Uniswap Price Analysis: UNI’s rise to new all-time highs only depends on one critical demand wall

- Uniswap price needs to get past the last crucial sell wall at $6.40 to increase its chances of revisiting the previous all-time high (ATH).

- Failure to conquer this demand wall could quickly push the price down by 10%, with more downswing on the horizon.

Uniswap token is trading at $6.35 at the time of writing, resulting from the considerable surge seen last week. At this rate, UNI will most likely hit its previous ATH at $8.70 very soon. However, a crucial sell wall might pose a threat to the token’s ascent.

Uniswap price on the cusp of revisiting its record highs

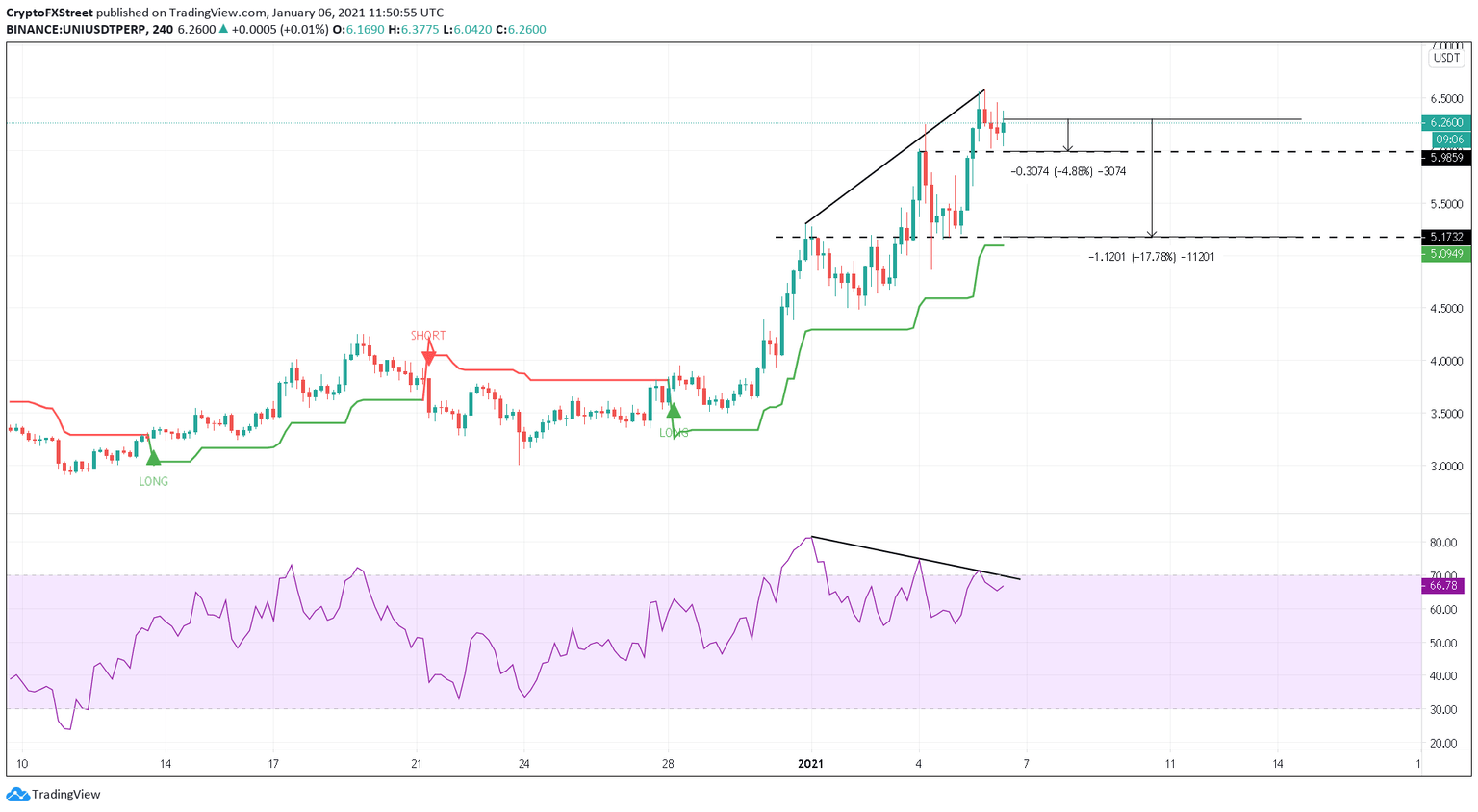

On the 4-hour chart, Uniswap price has established higher highs displaying the alt season’s buying pressure. Adding credence to the buying pressure is the SuperTrend index, which flashed a buy signal in late December.

