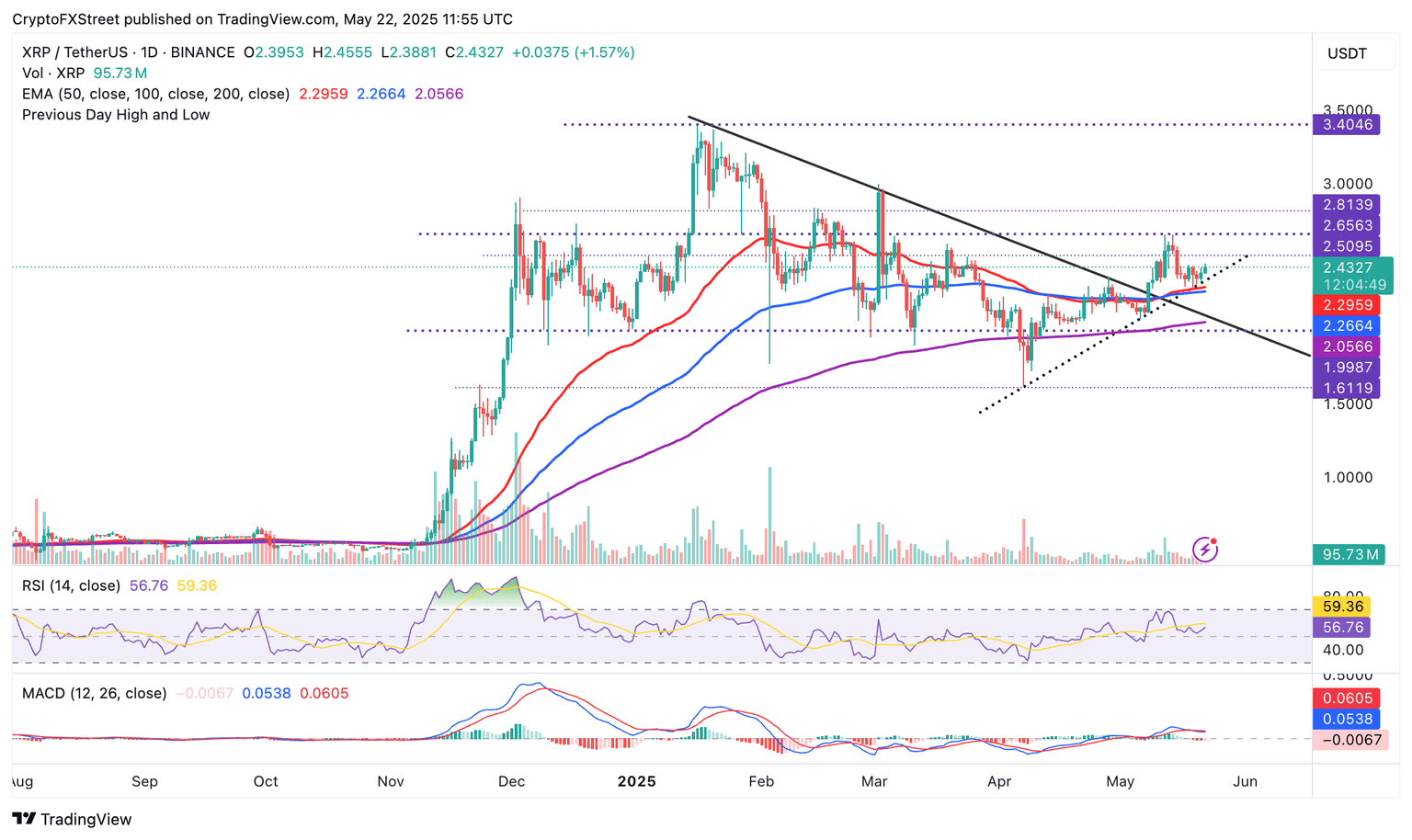

Ripple's (XRP) price accelerates the uptrend to around $2.43 at the time of writing on Thursday, propelled by improving sentiment in the broader crypto market after Bitcoin (BTC) rapidly rallied to new all-time highs at approximately $111,880. Short-term support at $2.40 sits above key demand areas like the 50-day Exponential Moving Average (EMA) at $2.29 and the 100-day EMA at $2.26, reinforcing XRP's bullish outlook.

The impressive rally in Bitcoin's price, which has also triggered subsequent increases in altcoins like XRP and meme coins, comes amid concerns about the sustainability of United States (US) debt, as discussed in the top gainers analysis.

Volatility Shares set to launch XRP futures ETF on NASDAQ

As XRP's price edges higher, Volatility Shares, a registered investment advisor, is preparing to launch the first-ever XRP futures Exchange-Traded Fund (ETF) on the Nasdaq stock market on Thursday.

According to a post-effective amendment filed with the Securities & Exchange Commission (SEC), the fund, part of the Volatility Shares Trust, will trade under the ticker XRPI.

Volatility Shares outlined in a press release on Wednesday that it will allocate at least 80% of its net assets to XRP-linked instruments, offering investors unlevelled exposure to XRP futures through a Cayman Islands-based subsidiary.

Moreover, the company announced plans to launch a 2x XRP futures ETF that pledges twice the daily appreciation of XRP via double the leveraged exposure to XRP futures contracts.

VolatilityShares is launching the first-ever XRP futures ETF tomorrow, ticker $XRPI.. yes there is a 2x XRP already on market (this is first 1x) and it has $120m aum and trades $35m/day. Good signal that there will be demand for this one. pic.twitter.com/rCooyNZgu0

— Eric Balchunas (@EricBalchunas) May 21, 2025

This development follows Teucrium Investment Advisors' launch of a leveraged XRP ETF in April, signaling swelling institutional interest in XRP-related financial products.

XRP's market dynamics have improved in the last few months with the Chicago Mercantile Exchange (CME) recently introducing regulated XRP futures contracts.

The longstanding lawsuit is also nearing its end after Ripple and the SEC agreed on a $50 million settlement, subsequently filing a joint motion to drop the appeals. Despite the Court denying the motion, Ripple and the Commission are committed to working together to meet the requirements for an indicative ruling.

XRP reignites bullish momentum as Open Interest surges

XRP's uptrend is gaining traction with Open Interest (OI) surging nearly 25% to $4.96 billion. This increase signals a robust comeback in market participation combined with the trading volume rising approximately 59% to $6.59 billion over the past 24 hours.

XRP derivatives data | Source: CoinGlass

The colossal influx of capital alongside heightened trader interest supports a potential push toward $3.00. The daily chart below highlights this potential with XRP sitting above key moving averages, ranging from the 50-day EMA at $2.29, the 100-day EMA at $2.26, and the 200-day EMA at $2.05.

A trendline (dotted) drawn from the tariff-triggered crash at $1.61 affirms the uptrend's strength, forming a higher low pattern.

XRP/USDT daily chart

With the Relative Strength Index (RSI) at 56 and climbing toward the overbought region above 70, XRP is building strength for its $3.00 mid-term target. Since it's not overbought yet, bulls have room to push higher before profit-taking changes dynamics, potentially triggering a reversal.

SEC vs Ripple lawsuit FAQs

It depends on the transaction, according to a court ruling released on July 14, 2023: For institutional investors or over-the-counter sales, XRP is a security. For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token. While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and had to pay a $125 million civil fine.

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at. Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say. Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales persist.

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation. While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren