Uniswap price primed for new all-time highs as it continues to lead the momentum in the DeFi space

- Uniswap price has outperformed most cryptocurrencies and has been leading the DeFi industry.

- The digital asset hit a new all-time high at $15.75 on January 29.

- On-chain metrics are extremely positive for Uniswap and have pushed its price higher.

Uniswap had one of the best performances in 2021 rising by 237% to new highs almost every single day. The digital asset has reached rank 15th on Coinmarketcap with a market capitalization of $4.1 billion.

Uniswap leads the way as other DeFi projects follow the decentralized exchange

Despite Bitcoin hitting a new all-time high at $42,000, Ethereum had a lot of trouble establishing a new all-time high and has been trading sideways for the past week. On the other hand, Uniswap and other decentralized exchanges have had a lot of success in 202.

Back in September 2020, Uniswap users received an airdrop of 400 UNI per user. The governance token had a massive sell-off during the first few weeks. However, surprisingly, the digital asset managed to recover and establish new highs.

Just recently, we have seen a lot of drama with GameStop and the need for decentralized exchanges as one of the biggest trading platforms, Robinhood, halted trading of GME stocks to thousands of clients and also stopped the trading of cryptocurrencies temporarily.

Uniswap price could continue to rise higher as metrics remain positive

Uniswap has seen massive growth in the past week with 190% new addresses joining the network and more than 150% active addresses compared to the last week. This tremendous growth indicates that Uniswap’s rally is healthy.

Uniswap new and active addresses chart

Since the beginning of 2021, around 31 new large holders have joined the network. They hold between 100,000 and 1,000,000 coins. Similarly, the number of whales with 1,000,000 to 10,000,000 coins also increased by six.

UNI Holders Distribution chart

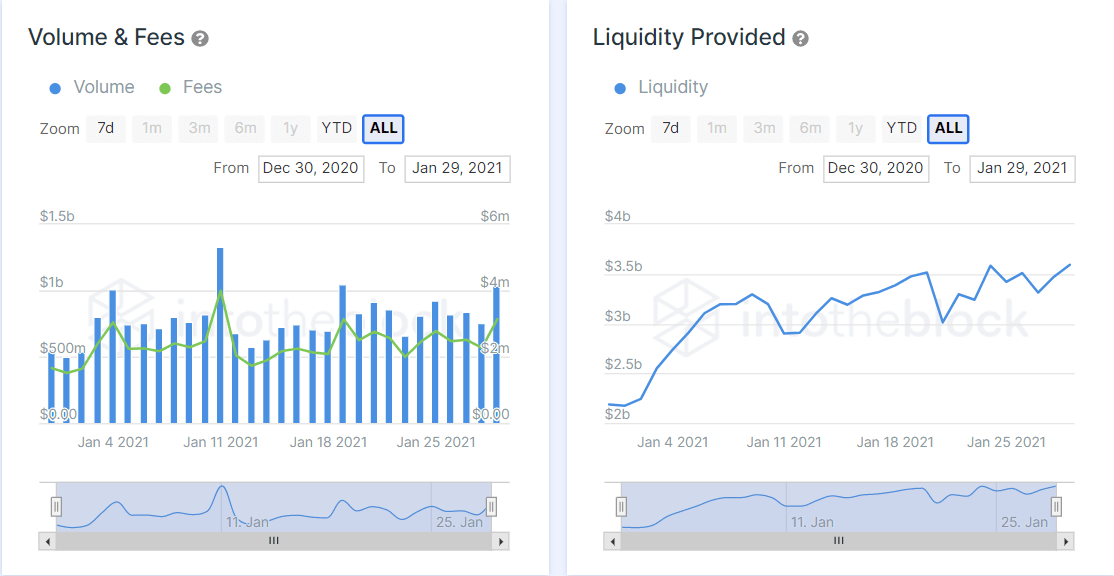

Additionally, the liquidity provided on Uniswap has exploded from $2.17 billion in January 2021 to a new all-time high of $3.59 billion currently. Of course, this also increased the fees received by the exchange as well as the volume peaking on January 11, at $1.33 billion with $3.99 million in fees. It seems that Uniswap price could continue its massive rally towards $20 without much opposition.

