Which altcoins can recover after today's drop?

On the last day of the week, neither bulls nor bears are dominating the market as some coins have entered the correction phase.

BTC/USD

Bitcoin (BTC), unlike most of the altcoins which keep rising, growing by 2.18% over the last day.

BTC/USD chart by TradingView

On the 4H chart, Bitcoin (BTC) needs energy on the way to the vital $60,000 mark.

In this case, the more likely scenario is sideways trading around $56,000-$56,000 at the beginning of the next week.

Bitcoin is trading at $56,900 at press time.

BNB/USD

Binance Coin (BNB) could not show short-term growth and went down by 4% since yesterday.

BNB/USD chart by TradingView

Despite the decline, the rising channel has not been broken, which means that bulls are not going to give up in the long-term projection. If buyers fix above the $350 mark, there are chances of updating the peak of $370 and going higher.

BNB is trading at $290 at press time.

XRP/USD

XRP is not an exception as the rate of the popular crypto has fallen by 3.30%.

XRP/USD chart by TradingView

XRP looks bullish in the short-term as bears could fix below $0.505 and a false breakout has been formed. That is why one may expect a retest of the resistance at $0.58 shortly.

XRP is trading at $0.5402 at press time.

XLM/USD

Stellar (XML) is the top loser today. Its rate has decreased by 4.37%.

XLM/USD chart by TradingView

Stellar (XLM) is about to keep growing as sellers could not fix below the rising channel. If the trading volume remains at the same level, there are high chances of seeing XLM at $0.60 within the next few days.

Stellar is trading at $0.4954 at press time.

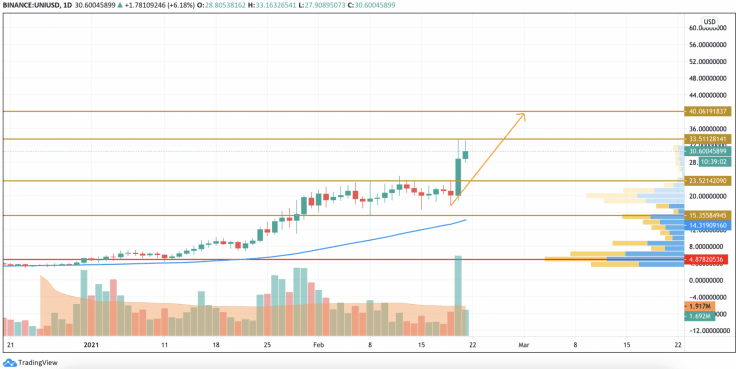

UNI/USD

UNI is a totally different picture: its price has rocketed by 10% over the past 24 hours.

UNI/USD chart by TradingView

Despite the sharp rise, UNI may not have reached its peak yet as bulls keep pushing the rate of the coin higher. If buyers break the $33 mark, the vital level of $40 may be achieved by the end of the month.

UNI is trading at $30.56 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.