Uniswap Price Prediction: UNI at risk of a major correction to $16, on-chain metrics suggest

- Uniswap price had a massive 350% rally in 2021, reaching a high of $20.75.

- The digital asset could be poised for a correction as it is overextended.

- Several on-chain metrics suggest UNI is bound to see a pullback sooner than later.

Uniswap has reached a market capitalization of over $5.5 billion and has been climbing the ranks of CoinMarketCap to hit 13th. UNI was up by more than 1,000% since its all-time low of $1.75 in November 2020.

Uniswap price can quickly fall towards $16

The MVRV (7d) indicates that Uniswap price has been inside the risk zone for the past week. This often leads to a correction in the short-term, as it happened on January 30 or January 18.

UNI MVRV (7d)

Even more worrying for the bulls is the percentage of UNI tokens inside exchanges, which had a significant spike from 6.3% on January 30 to 6.64% currently. This indicates that perhaps investors are ready to sell and take some profits in the short term.

UNI tokens on exchanges

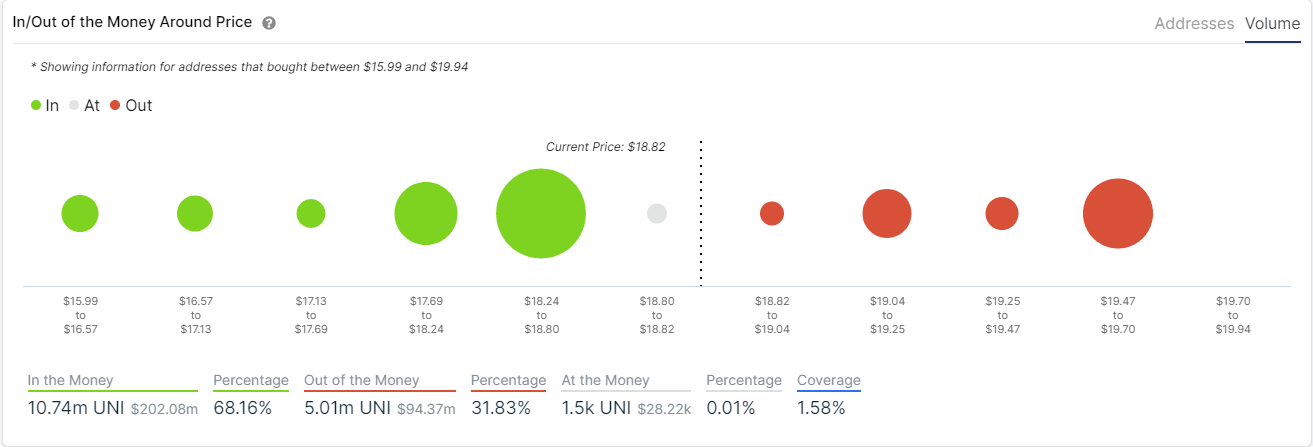

The In/Out of the Money Around Price (IOMAP) chart shows a robust support level between $18.24 and $18.8, where 122 addresses purchased 7.22 million UNI tokens. A breakdown below this point can drive Uniswap price down to $16 as there is weaker support below.

