VeChain Price Analysis: VET can re-test $0.025 if this vital resistance gives way

- VeChain's technical picture suggests that the token is poised for a recovery.

- VET needs to stay above $0.016 to confirm the bullish stance.

VeChain (VET) is changing hands at $0.016, having gained about 2% at the time of writing since Monday. The token takes 26th place in the global cryptocurrency market rating with the current capitalization of $1 billion.

VET is the native token of a blockchain-powered supply chain platform named VeChain, which was launched in 2016. It aims to solve supply chain management issues with the help of distributed governance and the Internet of Things (IoT) technology.

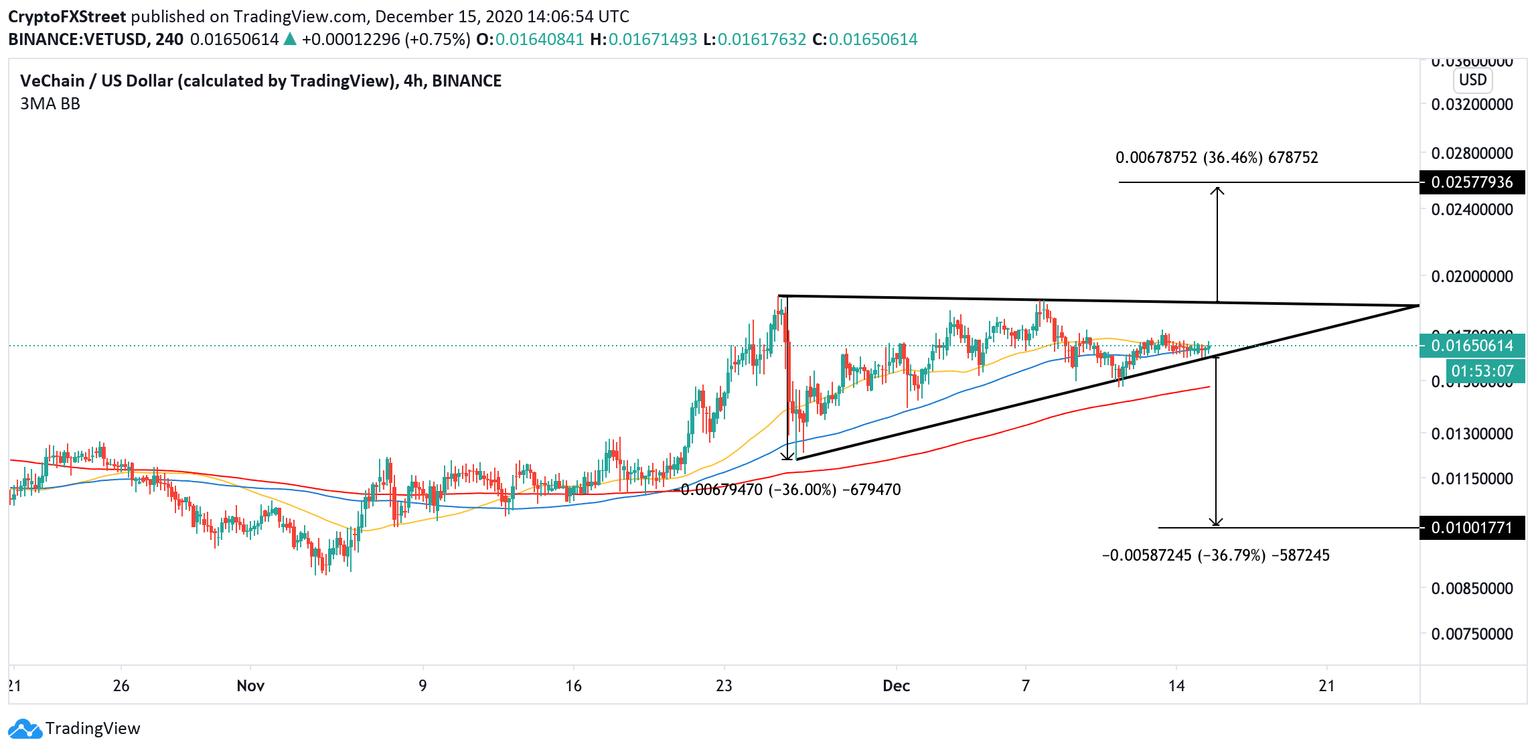

VET locked in an ascending triangle

On the 4-hour chart, VET is trading inside an ascending triangle. This bullish formation implies that the asset is positioned for a strong recovery, provided that the support created by the hypotenuse stays unbroken. Currently, the support comes at $0.016.

A rebound from this area will bring the x-axis of the triangle at $0.0186 into focus, with the eventual estimated bullish target at $0.025.

VET, 4-hour chart

Meanwhile, if $0.016 gives way, the immediate bullish scenario will be invalidated, opening the way to a sharp sell-off towards $0.01. However, the 4-hour 200 EMA at $0.014 may slow down the decrease and push the price back inside the triangle pattern.

The In/Out of the Money Around Price (IOMAP) data confirms the support at $0.014 as 4,000 addresses purchased nearly 89 million VET between $0.014 and $0.012. This area may absorb the selling pressure and initiate a recovery.

VET's In/Out of the Money Around Price data

On the upside, the insignificant resistance lies between $0.0167 and $0.18. If the bullish momentum is sustained, VET may extend the recovery towards $0.02 at least.

Author

Tanya Abrosimova

Independent Analyst

%2520Analytics%2520and%2520Charts-637436386758672826.png&w=1536&q=95)