Upexi turns to Solana for Treasury strategy in $100 million deal with GSR

- GSR announced on Monday that it has secured a $100 million PIPE in Upexi.

- Upexi has committed to establishing a Solana treasury strategy, including accumulating and staking SOL.

- Solana’s price hovers around $138.90 on Tuesday after rallying 7% the previous week.

GSR, a crypto trading and investment firm, announced on Monday that it has secured a $100 million private investment in public equity (PIPE) in Upexi (UPXI). Upexi has committed to establishing a Solana (SOL) treasury strategy that includes accumulating and staking SOL.

Corporations’ rising interest in Solana

On Monday, GSR, a crypto trading and investment firm, announced that it has secured a $100 million private investment in public equity in Upexi. The investment follows Upexi’s announcement of a strategic shift toward a cryptocurrency-based treasury strategy aimed at generating long-term appreciation and yield for shareholders. Upexi has committed to establishing a Solana treasury strategy, including accumulating and staking SOL.

“The investment underscores GSR’s confidence in Solana as a leading high-performance blockchain and GSR’s mission to bridge the gap between traditional capital markets and the digital asset ecosystem,” says GSR’s press release.

Brian Rudick, Head of Research at GSR, “Solana’s speed, scalability, and vibrant developer ecosystem make it an ideal foundation for long-term growth, and we are honored to help accelerate the integration of digital assets into institutional portfolios.”

Institutional interest in Solana is gaining momentum. On Monday, asset manager ARK Invest announced that it will incorporate Canada’s 3iQ Solana Staking ETF into its crypto-focused funds, marking a notable step toward the broader adoption of Solana-based investment products.

While many companies have followed MicroStrategy’s playbook—allocating Bitcoin to corporate treasuries since its pioneering move in 2020—most have remained exclusively focused on Bitcoin, as discussed in the previous report.

In contrast, Upexi’s Solana-centric treasury strategy is a unique bet on an alternative Layer 1 blockchain. Supporting this trend, commercial real estate firm Janover recently disclosed a purchase of 163,651 SOL, valued at $10.5 million, as part of its crypto treasury initiative.

Moreover, as shown in the Lookonchain data below, Galaxy Digital appears to be selling Ethereum (ETH) and buying SOL. In the past two weeks, Galaxy Digital has deposited 65,600 ETH, worth approximately $105.48 million, to the Binance exchange and withdrawn 752,240 SOL tokens, valued at $98.37 million, from Binance.

It seems that Galaxy Digital is selling $ETH and buying $SOL!

— Lookonchain (@lookonchain) April 22, 2025

In the past 2 weeks, Galaxy Digital deposited 65,600 $ETH($105.48M) to #Binance and withdrew 752,240 $SOL($98.37M) from #Binance.https://t.co/lD8tgkC4Py pic.twitter.com/olcPWNnGq2

Solana Price Forecast: SOL finds support around the 50-day EMA

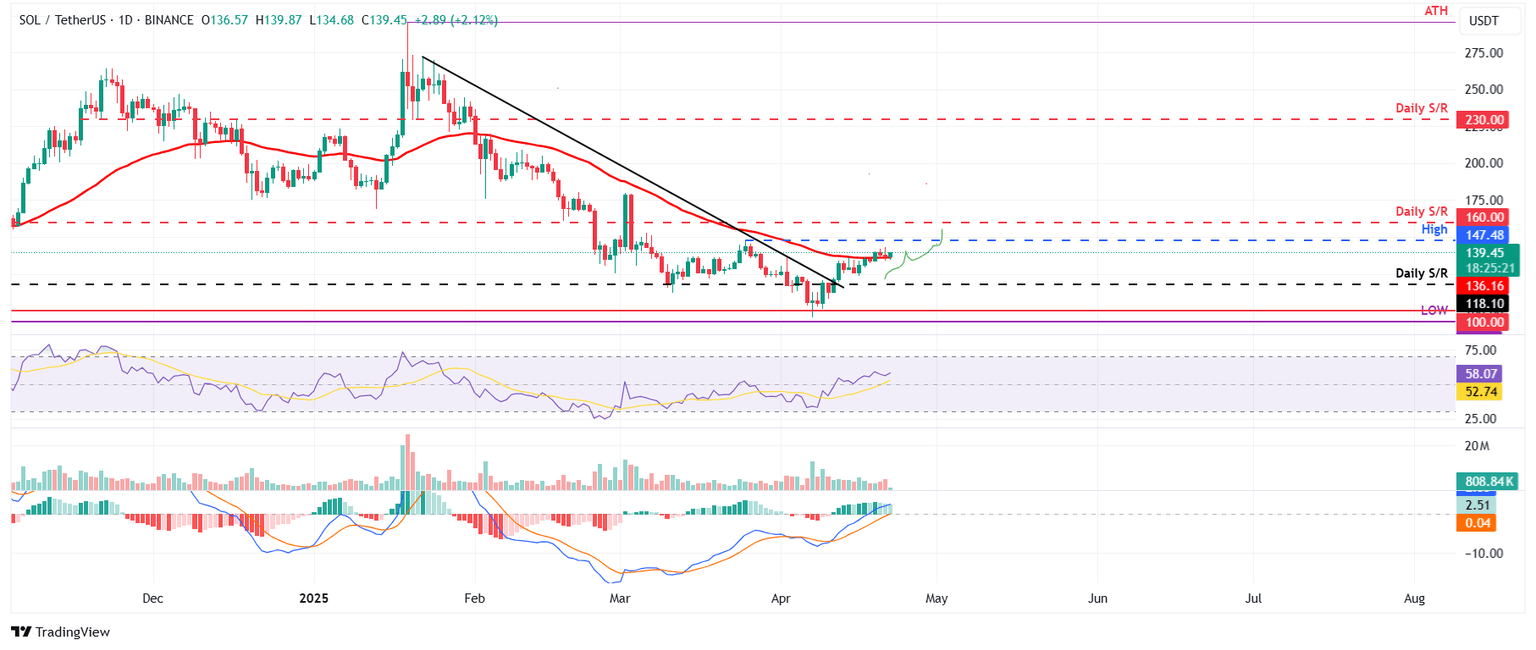

Solana price broke above the descending trendline (drawn by joining multiple highs since mid-January) on April 11 and rallied by 11% over the next six days. Moreover, SOL rose 4.35% and closed above its 50-day EMA level at $136.14 on Saturday. However, it declined slightly over the next two days, and it was retested and found to have support around its 50-day EMA level. At the time of writing on Tuesday, it bounces and trades higher around $139.02.

If the 50-day EMA at $136.14 continues to hold as support, SOL price could extend the rally to retest its March 25 high of $147.48. A successful close above this level could extend an additional rally to retest its next daily resistance at $160.

The Relative Strength Index (RSI) on the daily chart reads 58, above its neutral level of 50, indicating bullish momentum. The Moving Average Convergence Divergence (MACD) also exhibited a bullish crossover last week, signaling a buying opportunity and continuation of the upward trend.

SOL/USDT daily chart

However, if SOL fails to find support around the 50-day EMA level and closes below it, it could extend the correction to retest its daily support level at $118.10.

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.