UNI IOMAP chart

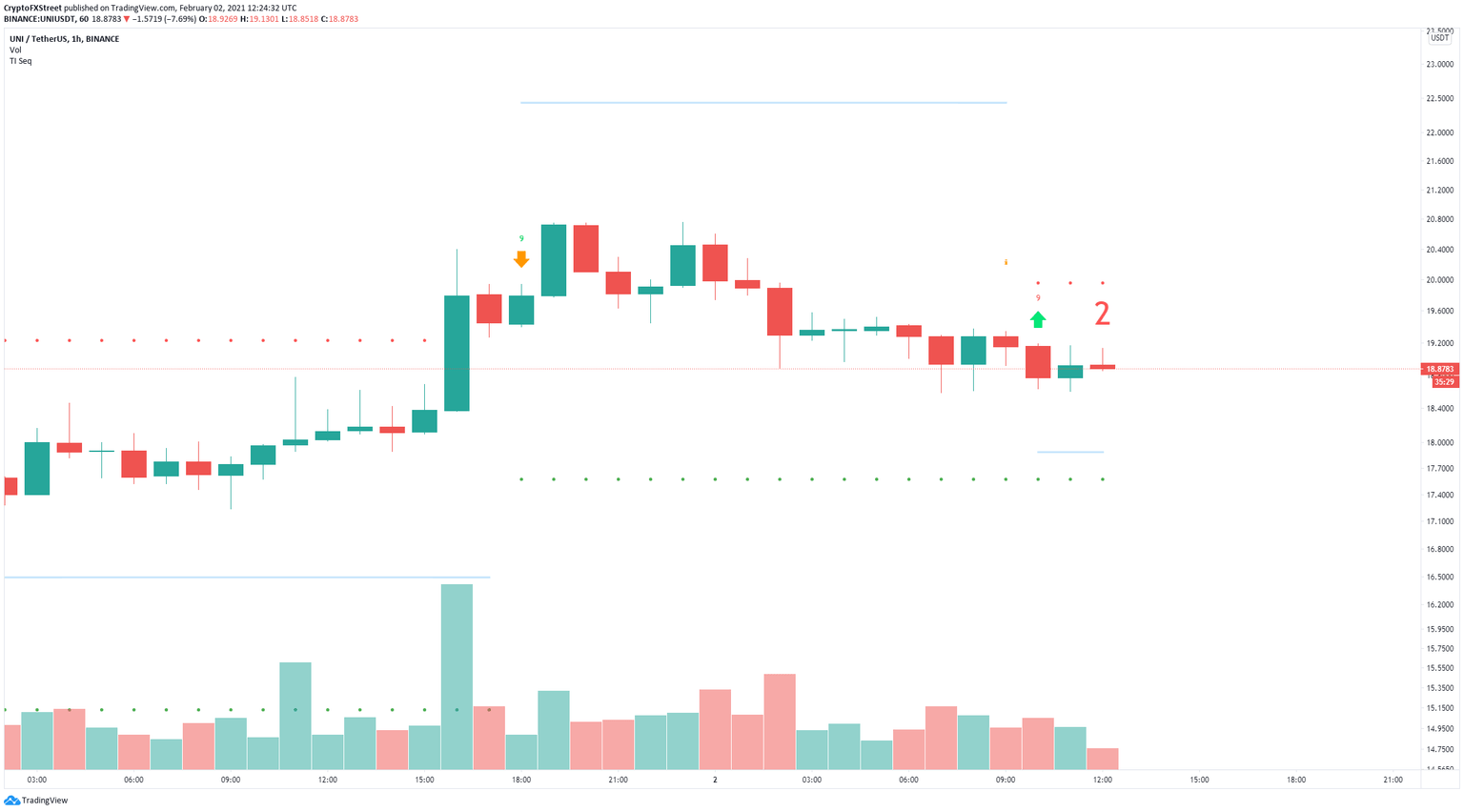

However, Uniswap is inside a major uptrend and could continue climbing higher. On the 1-hour chart, the TD Sequential indicator has presented a buy signal that could push Uniswap price towards $20 again.

UNI/USD 1-hour chart

According to the IOMAP chart, there is feeble resistance until the area between $19.47 and $19.7 with 3.55 million UNI in volume. A breakout above this point can easily drive Uniswap price above $20.

