XLM Price Prediction: Stellar puts the worst behind it, eyes 30% upswing

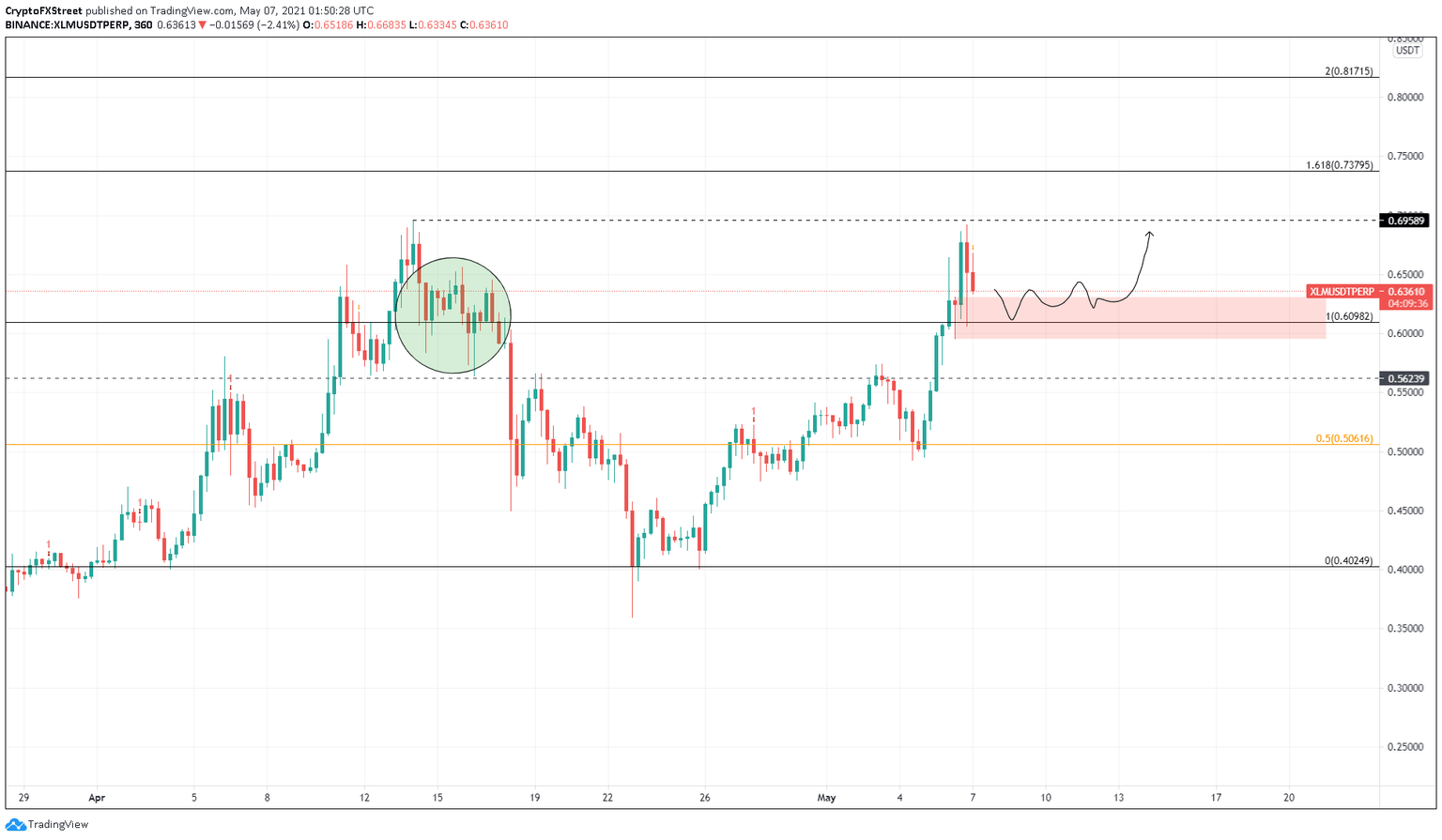

- XLM price witnessed a 37% upswing that has pushed it beyond the upper range at $0.609.

- Stellar is likely to consolidate around the demand zone extending from $0.595 to $0.631.

- Successful injection of buying pressure could propel the remittance token up by 30% to $0.81.

XLM price broke out of a range-bound consolidation and now sits comfortably above it. The immediate support barrier will help Stellar stay afloat before buyers decide to step in.

XLM price looks to consolidate

On the 6-hour chart, XLM price has risen above its local range at $0.609 and formed a demand zone that extends from $0.595 to $0.631. The Momentum Reversal Indicator (MRI) has flashed a preemptive top in the form of a yellow down arrow. This setup forecasts that if the uptrend continues, a reversal could be incoming.

Therefore, a consolidation around the demand barrier mentioned above is the most optimistic scenario. The sideways movement will allow buyers to recuperate, allowing a build-up of bullish momentum, which might eventually lead to a massive spike in XLM price to $0.817.

The local top at $0.695 and the 161.8% Fibonacci retracement level at $0.737 will be critical. Hence, investors need to keep a close eye on these barriers.

XLM/USDT 6-hour chart

The upswing narrative hinges on the fact that the demand zone holds the collapsing XLM price, but a breakdown could lead to a 6% correction to $0.562. However, a solid 6-hour candlestick close below this level would invalidate the bullish outlook and kick-start a bearish one.

Under these conditions, Stellar could retrace to the 50% Fibonacci retracement level at $0.506.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.