XLM Price Prediction: Stellar consolidates, anticipating 35% gains

- XLM price has been on a progressive downtrend for almost 20 days.

- However, a 10% retracement is likely to trigger a 35% upswing to $0.403.

- If Stellar produces a decisive close below $0.27, it will invalidate the bullish thesis and kick-start a 27% sell-off.

XLM price has been on a downtrend for almost 20 days. The inability of buyers has failed to prop up Stellar. As a result, the cryptocurrency has spent more time closer to the range low than the swing high.

However, this might change as a 10% retracement shows the potential of an upswing that pushes the remittance token closer to the mid-way point of the said range.

XLM price eyes a higher high

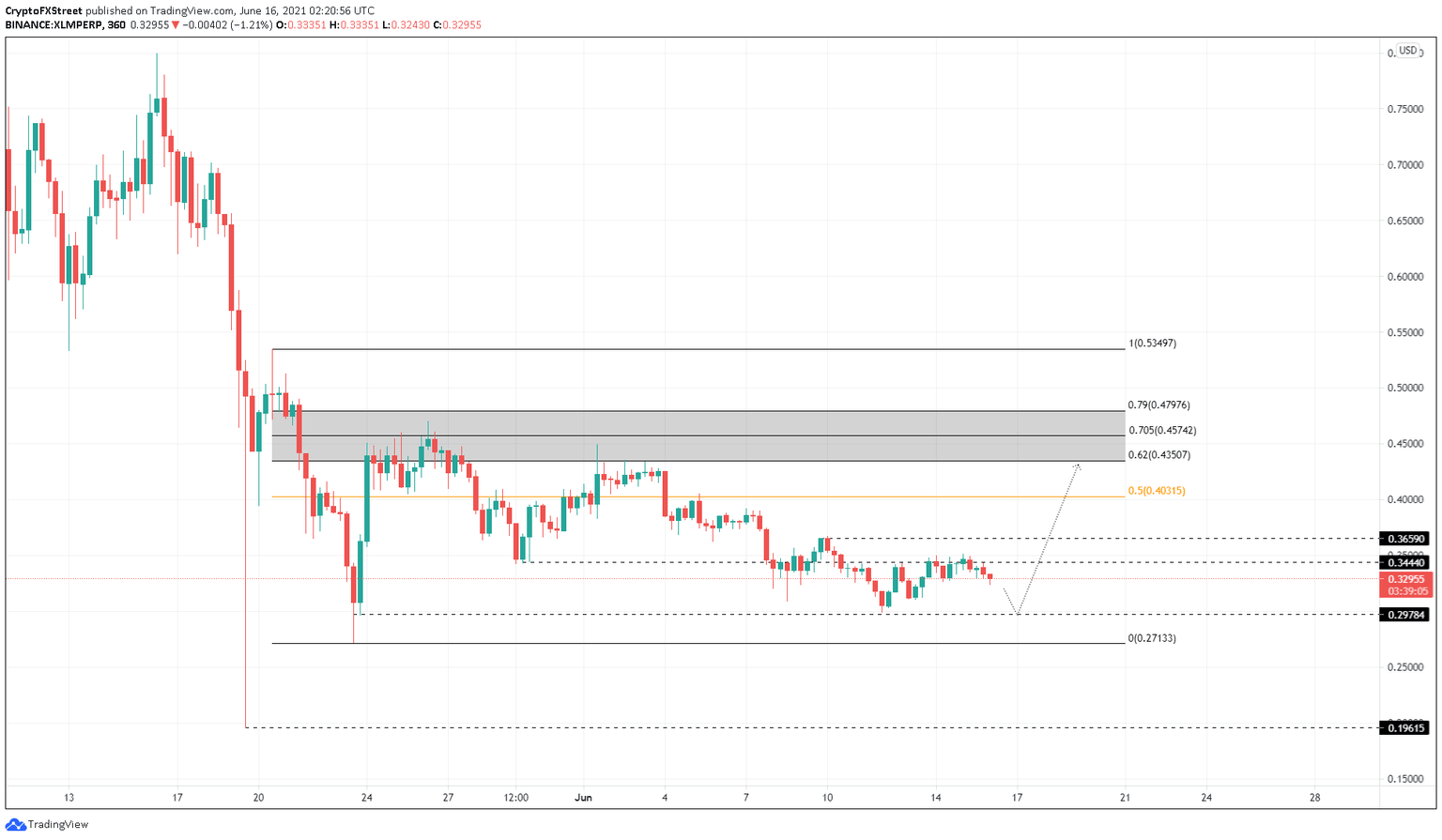

XLM price is stuck consolidating between the support level at $0.298 and the resistance barrier at $0.344 for roughly six days. Stellar is likely to retrace 10% to tag the demand floor mentioned above as the entire crypto market shows weakness.

This pullback is likely to trigger sidelined investors to scoop up XLM at a discount. If this were to happen, Stellar will likely attempt a bull rally that could push it past the immediate barrier at $0.344 to the swing high created at $0.366 on June 9.

Setting up a temporary top here might allow the bulls to target the mid-way point at $0.403.

If the bid orders continue to pile up, XLM price will likely visit the 62% or 70.5% Fibonacci retracement levels at $0.435 and $0.457, respectively.

XLM/USDT 6-hour chart

On the flip side, if XLM price fails to hold above the support floor at $0.298, it will indicate a weakness in buyers. Such a move might push Stellar price toward the range low at $0.271.

Although this level is likely to be pierced by the bears, a decisive close below $0.27 will invalidate the bullish thesis. Such a move might result in a 27% sell-off to $0.196.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.