Trader stakes $0.05 of SOL for 3.000 years: Here’s what it’ll be worth in 5.138

A crypto user has gone very long on Solana, staking a very small portion of the token for the next 3,000 years, according to blockchain analytics firm Arkham Intelligence.

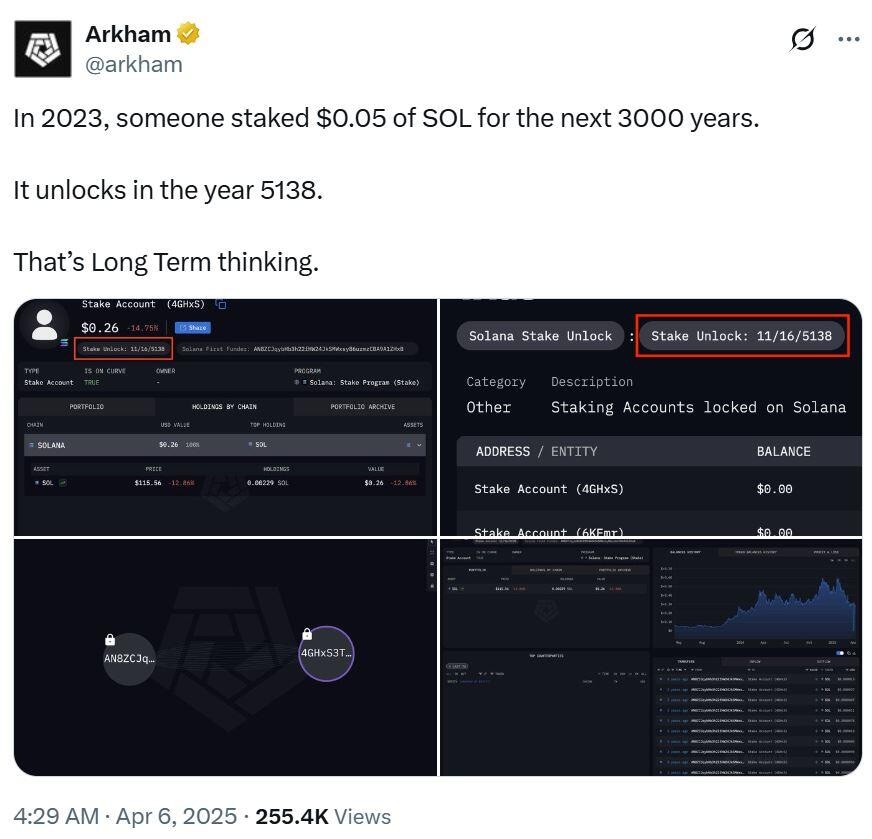

The unknown user staked $0.05 Solana in 2023, and it will unlock in the year 5138, Arkham said in an April 5 post to X.

Speaking to Cointelegraph, Vincent Liu, chief investment officer at Kronos Research, said the move was likely a symbolic act reflecting a strong belief and conviction in Solana’s long-term ecosystem.

Source: Arkham Intelligence

“Legacy staking is more than locking assets it’s a mindset. The real edge in crypto isn’t in chasing short-term hype, but in holding long-term conviction assets through cycles,” he said.

Adding that: “this kind of thinking builds not just portfolios, but long term legacies.”

SOL is currently trading for $102, according to CoinMarketCap. A January report from asset manager Bitwise predicts the token could be worth between $2,300 and over $6,000 by 2030.

It's impossible to know what the staked SOL will be worth by the time it’s unlocked in a few thousand years, but Liu says it would likely be a significant sum.

“If SOL appreciates just 2–5% annually, the compounding over 3,000 years becomes exponential. In any market condition, long-term compounding remains one of the most powerful financial forces,” he said.

Staking Solana for over 3 millennia

To put it into perspective, 5 cents compounded annually at a 3% annual interest rate would already result in over $486 undecillion (486 followed by 36 zeros) after 3,115 years.

However, the Solana sum would likely be much higher, given staking rewards are paid out every two to three days and compounded.

Users on X are speculating that the stake could be an attempt at creating generational wealth, or a random stunt with no real long-term plan.

Source: Arkham Intelligence

Kadan Stadelmann, chief technology officer at blockchain platform Komodo, told Cointelegraph he thinks the “3,000-year nickel play on SOL is a meme trade” that will one day be stamped on the SOL blockchain.

“What will 3,000 years from now look like? Will humans still be around? Will the Solana blockchain? Such a long time horizon makes one ponder one’s place in the scheme of things,” Stadelmann said.

He speculates people might even seek to outdo it by “making a 5,000-year play.”

At the moment, depending on the platform and validator choice, Solana can offer between 5% to over 8% in staking rewards. Meanwhile, Cardano

ADA can start at around 2%, and Ether staking rewards are usually between 2% and 7%.

Four Solana whales recently profited over $200 million in a staking play that began in April 2021, when they staked 1.79 million Solana, worth $37.7 million at the time.

A similar unlock is expected in 2028.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.