Trading bots feted as UniBot on-chain volume nears 10 million in 24 hours

- Telegram trading bots are going mainstream, taking over from where the meme coin mania left off.

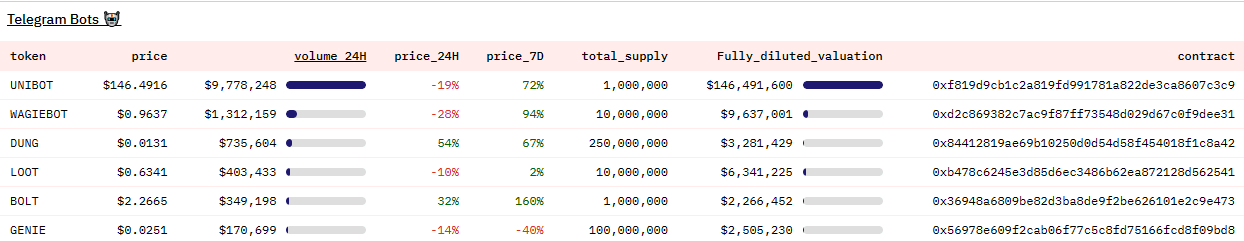

- UniBot champions the pressing Telegram bot narrative as the leading contender, with on-chain volume nearing 10 million in 24 hours.

- Analysts say trading bots could be a massive trend in crypto, outliving meme coin mania because of long-term value.

Trading bots are a new frenzy, steadily taking center stage and recording incredible gains daily on several projects. The concept is taking over messaging platform Telegram, allowing retail investors in the crypto space to venture into decentralized finance (DeFi) to profit from the altcoin-fueled market rally. The traction has seen CoinGecko establish a new category specifically for TelegramBots tokens.

Also Read: ChatGPT founder Sam Altman's Worldcoin under investigation by French authorities.

Trading bots mania settles with UniBot as flag bearer

Trading bots, presenting as computer programs using artificial intelligence (AI) and advanced algorithms to buy and sell cryptocurrencies automatically, have become the latest mania on crypto corridors as retail traders look to cash in on the altcoin-fuel market rally.

The trading bot innovation has taken over the Telegram app, providing a direct entrance into DeFi, making it arguably a more popular trend than PEPE's recent meme coin euphoria. With on-chain volume nearing ten million in the last 24 hours, UNIBOT is the leading contender in the Telgram trading bots category.

UNIBOT volume Dune Analytics

Traders use UniBot for limit orders, copy trading, fail guard sales, shielded transactions, and revenue sharing. Other trading bots like LootBot help users farm for airdrops using a zkSync wallet. UniBot's suite of predefined niches is perhaps the reason behind its popularity.

Notably, the UNIBOT market capitalization has risen almost 140% in less than ten days, from 66 million on July 23 to 156.7 million on CoinGecko.

CoinGecko New Category: Telegram Bots

— CoinGecko (@coingecko) July 19, 2023

We've just added a new category for Telegram Bots tokens.

