Trader turns $5k into $670K on Ethereum pump.fun rival Ethervista

A crypto trader has locked in massive profits from buying the native token of a new platform called Ethervista, the latest decentralized exchange and token minting marketplace to launch on Ethereum.

The trader purchased $5,000 worth of the VISTA token immediately following the launch of the Ethervista protocol. This purchase netted them roughly 5% of the total circulating supply of VISTA tokens, which went live for trading on Aug. 31.

The trader then distributed his VISTA holdings across seven different wallets to sell them off, realizing over $670,000 in profit in (ETH $2,376) after just two days, according to a Sept. 3 X post from crypto intelligence platform Arkham.

Source: Arkham Intelligence

Ethervista is a new token minting marketplace to go live on Ethereum enabling users to create and launch their own tokens, primarily memecoins.

Ethervista: Ethereum’s “answer” to Pump.fun

Ethervista has been described by some crypto pundits as “Ethereum’s answer” to its Solana-based rival Pump.fun — a memecoin launchpad that has generated outsized adoption since its launch in January.

The retro-themed Ethervista platform offered a “fair launch model” with 100% of its native VISTA tokens allocated to liquidity providers and locked for five days in a bid to prevent early rug pulls.

It has deflationary tokenomics with a one million supply cap and continuous token burns to reduce supply and raise the price floor.

However, some have reported failing transactions when trying to remove liquidity.

Crypto researcher Stacy Muur noted the liquidity lock but added that "it's the ETH/USDT pair, not a newly created token that needs anti-rug protection,” adding that there was no disclaimer to let users know.

Unlike traditional DEXes and marketplaces, Ethervista charges fees in native ETH, which are distributed to liquidity providers and token creators.

Since it uses ETH for network fees, the platform’s gas usage has surged making it the third largest consumer of gas, behind Uniswap and Tether, over the past 24 hours with 22.5 ETH, according to Etherscan.

Ethervista was spawned out of the need to fill a gap in the Ethereum DeFi space and to compete with rival networks Solana, Base, and Tron which have attracted millions of dollars in revenue from hordes of memecoin degens in recent months.

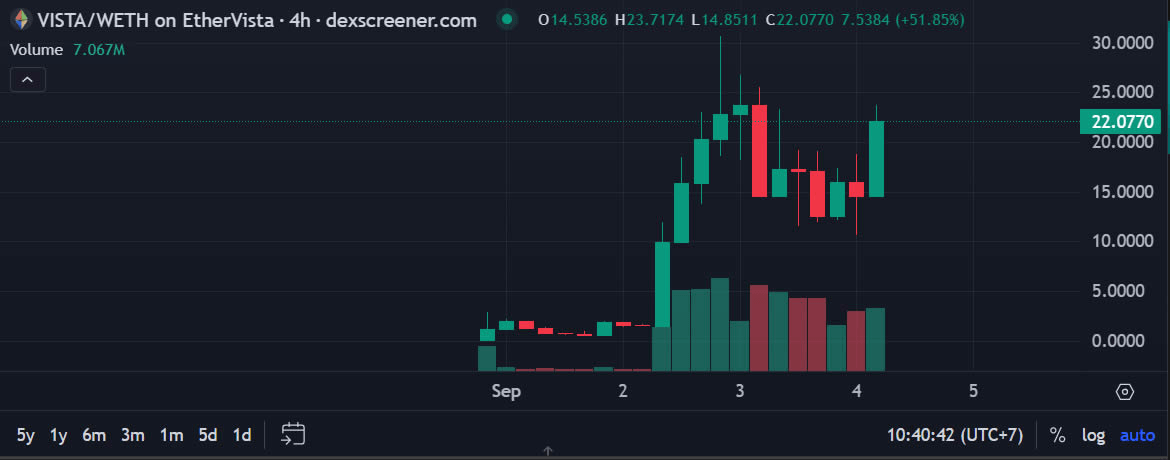

The Ethervista platform has witnessed massive attention from crypto market participants, with the native token’s market capitalization reaching as high as $30 million just two days after it launched, according to DexScreener data.

VISTA prices. Source: DEXscreener

VISTA prices have surged 33% over the past 24 hours reaching $21.19 at the time of writing, according to CoinGecko. The new token hit a peak of $28.80 on Sept. 2, just a couple of days after launch however, the liquidity unlock on Sept. 4 could cause volatility.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.