Top Crypto Gainers Price Forecast: BONK, TIA, WIF post double-digit gains, signal trend reversal

- Bonk edges higher by 6%, extending the double-digit gains from Wednesday amid a gradual shift in momentum.

- Celestia ticks higher after recording double-digit gains on Wednesday to break out of a falling channel.

- Dogwifhat extends the 16% growth from the previous day, nearing a potential channel breakout.

The cryptocurrency market recovers sharply on Wednesday as Bitcoin (BTC) surges above $109,000, triggering a boost in meme coins such as Bonk (BONK) and Dogwifhat (WIF), and altcoins like Celestia (TIA) posting double-digit gains over the last 24 hours. As BONK, TIA, and WIF are clear front-runners in the market recovery, the technical outlook shares a bullish inclination with a range-bound movement breakout seen across charts.

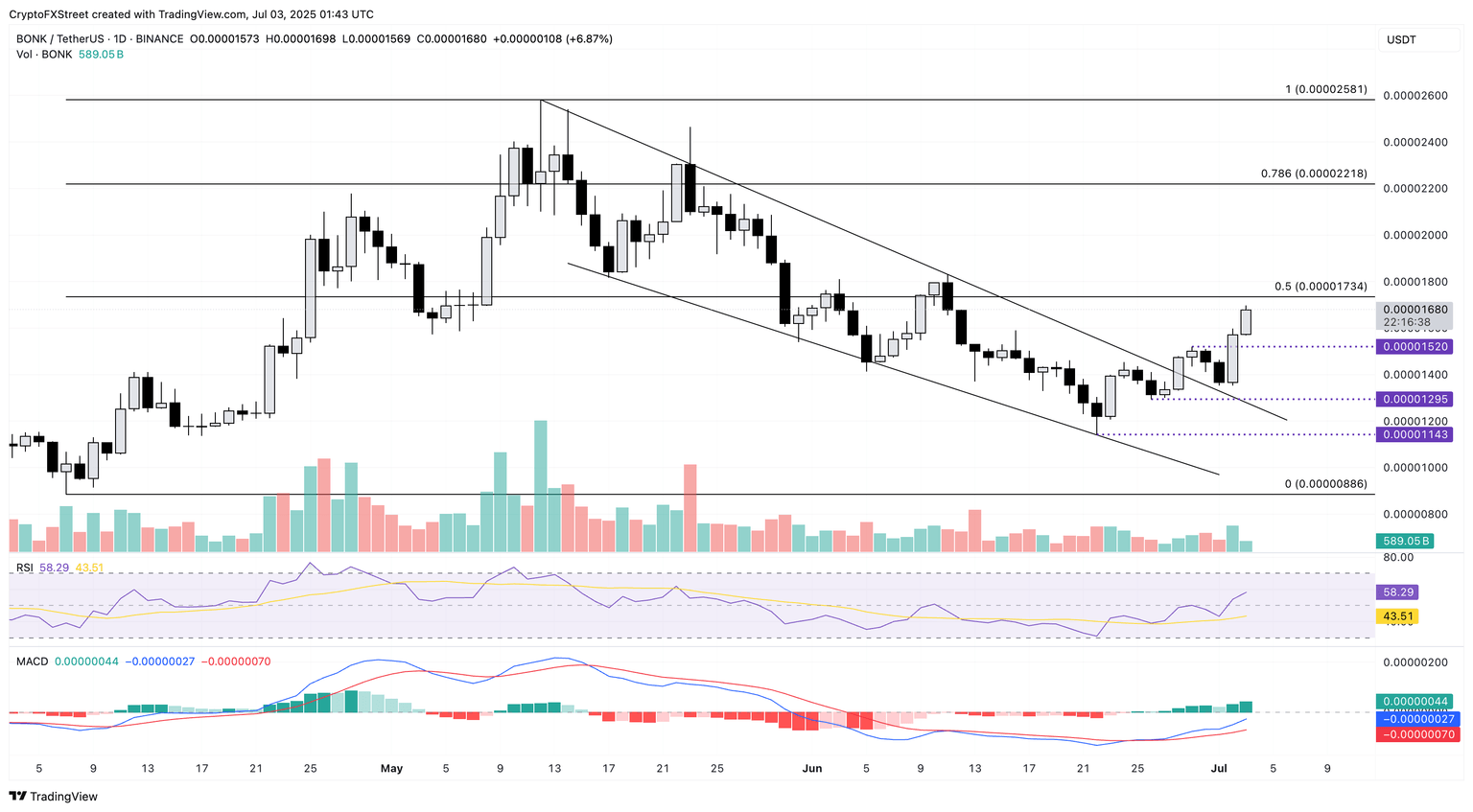

BONK’s wedge breakout rally eyes further gains

Bonk edges higher by over 6% at press time on Thursday, extending the 15% growth from the previous day. Further up, the meme coin extends the breakout rally of a falling wedge pattern as previously reported by FXStreet.