Check it out here: https://t.co/8MO6PC6JGv pic.twitter.com/o0WYnIRA4i

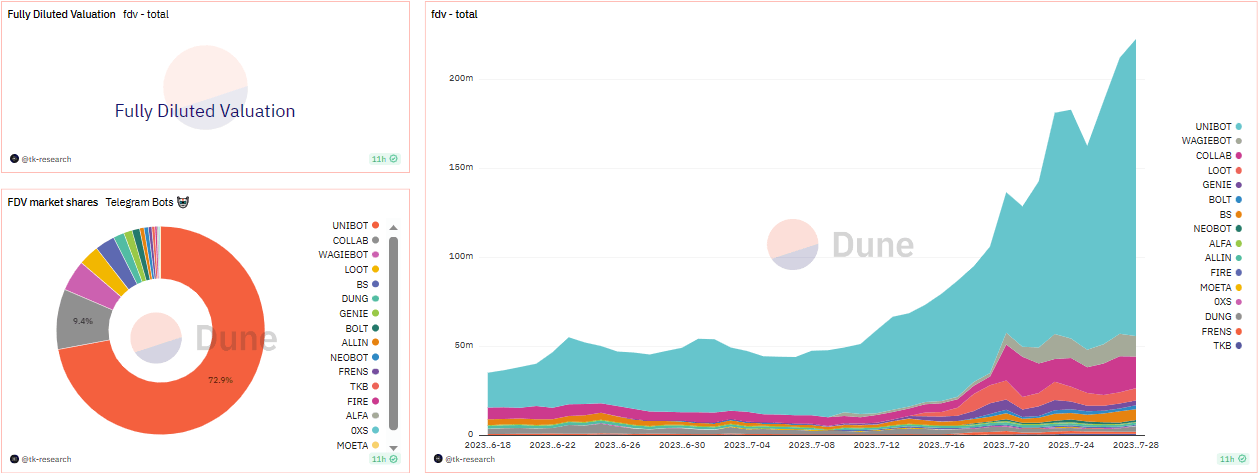

Data from Dune analytics shows that UniBot dominates the trading bot's fully diluted valuation of almost 150 million, accounting for over 70% of the market share.

Trading bots fully diluted valuation.

UniBot price forecast

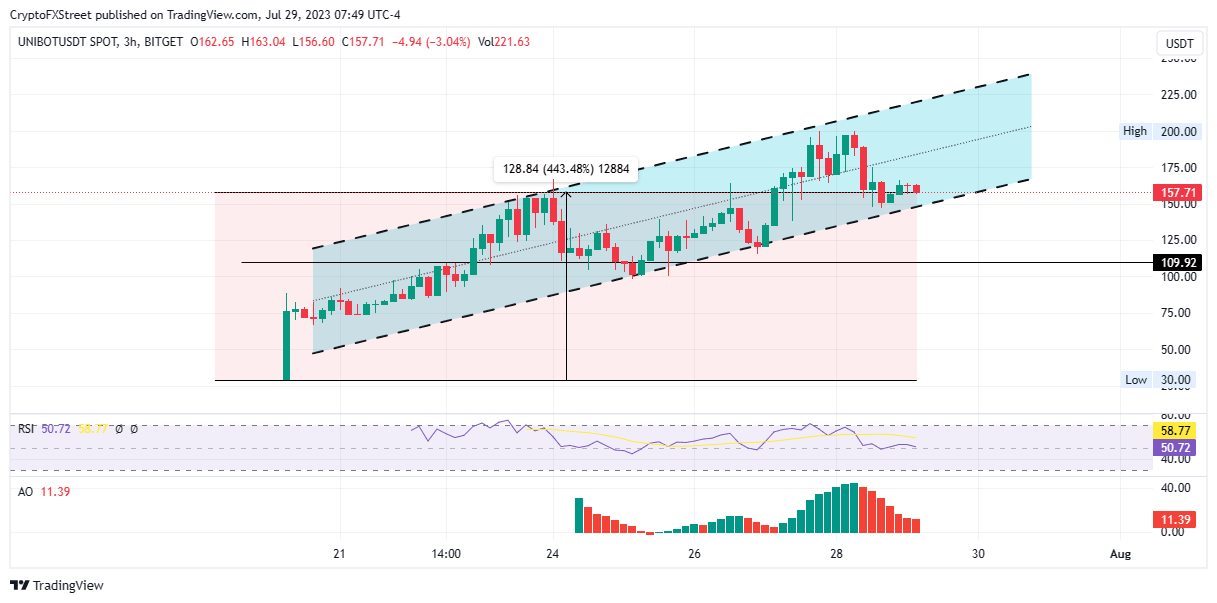

At the time of writing, UNIBOT is auctioning at $160.66, recording a daily drop of 15%. However, it remained almost 70% higher than its market value seven days ago and nearly 450% from its all-time low of $30.00 recorded on July 20. The token is available for trading on Gate.io, Bitget, and BitMart.

As UNIBOT price continues to consolidate along an ascending parallel channel, increased buyer momentum to sustain the trading bot token within the bullish technical formation could see investors rake in more gains.

UNIBOT/USDT 3-hour chart

Based on the 3-hour chart above for the UNIBOT/USDT trading pair, momentum is waning. This is evidenced by the falling Relative Strength Index (RSI) and the volume of the Awesome Oscillators (AO) histograms reducing toward the midline. This could lead to the UNIBOT price dropping below the channel's lower boundary, exposing it to a cliff toward the $109.92 support level. Such a move would constitute a 30% slump from current levels.

Like this article? Help us with some feedback by answering this survey:

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.