Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Cryptos hint at a bullish week with a twist

- Bitcoin price shows a bullish start to the week, but the liquidity objective to the downside is incomplete.

- Ethereum price eyes using the $2,000 psychological barrier as a stepping stone for a swing rally to $2,412.

- Ripple price attempts to move higher after bouncing off the $0.389 support floor.

Bitcoin price reveals its bullish move after tight consolidation over the weekend. This impulsive move has caused many altcoins to explode as well. Ethereum and Ripple have followed suit but are far away from reaching their short-term objective.

Bitcoin price and incomplete objective

Bitcoin price created equal lows around the $29,288 support level by tagging it thrice over the last week. While a sweep of this barrier aka Monday’s low was necessary, the buyers seem to have taken control, leading to a rally.

So far, Bitcoin price has rallied to retest the range high at $31,493 and is likely going to reverse the trend here. A sweep of Monday’s low at $29,288 should be the key to triggering a relief rally bounce to the short-term targets, extending from $34,455 to $35,180.

BTC/USD 4-hour chart

Invalidation of this bullish thesis would occur if Bitcoin price produces a four-hour candlestick close below the range low at $28,575. In this situation, BTC might crash to $27,708.

Ethereum price needs to pause

Ethereum price created a double bottom pattern after tagging the $1,731 support level twice on May 28 and June 3. The reaction from this setup led to a 9% ascent, with more gains in the works.

Investors can expect Ethereum price to retrace and tag the $1,813 foothold before continuing its ascent. This level would be a good place to bid, especially considering the short-term targets for ETH are present at $2,164, $2,341 and $2,412.

ETH/USD 4-hour chart

If Ethereum price fails to hold above the $1,813 support level, a good buy area would be as ETH sweeps the $1,731 support level. However, a four-hour candlestick close below $1,701 will invalidate the bullish thesis.

Such a development could send ETH plummeting to $1,543.

Ripple price on track to its targets

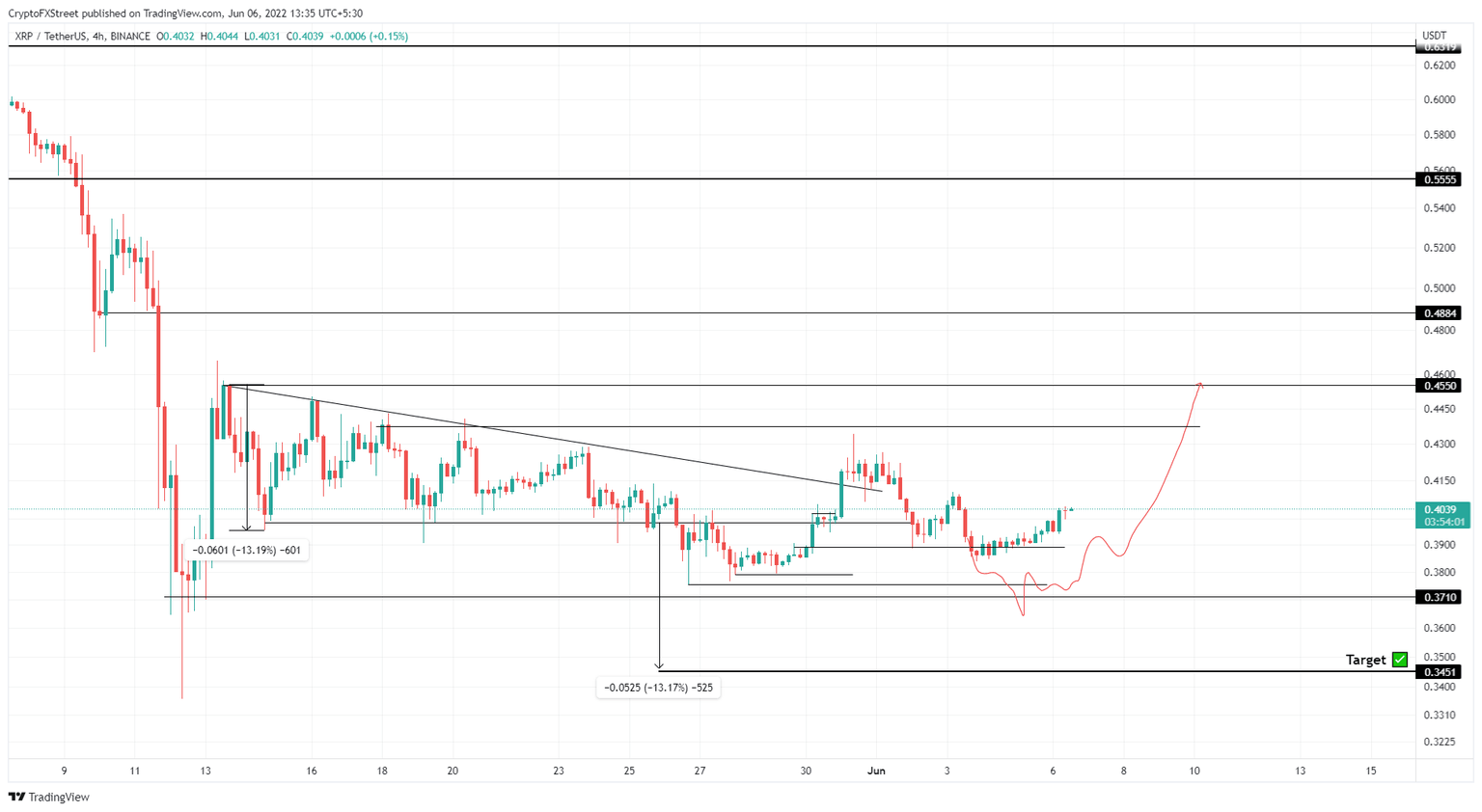

Ripple price moved close to retesting the $0.437 hurdle but failed and retraced to the $0.389 stable support level. After a quick sweep of this level, bulls took control and triggered a 5% run-up to $0.404.

Going forward, Ripple price might undergo a minor retracement to $0.389, but the upside objectives remain the same ie., a retest of the $0.437 and $0.484. Therefore, investors need to be patient with the remittance token.

XRP/USD 4-hour chart

Regardless of the bullish outlook, if Ripple price creates a lower low below $0.371, it will invalidate the bullish thesis. In such a case, the XRP price could crash to the $0.345 support floor.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.