What to expect from Cardano price ahead of the Vasil hard fork on Thursday

- Cardano price fights to regain losses after bouncing off support at $0.4400.

- Input Output confirms Cardano’s Vasil hard fork on September 22.

- ADA price is ready for a bullish breakout if the MACD flips positive in the short term.

Cardano price is preparing for its big day on Thursday by firmly holding onto support at $0.4400. The smart contract token is scheduled to receive a major software upgrade a week after Ethereum’s Merge. Price recovery is expected to take center stage during the hard fork, which brings ADA’s target at $0.5200 within reach.

Meet Cardano’s Imminent Vasil hard fork

IOHK (Input Output), the organization tasked with developing Cardano’s blockchain, announced via a blog post that the much-awaited Vasil hard fork would occur on Thursday, September 22. The post also highlighted some of the major changes users can look forward to, for instance, upgrading the platform’s smart contracts via its Plutus v2 protocol.

Following the software upgrade, smart contracts will become highly efficient in line with increasing activity since their inception. A recent report revealed that contracts on Cardano crossed the 3,000 mark for the first time in August.

Vasil will help the Cardano blockchain realize various functionalities in relation to reference input, enabling sharing of data on-chain. In other words, accessing data stored on the protocol would be possible without necessarily having to recreate UTXOs (unsent transaction output).

The changes the Vasil software upgrade brings cannot all be listed in this article, but the event could positively influence Cardano price going into the weekend. Meanwhile, IOHK maintains that the network’s security is paramount.

“There are multiple ecosystem stakeholders to be considered. Ensuring that any upgrade is safe and secure, and that players across the Cardano ecosystem are fully ready has always been paramount,” IOHK’s blog post reads in part.

What’s next for Cardano price after the Vasil upgrade?

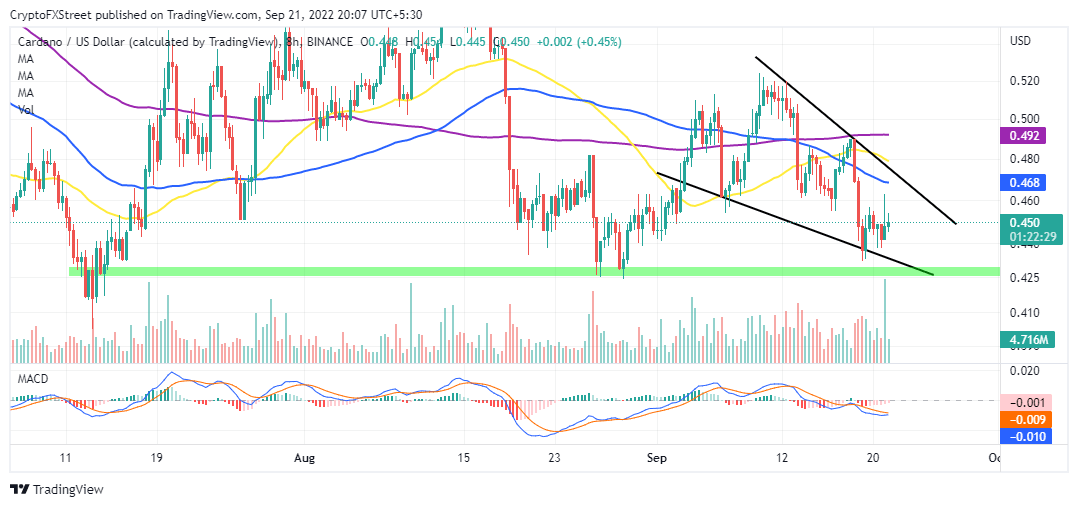

Cardano price is doddering at $0.4470 while awaiting demand for its ADA token to rise ahead of the software upgrade. The Moving Average Convergence Divergence (MACD) indicator is on the verge of triggering a buy signal – to boost ADA price above a gradually forming falling wedge.

Traders must wait until the 12-day (blue) Exponential Moving Average (EMA) crosses above the 26-day EMA (green) before filling their long positions to avoid sudden bull traps.

ADA/USD eight-hour chart

Support at $0.4400 is crucial for developing the Cardano price uptrend. Possible short-term targets are the upper trendline of the wedge at $0.4600 and the 50-day (yellow) Simple Moving Average (SMA) at $0.4800. It is probable for ADA price will close the week trading above $0.5200 as long as demand soars owing to the Vasil software upgrade.

On the other hand, Cardano price is yet to clear the woods, especially if support at $0.4400 shatters. It would be detrimental to the bulls if the down leg stretches below the wedge. Key targets to the downside are the buyer congestion area at $0.4250 and $0.4020.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren