TRX Price Prediction: TRON is expected to fall lower, but the uptrend looks healthy

- TRX price declined by 3% on January 9.

- A 10% decline targeting $0.055 is likely to occur.

- The downtrend thesis would be invalidated from a breach above $0.071.

TRX price saw a 46% rally throughout the winter but has recently declined by 3% on January 9. Despite this decline, the overall trend remains positive, as the bulls are in control of the larger narrative. In the short term, however, TRX is expected to decline further.

TRX price expected to pullback

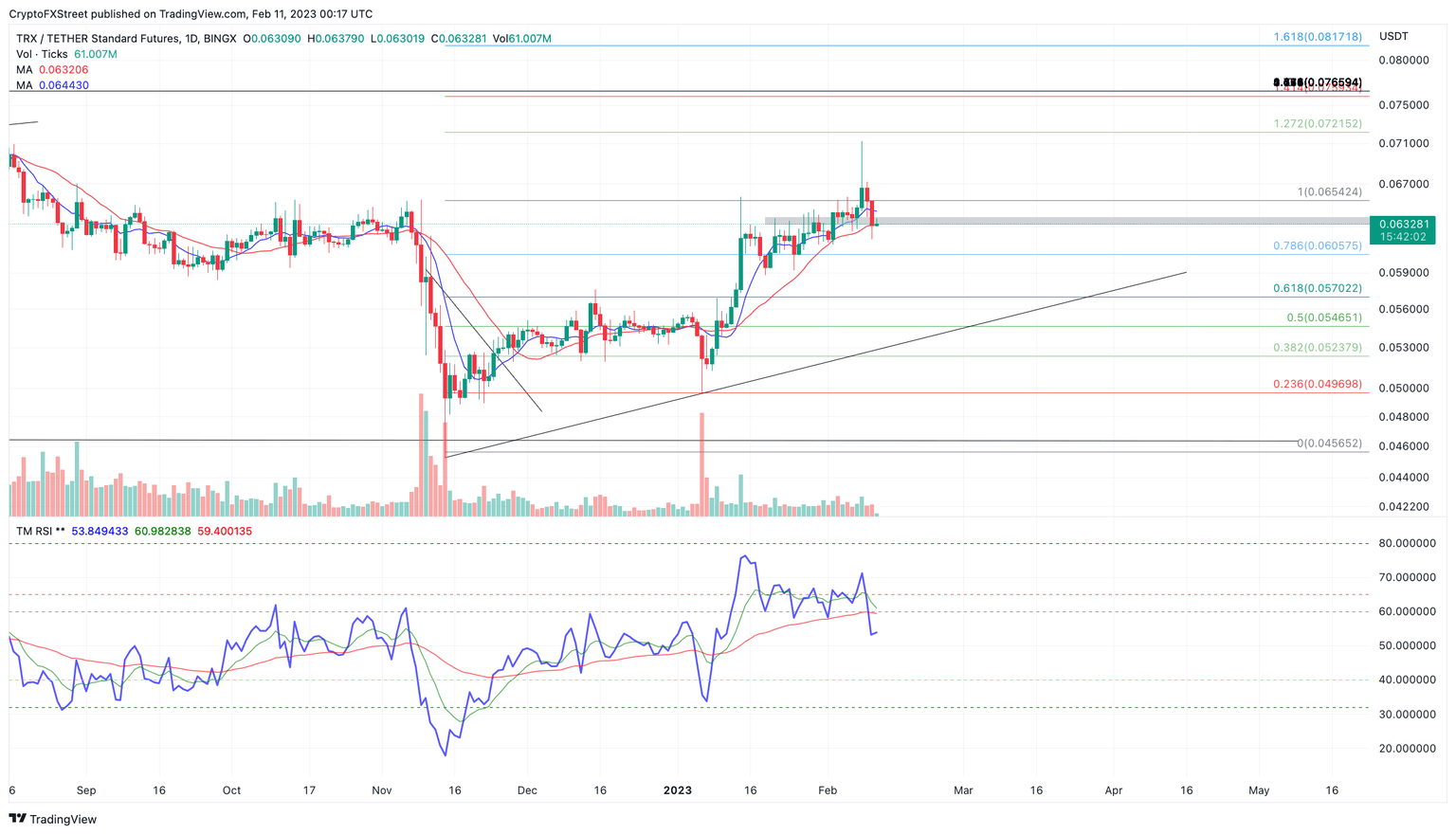

TRX price is currently trading at $0.063 as the bears are testing the support of the 21-day simple moving average. During the 40% rally this winter, the Relative Strength Index breached overbought conditions. The RSI implies that the current pullback is a countertrend move before more gains occur.

It is worth noting that there is a bearish divergence on the RSI between highs marked at December 14 high at $0.065 and the February 8 high at $0.071. Given this newly developed information, The TRX price is subject to a stronger downtrend move in the near future, A conservative target would be midpoint of the 40% winter rally near $0.055. The bearish scenario ceates the potential for a 10% decline in the short term. If the relative strength index remains above 40 as the price declines, TRX could be viewed as a buying opportunity in the coming weeks.

The short-term downtrend thesis could be invalidated by a breach above the recent swing-high of $0.071. This bearish thesis remains short-term and targets the midpoint zone of $0.055.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.