Why the Cardano price collapse will return ADA to $1

- Cardano price dropped nearly 23% during the Thursday trading session.

- Massive incoming volume shows the bottom is likely in for ADA.

- Multiple time cycles complement price action for a new uptrend for Cardano.

Cardano price action has been some of the most bearish in its history. In fact, The nine-month stretch from September 2021 to May 2022 is arguably the most devastating price action Cardano has ever experienced. However, a low may have been found, and a resumption of the bull market is likely to occur soon.

Cardano price recovers nearly all of its daily losses during the late NY session

Cardano price is on track to retrace almost the entirety of its nearly 23% wipeout for the day. The daily volume (not shown) is thus far the third-highest volume traded day of 2022 and the third-highest since the all-time high made in September 2021. Volume has been steadily increasing on a daily average since the middle of April 2022 – and if volume does precede price, then ADA is ready to bounce and bounce hard.

New fifteen-month lows were hit for Cardano price, pushing ADA into the $0.30 value area for the first time since February 2021. Support was found primary at $0.40, where the 88.6% Fibonacci retracement and just above a high volume node in the 2021 Volume Profile.

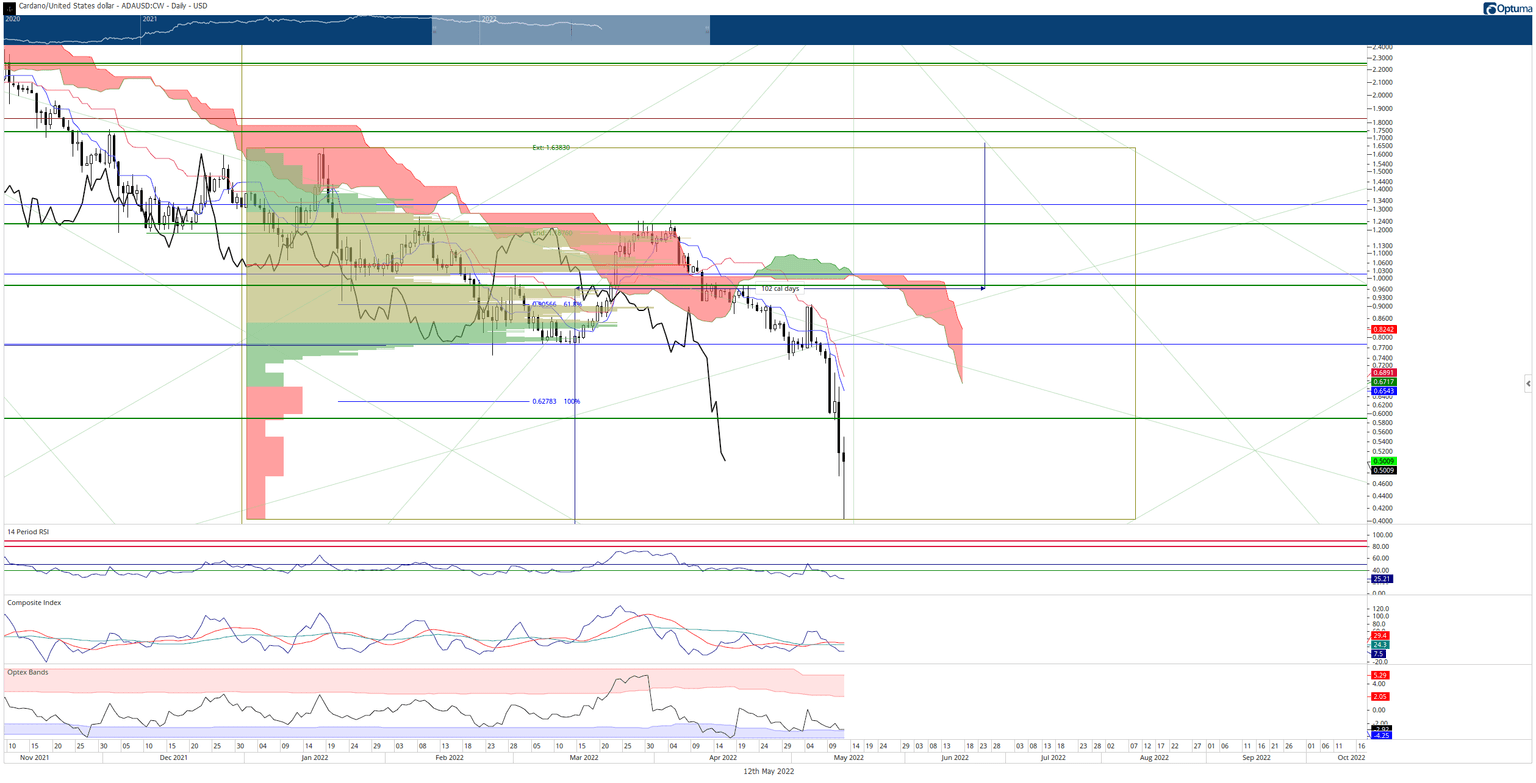

ADA/USD Daily Ichimoku Kinko Hyo Chart with Gann's Square of a Range

From a time cycle perspective, there are multiple reasons that Cardano price will reverse and begin a new and extended uptrend.

- Kumo Twist on May 13th.

- 50% range of the current Gann Square of a Range

- 240-day Ganny Cycle of the Inner Year (tends to be a low if the market is in an uptrend)

- 49 – 52 day Gann ‘death cycle’ (often terminates blow-off moves - like what ADA has experienced this week).

The initial resistance zone that Cardano price will like face is the 50% Fibonacci retracement at the critical $1.00 value area. The $1 price level will likely determine the direction of Cardano price for the remainder of 2022.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.