VeChain price offers traders a chance to quantify their risks before the next breakout

- VeChain price action has formed a rising wedge on the daily timeframe.

- However, VET could record a new all-time low unless bullish momentum abounds.

- While this technical formation indicates bearishness due to weakening buyer momentum, conservative investors can wait for a secondary wave.

- A decisive daily candlestick close above $0.032 could invalidate the bearish thesis.

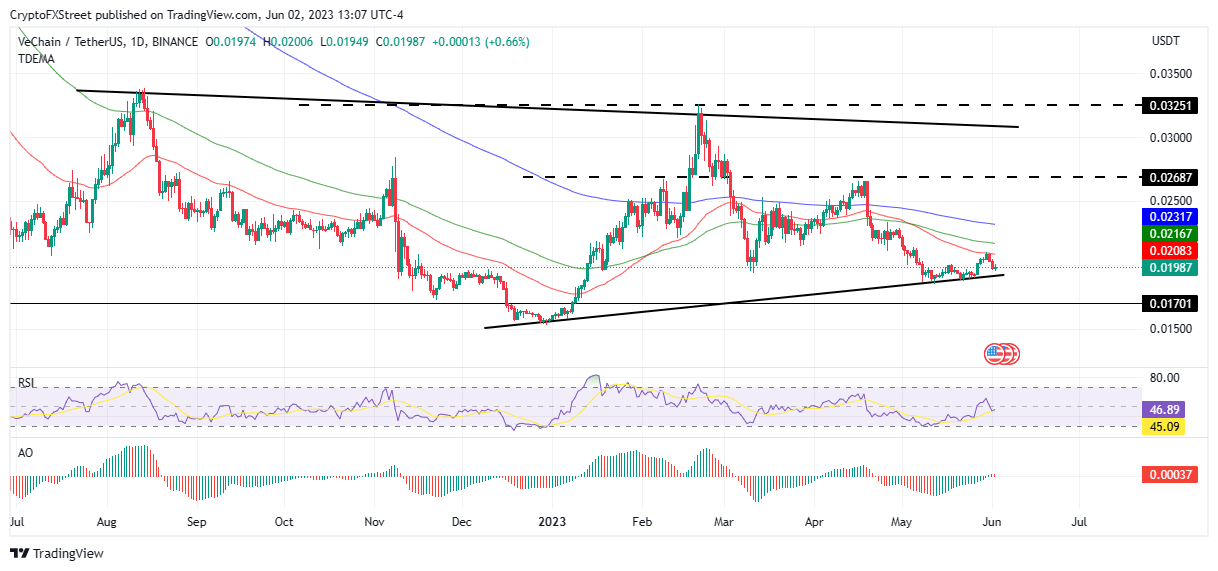

VeChain (VET) price action since August shows growing volatility as VET consolidates within a broader fixed market range. The price action is characterized by explosive moves south countered by less aggressive moves north, suggesting a readiness among investors to short the market once it tests the upper boundary. Possible reasons below.

VeChain price coils up for a breakdown

VeChain (VET) price action has formed a rising ‘ascending’ wedge pattern. This technical formation forecasts a bearish chart pattern, signaling an imminent breakout to the downside. The pattern is formed by connecting a series of lower highs to form the upper boundary and a series of higher lows to form the lower boundary. Notably, the upper boundary is often less steep than the lower boundary, suggesting less aggression coming from the bulls than bears. As VeChain price cruises through the prior highs, it is not getting enough momentum to make higher highs.

VeChain price could break below the lower boundary of the pattern at around $0.018 as overhead pressure from the 50-, 100-, and 200-day Exponential Moving Averages (EMA) abound at $0.020, $0.021, and $0.023 respectively. The Relative Strength Index (RSI) adds credence to this thesis because its downward direction indicates weakening momentum.

Given that the price has only tested the upper boundary a few times, there is less liquidity accumulation around that level, giving VeChain price less incentive to break above. The impulsive moves south after every retest of the upper boundary demonstrate a unique keenness to short the market by triggering stop losses.

To support the bearish case, whenever VeChain price hits the support offered by the lower boundary, there are traders looking to buy VET. This is indicated by the ensuing successive green bars. Accordingly, a cluster of stop losses accumulates just below this support. This incentivizes the altcoin to break below this lower boundary, triggering those stop losses to consume liquidity.

In addition, VeChain price making lower highs coming into the support shows that bears are in control, a sign of strength that could favor the downside. If this thesis pans out, VET could break below the lower boundary to tag the $0.017 support level.

VET/USDT 1-Day Chart

On the other hand, conservative investors can wait for a secondary wave below the support provided by the lower boundary of the ascending wedge. The liquidity collected underneath could fuel a strong move upward.

If sustained and VET manages to flip the EMA resistances into support, VeChain price could break above the $0.026 resistance and escape the upper boundary of the governing chart pattern. A daily candlestick close above the $0.032 would invalidate the bearish thesis.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.