BONK nears the $0.00001734 level, aligning with the 50% Fibonacci retracement level drawn from the April 7 low of $0.00000886 to the May 12 high of $0.00002581. An extension above this level with a decisive daily close could extend the uptrend towards the 78.6% Fibonacci level at $0.00002218.

The technical indicators suggest a shift in momentum as the Relative Strength Index (RSI) crosses above the halfway line to 58 while the Moving Average Convergence/Divergence (MACD) indicator and its signal line rise towards the zero line.

BONK/USDT daily price chart.

However, a reversal from the 50% Fibonacci level could test the June 29 high of $0.00001520.

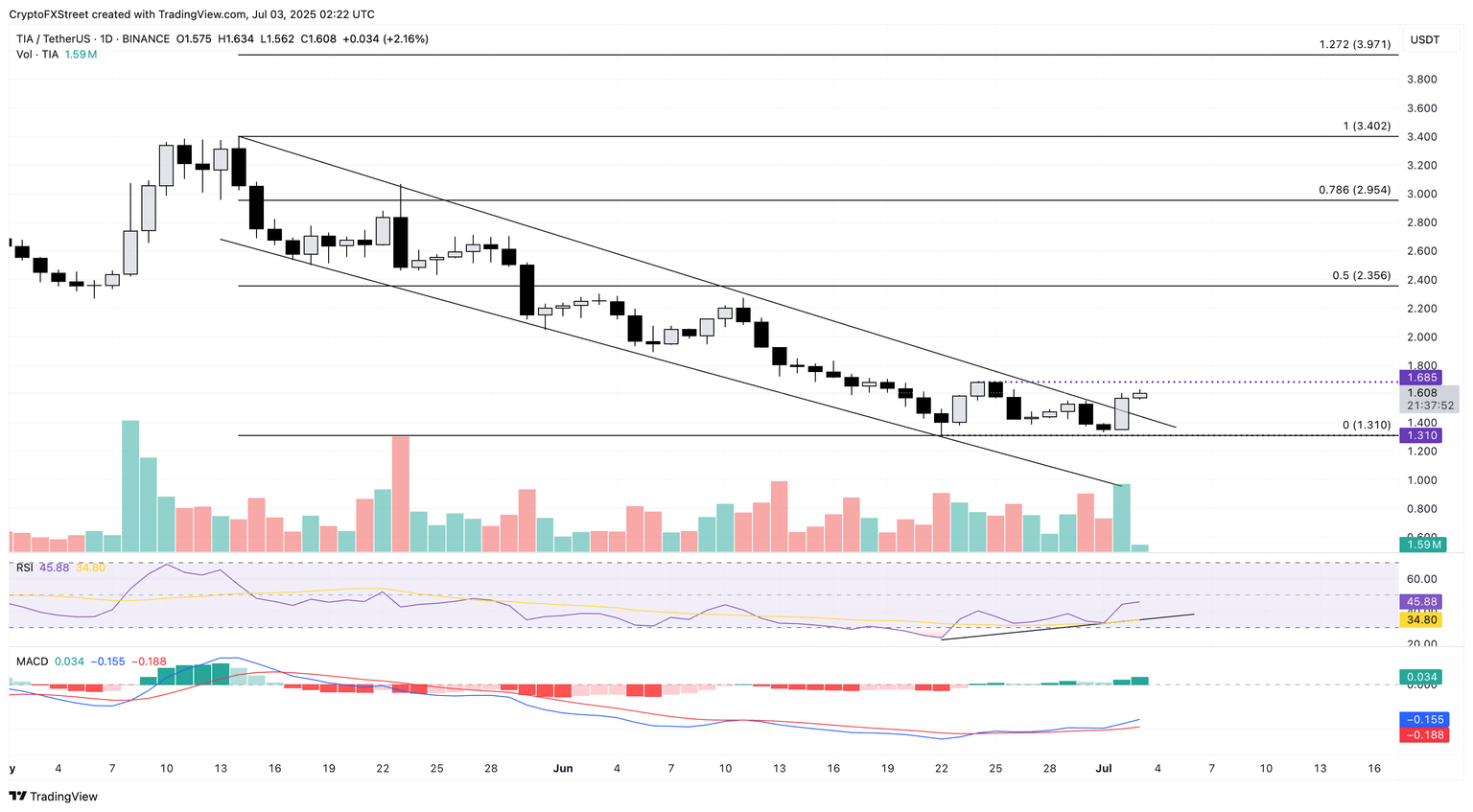

Celestia breaks above the descending channel

Celestia trades in the green by over 2% at the time of writing on Thursday, extending the 16% from Wednesday. The uptrend breaks out of a falling channel, fueled by the underlying RSI divergence, as previously reported by FXStreet.

As TIA signals a potential trend reversal, a clean push above the June 24 high at $1.68 could extend the recovery to the 50% Fibonacci level at $2.35, traced from the high of May 14 at $3.40 to the low of June 22 at $1.31.

The indicators reflect a gradual shift as RSI at 45 nears the halfway line after bouncing off the oversold region. Meanwhile, the MACD and its signal line are deep in the negative region despite the growth of green histogram bars.

TIA/USDT daily price chart.

If TIA fails to exceed the $1.68 level, a reversal could test the $1.31 base level.

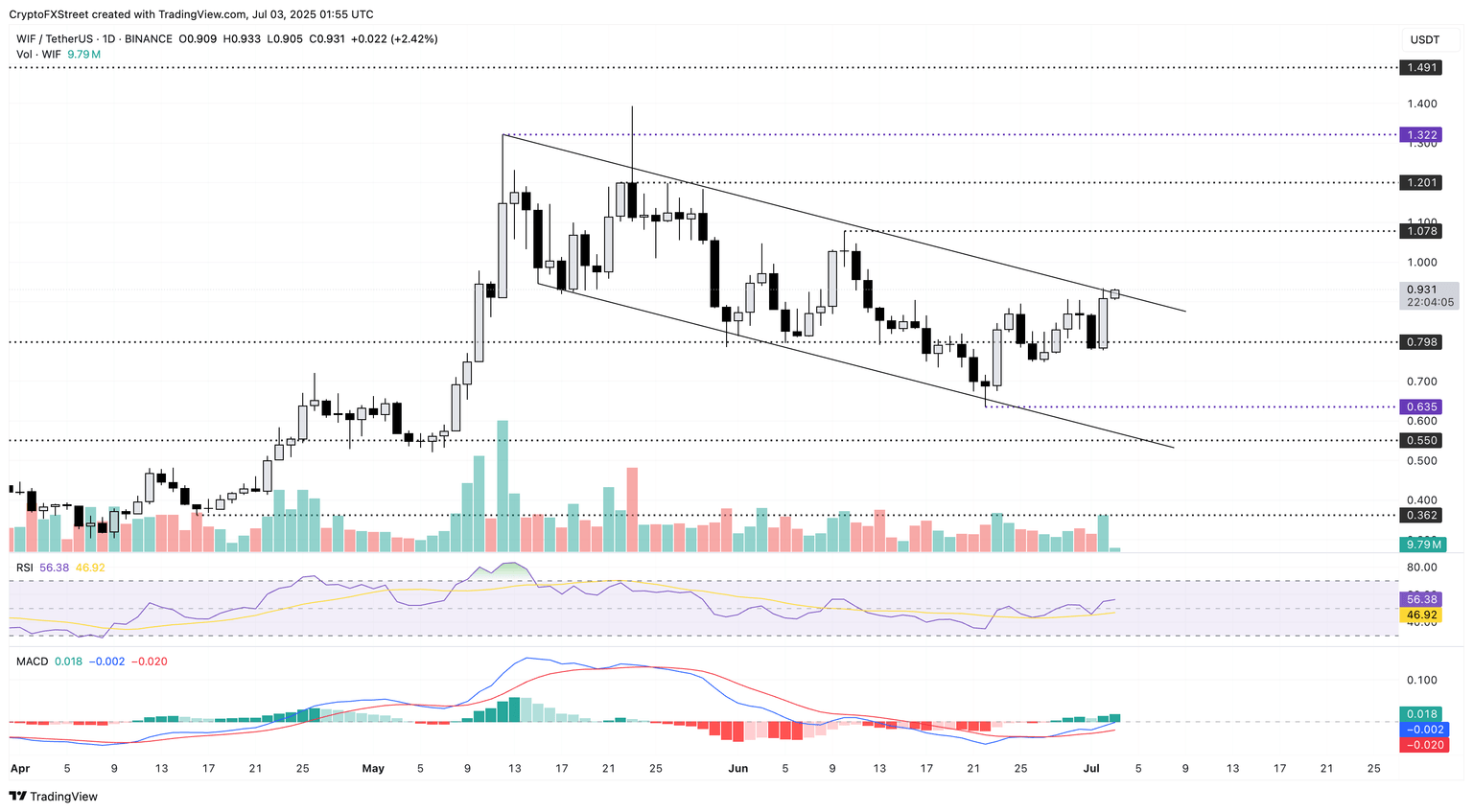

WIF eyes channel breakout to extend gains

Dogwifhat ticks higher by over 2% at press time on Thursday, adding to the 16% gains from the previous day. WIF nears a key resistance trendline formed by connecting the highs of May 12, May 29, and July 2.

A daily close above the resistance trendline near Wednesday’s high of $0.934 would mark the breakout of a falling channel completed by a parallel support trendline formed by the lows of May 15 and June 1. The breakout rally could target the highest trading price of June at $1.078.

The technical indicators suggest a minor surge in recovery momentum, as the RSI remains above the halfway line at 56, indicating room for growth. Meanwhile, the MACD indicator displays the MACD and signal lines inching closer to crossing the zero line.

WIF/USDT daily price chart.

On the contrary, a reversal within the channel could test the $0.798 support level, last successfully tested on June 13.

Author

Vishal Dixit

FXStreet

Vishal Dixit holds a B.Sc. in Chemistry from Wilson College but found his true calling in the world of crypto.