VeChain Price Prediction: VET upswing thwarted again as sell signals multiply

- VeChain price has failed its third attempt to breach the $0.228-$0.245 supply zone.

- A decisive close above $0.245 will signal the start of a new bull rally.

- The development of MRI’s sell signal worsens VET outlook as sellers eye a 12% decline.

VeChain price shows an ambiguous outlook as it has set up a textbook uptrend with a series of higher highs and higher lows, but technical indicators hint at a downtrend.

VeChain price tests bulls’ persistence

VeChain price has been a high-performing asset since the start of the current bull run in early January. Of late, though, VET seems to be experiencing a slowdown after hitting an all-time high of $0.279 on April 17.

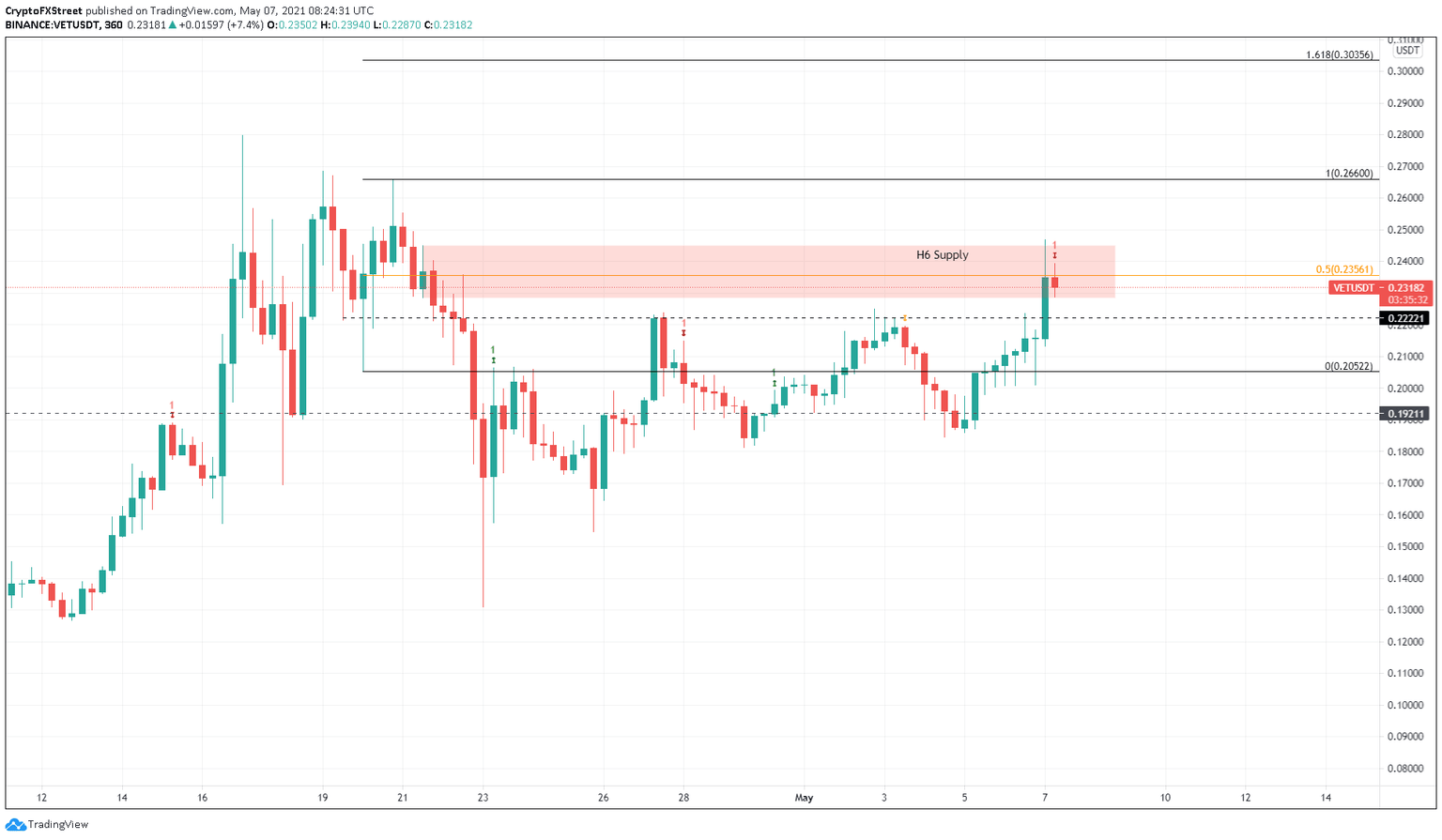

The supply zone that extends from VeChain price $0.228 to $0.245 has prevented VET from heading on a full-blown upswing. This resistance barrier has prevented the bulls from ascending three times over the past two months.

While this can be interpreted as bearish, the series of higher highs and higher lows over roughly the same period shows a bullish formation.

However, the Momentum Reversal Indicator (MRI) has flashed a cycle top signal in the form of a red ‘one’ candlestick on the 6-hour chart. This setup projects a one-to-four candlestick correction.

Regardless of the bearish setup, if VeChain price produces a swift close above $0.245, it would signal the start of a new uptrend.

In such a case, VET could surge nearly 9% to tag the recent swing high at $0.266. Following the breach of this level, if the buying pressure persists, VeChain price could set up a new high at $0.303, coinciding with the 161.8% Fibonacci extension level.

VET/USDT 6-hour chart

On the flip side, if the MRI pushes VeChain price below the support barrier at $0.222, it would invalidate the forementioned bullish scenario.

If this were to happen, VET could fall 13% toward the next demand level at $0.192.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.