UNI/USDT 4-hour chart

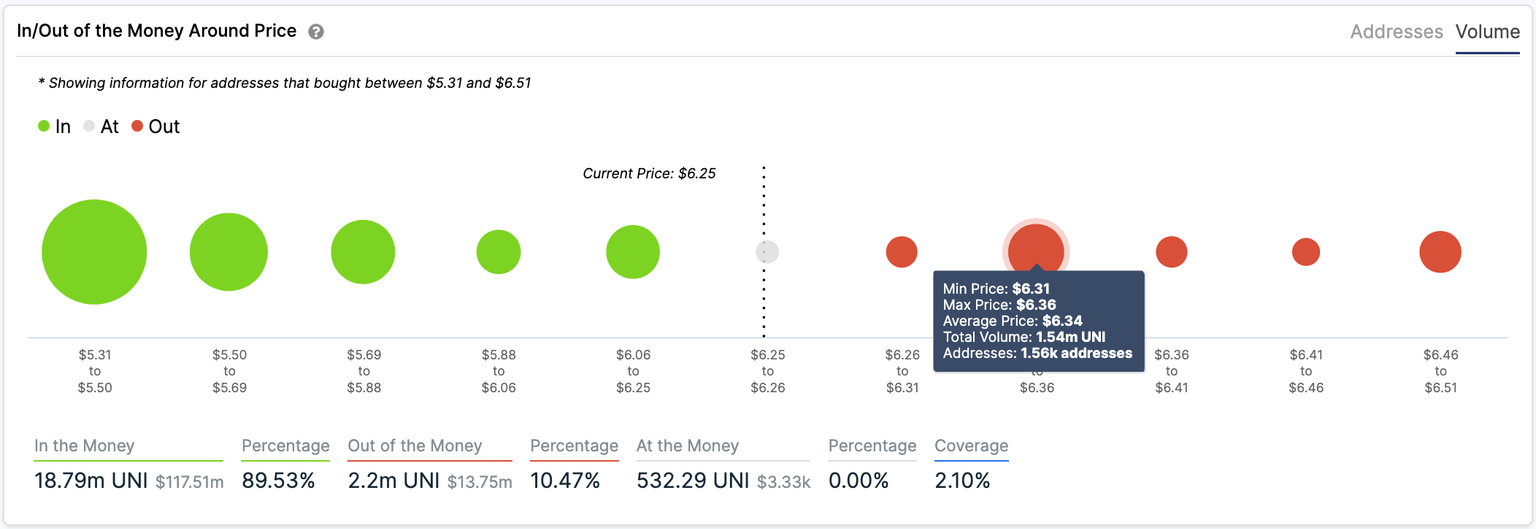

According to IntoTheBlock’s In/Out of the Money (IOMAP) metric, about 1,540 addresses have previously purchased 1.57 million UNI at an average price of $6.40. Hence, this level is crucial if UNI needs to revisit its ATH.

UNI IOMAP

A breach of the demand wall at $6.40 will push UNI into quiet waters allowing it to head higher, perhaps to its previous ATH.

On the other hand, the token’s bearish scenario poses a threat to push UNI price down to the immediate support levels at $5.60 and $5.20. This bearish scenario is a result of the bearish divergence between Uniswap price and the RSI indicator.

To conclude, Uniswap might dive anywhere between 5% to 15% if it fails to conquer the sell wall at $6.40, while breaching this hurdle will send it to nearly $9.00.

Author

FXStreet Team

FXStreet