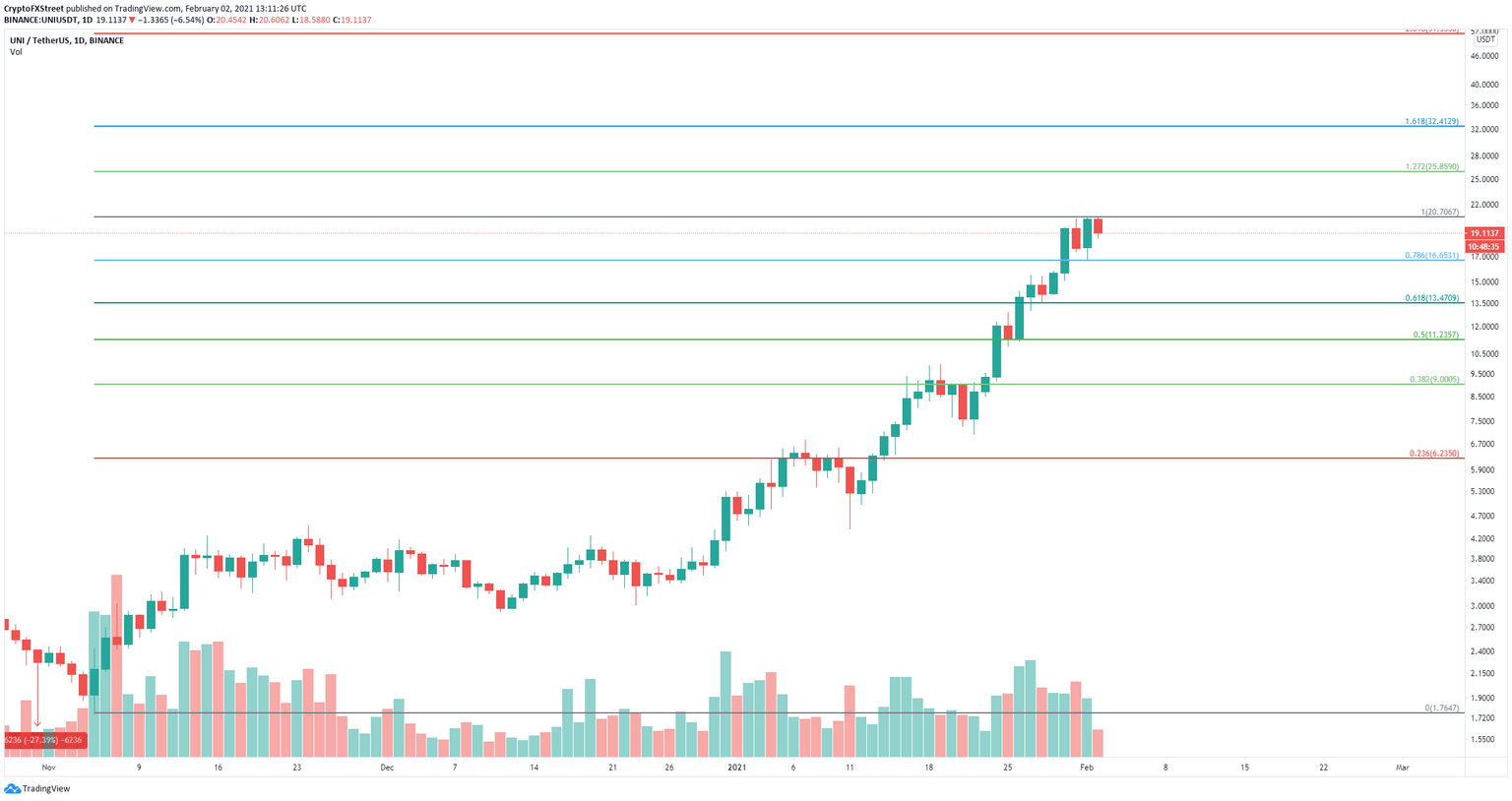

UNI/USD daily chart

The Fibonacci Retracement indicator shows that Uniswap price will climb to $26 at the 127% level if there is a breakout above $20. The next price target would be $32.4 which is the 168% level.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B13.20.54%2C%252002%2520Feb%2C%25202021%5D-637478657559133427.png&w=1536&q=95)

%2520%5B13.20.43%2C%252002%2520Feb%2C%25202021%5D-637478657587586197.png&w=1536&q=95)