VeChain price consolidation prolonged, while VET developers pursue a dynamic eNFT ecosystem

- VeChain price battles descending trend line with little volume commitment.

- Key Fibonacci retracement level of the April decline detaining price strength.

- VET to capitalize on enterprises bringing NFTs to the ecosystem.

VeChain price has lagged the collective rebound in the cryptocurrency complex with a meager 12.5% rally since the April 17 low. To overcome trend line resistance and march to the all-time high, VET may need a catalyst.

VeChain price yet to price in a new eNFT ecosystem

In a lengthy analysis, VET concluded that enterprises would be fundamental to the mass adoption of NFT. The optimum way is to work with them to co-develop a vibrant eNFT (Enterprise NFT) Ecosystem on the VeChain Thor blockchain.

Individuals creating NFTs do it for fun or as a moment to remember, but it is projected that enterprises will have a more precise purpose when designing and developing NFTs. Enterprises will be compelled to build and improve facilities to improve the experience for users. As a result, it would ensure the quality of NFTs.

Enterprises, unlike individuals, are committed to making sure that the ownership associated with an NFT issued as the whole or part of a product is enforced. They have an embedded interest in ensuring that the product is delivered to customers as stated, or it will damage the company’s reputation, leading to an exodus of clients and a loss of profitability.

Undoubtedly, enterprises will bring new users to the ecosystem.

Once eNFTs are issued on blockchain, and become tradable on marketplaces, it would be natural for the eNFT owners and those who pay close attention to the eNFTs to join the ecosystem.

VET believes that VeChainThor public blockchain’s Proof of Authority (PoA) is the perfect solution for building an enterprise-grade public blockchain. PoA 2.0 is poised to improve network security and lift the upper bound of the maximum throughput of VeChainThor by allowing nodes to “best utilize the network bandwidth for transmitting transactions most of the time.” Moreover, it guarantees ample decentralization of the network via demanding that sufficient qualified nodes be participating in its consensus process. It provides an absolute guarantee of public ledger safety.

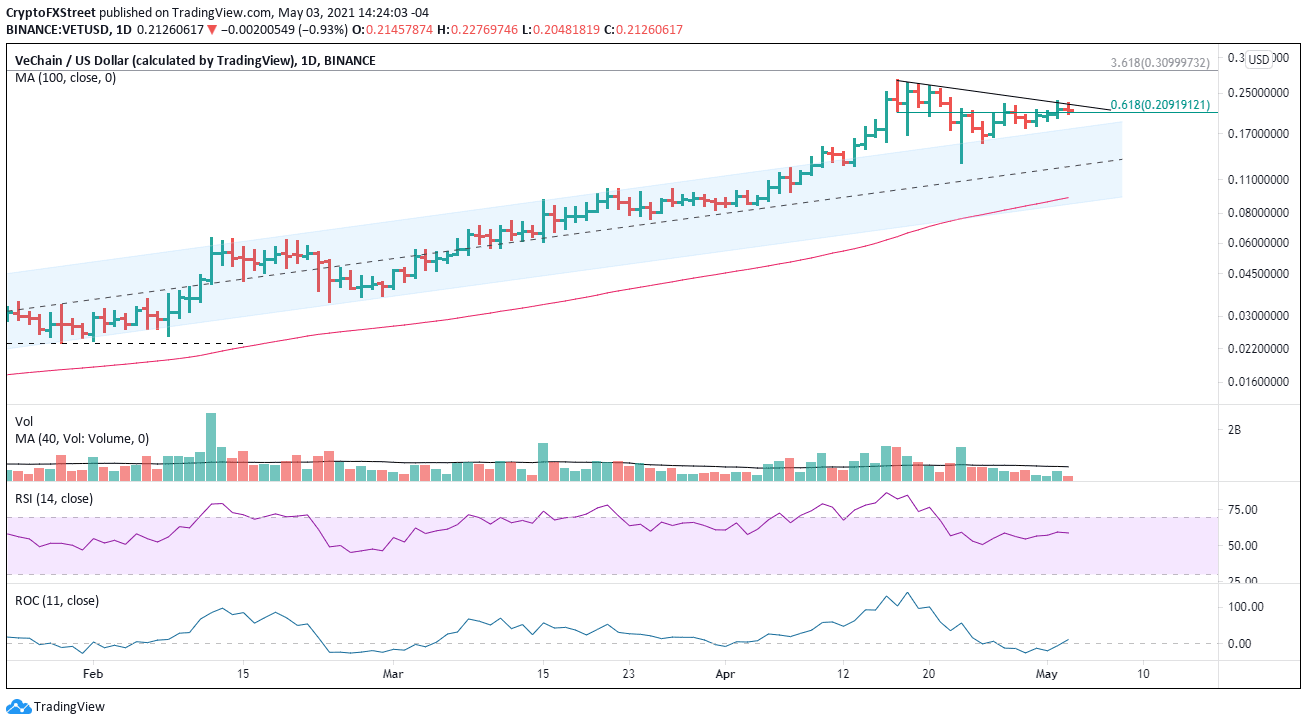

Since the April 23 bullish hammer pattern on the fourth largest daily volume in 2021, VeChain price has been drifting higher, holding the upper trend line of an ascending channel. The upside is contained by the 61.8% retracement of the April decline at $0.209. Now VeChain price has stumbled into the declining trendline from the April high, putting bullish speculators in a more challenging technical position.

The primary objective for VeChain price is to overtake the all-time high at $0.282, but it will not materialize if the volume remains below average. A final breakthrough would release VeChain price to experiment with the 361.8% extension of the August-November correction in 2020 at $0.309, representing close to a 50%

VET/USD daily chart

For the mildly bullish outlook to be invalidated, VeChain price would have to undercut the April 23 low of $0.128, which currently appears unlikely.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.