Weekly Technicals - A mixed start

The cryptocurrency markets started the week with the mixed sentiment, as the prices of bitcoin dipped to 8700 areas over the weekend before rebounding to 9000 levels. That came two weeks after the massive rally that sent the leading crypto from 7300 to 10500. We’ve only seen muted actions during the early Asia session on Monday. JJ Kinahan, Chief Market Strategist at TD Ameritrade told Bloomberg that bitcoin is going to remain range-bound for a while, and markets seem to be uncertain about what would bring bitcoin prices out of that range.

We’ve seen green across the board in the altcoin space, as major altcoins jumped about 3% during the early session. XLM outperformed its altcoin peels, as the burning of 55 million XLM tokens could continue to be a key driver of XLM in the short term.

What You Missed

-

We’ve seen more central banks are opening its interest in having its digital currency, and Hong Kong is one of them. The HKMA said it has been studying the application of a CBDC and will release a report by 1Q20. That came after the SFC introduced a regulatory framework for crypto-asset exchanges in the city.

-

Zhou Xiaochuan, the former governor of PBoC believes that the IMF should take over Facebook’s Libra project. During a finance conference, Zhou said: “People will question the motive of Libra as it’s initiated by a private company, it works better if it’s in IMF’s custody”.

-

The trade volume of Bakkt’s bitcoin futures has hit a new all-time high. The exchanged has recorded a volume of over 15 million USD on Friday, representing 1756 BTC worth of contracts have been changed hands

-

Ethereum Istanbul upgrade is getting more likely to launch on December 4. Ethereum core developer Peter Szilágyi said the upgrade is targeted for the early December launch, and it expects to make the network more secure and efficient.

Price Analysis - BTC/USD

-

BTCUSD has rebounded to the lower 9000 levels after the weekend dip. Indicators show some mixed signals here.

The pair have briefly traded below the 23.6% Fibonacci Retracement before rebounding and still well above the June-October downtrend (green line). We believe the mid/long term outlook could still be positive if the price remains above that channel. -

However, the ultimate oscillator broke the recent uptrend, signalling a shift in the momentum could have been taking place, and the bias more to the downside.

-

The +DM line has ticked up while the -DM line has slowed down a little. This could mean the positive momentum has picked up but only slightly.

-

OKEx’s BTC Long/Short Ratio suggests that short positions have higher potential profit than longs, suggesting a long squeeze could be possible.

-

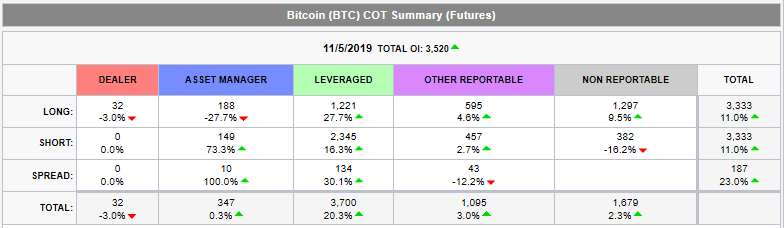

CME’s CoT shows that institutional asset managers have cut back some of their long positions, it could be driven by profit-taking activities after the massive rally. At the same time, short positions in asset managers and leveraged accounts have increased.

Figure 1: BTCUSD Daily Chart(Source: FX Street)

Figure 2: OKEx BTC Long/Short Ratio (Source: OKEx)

Figure 3: CME Bitcoin Commitment of Traders Summary (Source: CME)

XRP/USD

-

XRPUSD has been moving in a 4-hour ascending triangle pattern since late September, and the recent price actions suggest that a rebound could be in the making, as the pair has recently been trading near the lower end of the triangle.

-

The RSI also rebounded slightly after touching the 30 levels. We’ve seen the price rebounded after the RSI touched or went below 30 in late September and late October, let's see if that will repeat this month.

-

Also, the pair has touched the lower end of the Bollinger bands before slightly drifting upward, suggesting the pair has been recovering from the previous oversold.

Figure 4: XRPUSD 4-Hour Chart (Source: FX Street)

XLM/USDT

-

XLM bulls may want to wait a bit longer before entering the market despite the pair still largely in an upward channel and supported by the token burn.

-

The RSI confirmed the top twice as it surged to above the 80 levels, and the RSI remains relatively high, this could indicate that bias to the downside persists.

-

Furthermore, the ultimate oscillator seems to divergence with the price recently, suggesting that a correction could be possible.

Figure 5: XLMUSDT Daily Chart (Source: OKEx; Tradingview)

DOGE/USDT

-

DOGEUSDT could continue to rally as the pair traded toward the 78.6% Fibonacci Retracement. In our October Global Markets Review, we’ve noted that coins and tokens that shown lower correlation with bitcoin generally outperformed its peels, and Dogecoin was one of them.

-

As the price moves upward, the pair has touched the upper end of the Bollinger Bands, it indicates that the pair could be oversold.

-

The ultimate oscillator also suggests an oversold situation, and a correction could be due in the short-term, but it could represent an ideal entry point.

Figure 6: DOGEUSDT Daily Chart (Source: OKEx, Tradingview)

Author

Cyrus Ip

OKEx

Cyrus Ip has the privilege to work with OKEx as a Research Analyst, where he found some of the brightest talents in the crypto space.