Bitcoin breaks $100,000 again as US trade talks fuel crypto rally

- Bitcoin rallies past the $100,000 level on Thursday.

- BTC price rally comes in response to US President Trump’s announcement of a US-UK trade deal.

- Crypto market capitalization crossed $3.21 trillion, meme coins and nearly all tokens in top 100 are rallying.

Bitcoin price crossed $100,000 on Thursday and hovers around $101,525, at the time of writing. The largest cryptocurrency ignited a rally in meme coins, AI tokens and altcoins in the top 100 cryptos by market capitalization.

Bearish traders on Bitcoin paid a heavy price for their bets with over $118 million in shorts liquidated in the last 24 hours, according to Coinglass data. Open interest in Bitcoin climbed by 7% in the past day, crossing $70 billion.

The top three market movers driving Bitcoin price gain are the US-UK trade deal, positive sentiment among traders and Bitcoin’s rising correlation with Gold.

Bitcoin climbs to $101,525

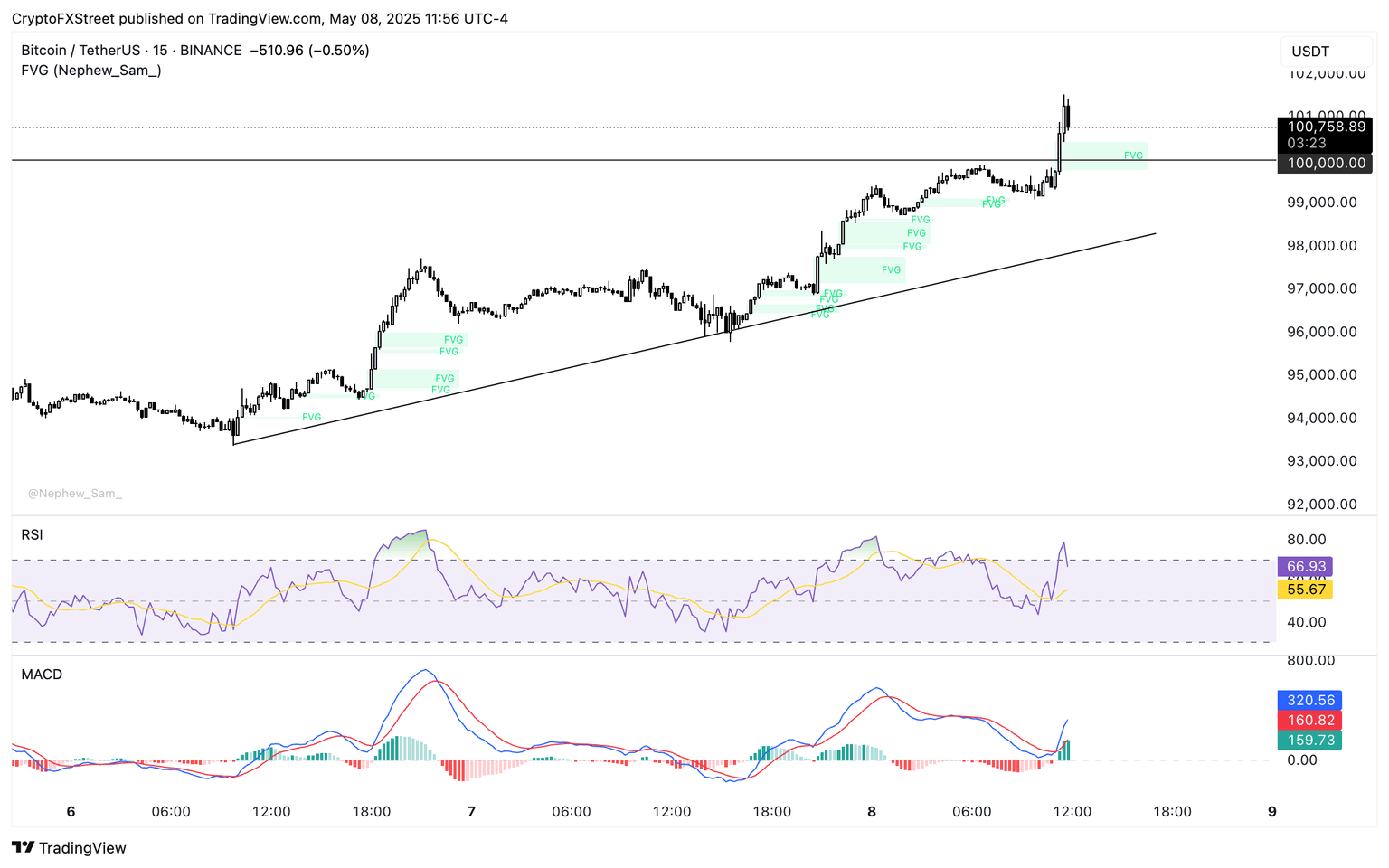

Bitcoin shattered the $100,000 barrier on Thursday, climbing to a high of $101,525. The milestone was considered a sticky resistance for BTC. On the 15-minute price chart, a key momentum indicators Moving Average Convergence Divergence (MACD) is bullish at the time of writing.

Relative Strength Index (RSI) reads 66 while MACD flashes green histogram bars above the neutral line, signaling an underlying bullish momentum in Bitcoin price trend.

BTC/USDT 15-minute price chart

Ryan Lee, Chief Analyst at Bitget Research told FXStreet,

“Bitcoin's surge to $100K, is primarily macro-driven, fueled by expectations of Fed rate cuts and Trump's vocal push for lower interest rates, which bolsters risk assets. However, the Fed's focus on unemployment and inflation creates uncertainty around actual rate cuts, with Trump's influence adding political but not definitive weight. Strong institutional inflows, ETF demand, and whale accumulation provide solid support for a sustained move higher. However, volatility may arise from tariff concerns or profit-taking at the $100K resistance level. A clear break above this psychological barrier could hinge on consistent economic signals favoring policy easing.”

Macro drivers of Bitcoin price rally

The US Federal Reserve held interest rates steady amidst tariff uncertainty, according to an announcement on Wednesday. Key Trump officials are slated to meet Chinese officials in Switzerland later this week, authorities said market participants should expect negotiations to occur.

Other key developments include the announcement of the US-UK trade deal reached earlier today and Bitcoin’s rising correlation with Gold.

The 30-day Pearson correlation co-efficient between Bitcoin and Gold climbed to 0.61, according to the Block.

Bitcoin Pearson Correlation | Source: TheBlock

At the time of writing, Bitcoin is trading at $100,837.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.