Uniswap Pirce Forecast: UNI flirts with another breakout that could see it rise nearly 20%

- Uniswap price continues to consolidate after enduring a parabolic advance over the past last month.

- If UNI manages to close above $21, it will re-enter price discovery and aim for $25.

- Transaction history reveals a strong demand barrier underneath this token that may absorb any downward pressure.

Uniswap market value has skyrocketed by nearly 300% since the beginning of the year. Although UNI has remained stagnant throughout February, it may be bound for another leg up.

Uniswap price prepares to resume bull rally

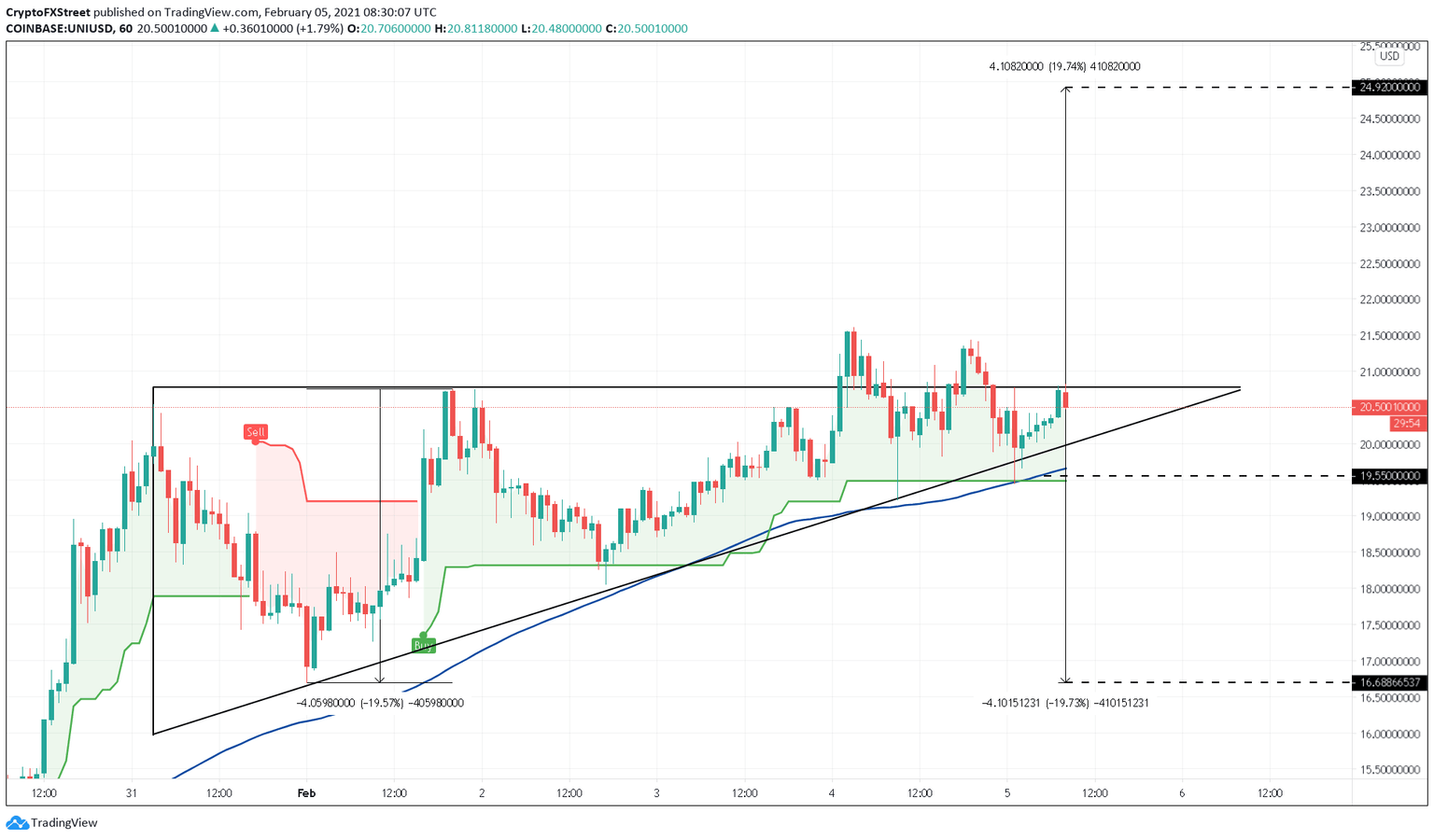

The DeFi token is currently trading inside an ascending triangle that formed on its 4-hour chart. Since this type of technical pattern develops as a continuation of the previous trend, it is reasonable to assume that UNI will break out in a positive direction.

By measuring the height of the triangle's y-axis and adding it to the breakout point at $21, it seems like Uniswap price is primed for a 20% upswing. If validated, UNI’s market value could rise towards $25.

UNI/USD 1-hour chart

The SuperTrend indicator also suggests that UNI is on the verge of a bullish breakout. This technical index flashed a buy signal on February 1, at 16:00 UTC, and continues trending upward.

A massive demand wall

IntoTheBlock's In/Out of the Money Around Price (IOMAP) model shows little to no resistance above the current price level that may prevent Uniswap price from advancing further.

Instead, the IOMAP cohorts show a massive demand wall underneath this cryptocurrency. Based on this on-chain metric, the $19.60 support level is a crucial hurdle since nearly 2,900 addresses purchased around 8.40 million UNI.

Given the strength of this support wall, any near-term selling pressure may prompt these investors to buy more tokens to prevent seeing their investment go 'Out of The Money.'

UNI IOMAP chart

Regardless, it would be disastrous for Uniswap price to slice through the $19.60 support level. A downswing below this crucial barrier could push UNI to $18.04, based on the IOMAP. This is the next significant area of support where 6,500 addresses purchased about 1.45 million tokens.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.