Uniswap statistics

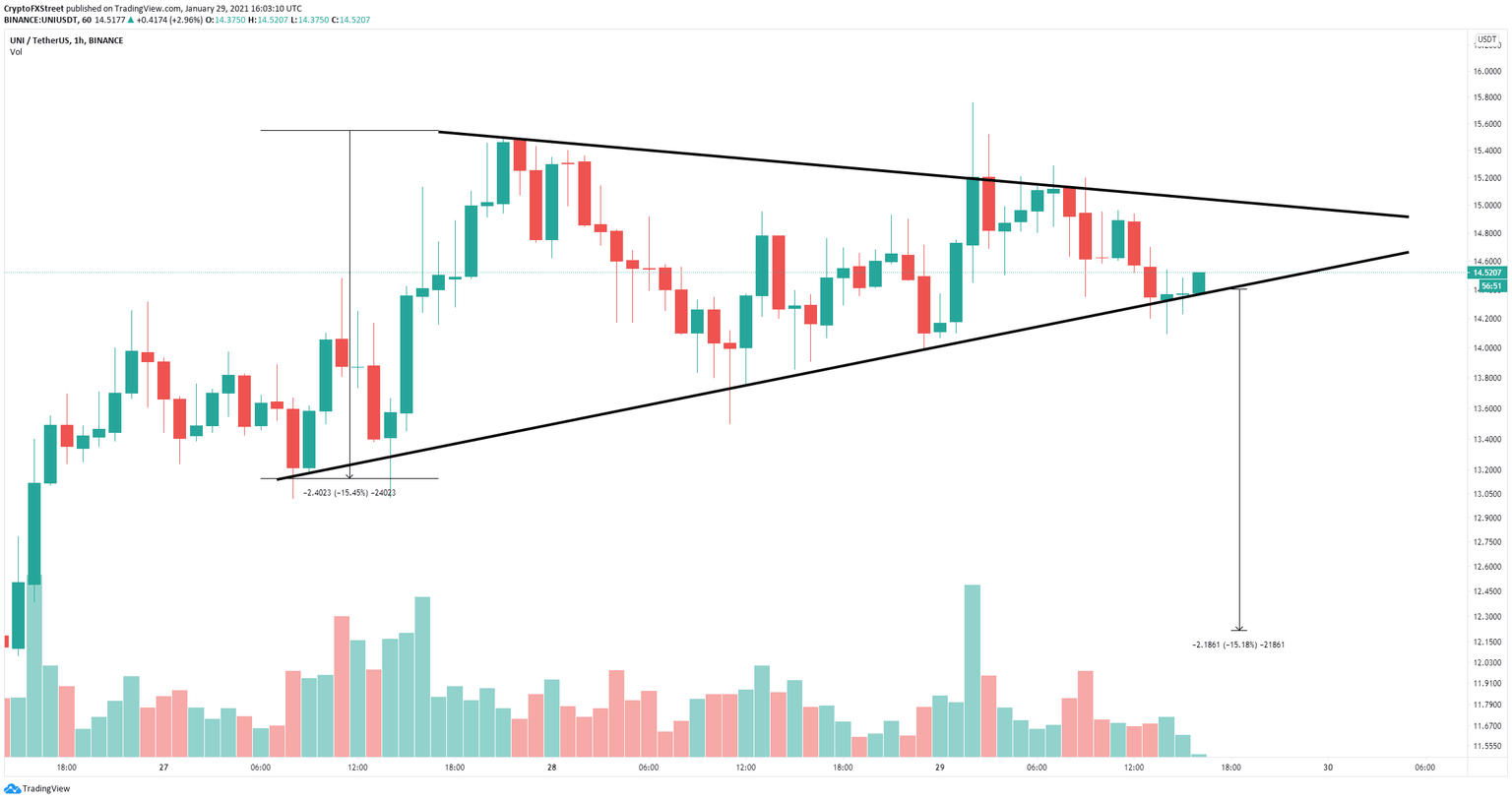

However, on the 1-hour chart, Uniswap has established a symmetrical triangle pattern which could be close to a breakdown. Losing the support level at $14.3 could quickly push Uniswap price towards $12.

UNI/USD 1-hour chart

The digital asset seems on the verge of a big move as its trading volume has been declining significantly. Uniswap current price of $14.5 is closer to a breakdown.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B16.58.31%2C%252029%2520Jan%2C%25202021%5D-637475330612575105.png&w=1536&q=95)