How to time Cardano price correction to buy the dip and make 100% gains

- Cardano price is set to tank another 30% before finding support.

- ADA price will enter a distribution zone around $0.50, where bulls are ready to build a massive stake.

- Expect a sharp rebound to $1.00 as the ultimate profit target as bulls squeeze prices higher.

Cardano (ADA) price is missing any action from bulls, but as price action is delivered at the mercy of the bears, bulls are fretting about a plan to spark a turnaround. With the US dollar's strength, bulls will sit on their hands and wait for the right buying opportunity, which lies around $0.50, where a distribution zone is waiting for massive buying. Once the distribution phase is completed, expect a bullish breakout, with an accelerated upswing towards $1.00.

ADA price set to book 100% gains from the low of 2022

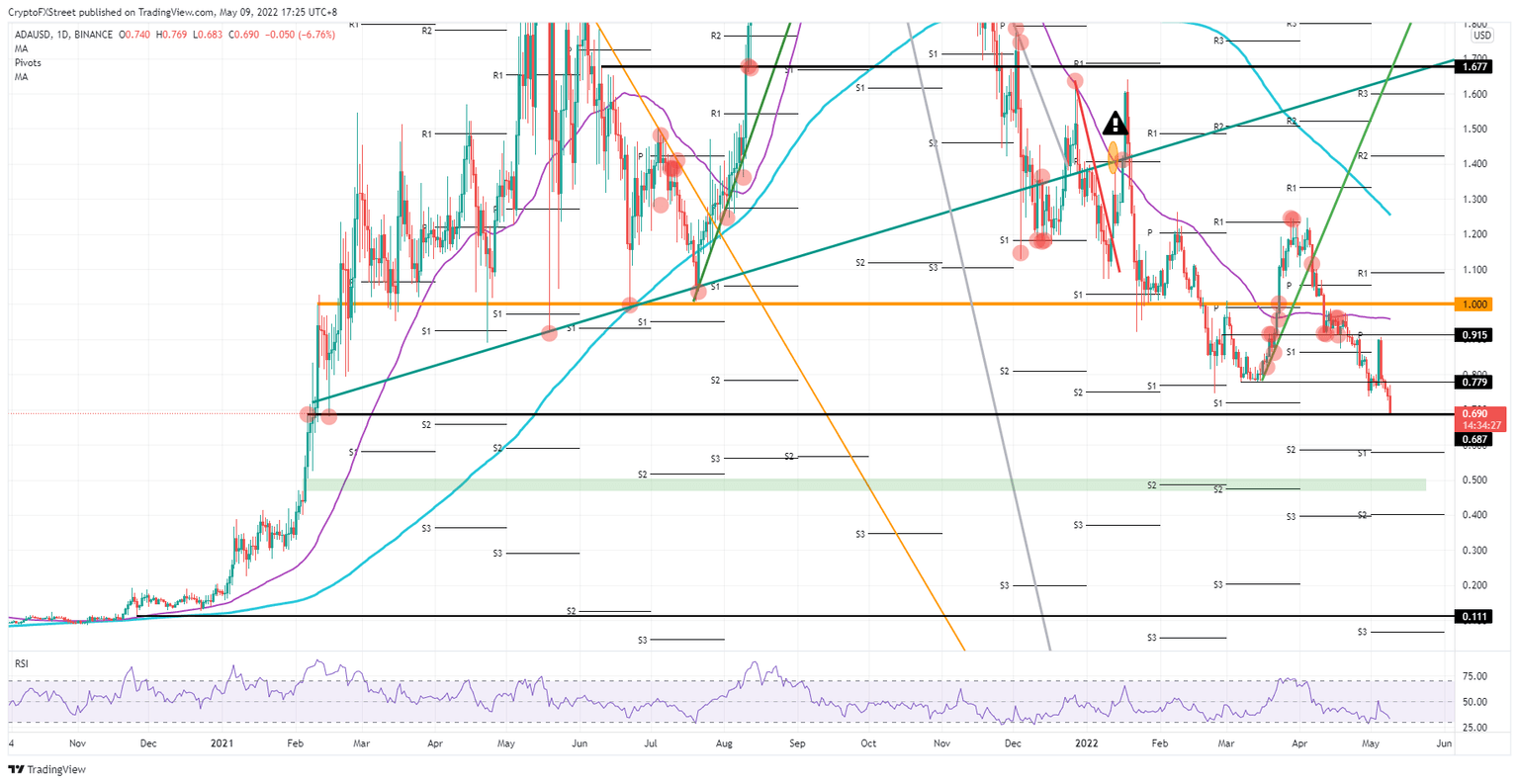

Cardano price saw a strong rejection against $0.9150 last week, which triggered a complete pairing back of the gains locked in the previous trading day. With that rejection, bears used the momentum to further accelerate losses as the US dollar strength only attributed to more downside in ADA price. Cardano price is testing $0.6900, which coincides with the lows of February 2021.

ADA price is more than sure to break below that level as the US dollar strength is looking to continue for another round, but with that downturn, the opportunity comes for bulls to scope up ADA price at an attractive discount. A distribution zone awaits near $0.50 where bulls can buy in heavily and squeeze price action to the upside, triggering bears to get out and see buy-side demand exploding. ADA price will pump higher towards $0.9150 before jumping the final tranche to $1.00.

ADA/USD daily chart

With the EU bloc still divided on what to do with the next round of sanctions, the EUR/USD equation does not look to favor any upside anytime soon, though. As the US dollar strength will remain for another few trading days or even weeks, expect to see ADA price start to see several legs lower with the risk that Cardano might be decimated to $0.11, which would erase all the gains from 2021 and put it back to 2020 values. Translated into numbers, that means a whopping 85% devaluation from where ADA price is trading at the time of writing.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.