Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC contemplates breakout, while altcoins promptly follow

- Bitcoin price is currently hovering below a resistance level at $39,450, deciding if it should go higher or lower.

- Ethereum price has set up higher lows, but considering BTC’s indecisiveness, a lower low before an upswing seems likely.

- Ripple price is hovering above the 62% Fibonacci retracement level at $0.821, a retest of which could send XRP flying.

Bitcoin price rose from the range low to nearly tagging the swing high this week. However, the impulsive move reversed and is now heading toward the midway point. Ethereum and Ripple are following in BTC’s footsteps and are expected to head lower.

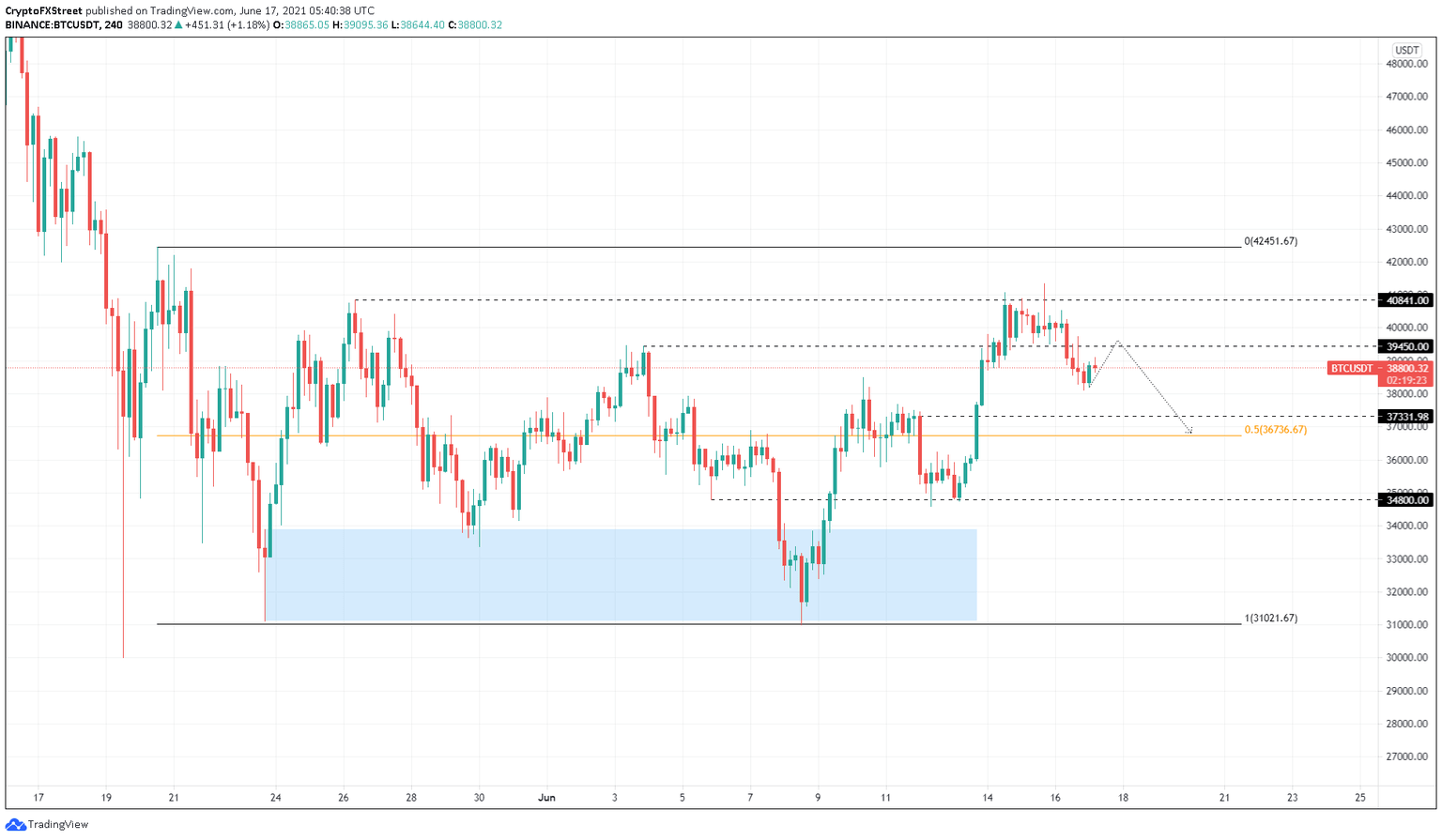

Bitcoin price at crossroads

Bitcoin price rose 19% from $34,757 to $41,333 on Monday and Tuesday and came very close to hitting the range high at $42,451. However, investors booking profit seem to have played a vital role in stopping this impulsive move. As a result, the bears have taken over BTC and have pushed it 7% lower, slicing through the immediate support level at $39,450.

Now, a rejection at this barrier will result in a downswing to $37,332 or the 50% Fibonacci retracement level at $36,737.

This minor pullback will allow the buyers to recuperate, kick-starting the next leg. This impulsive wave could target the range high at $42,452.

Although unlikely, a dip below the said barrier will push the flagship cryptocurrency toward the support level at $34,800, which does not affect the bullish thesis whatsoever.

BTC/USDT 4-hour chart

On the flip side, a breakdown of $34,800 could invalidate the optimistic scenario and trigger a 10% downswing to the range low at $31,022.

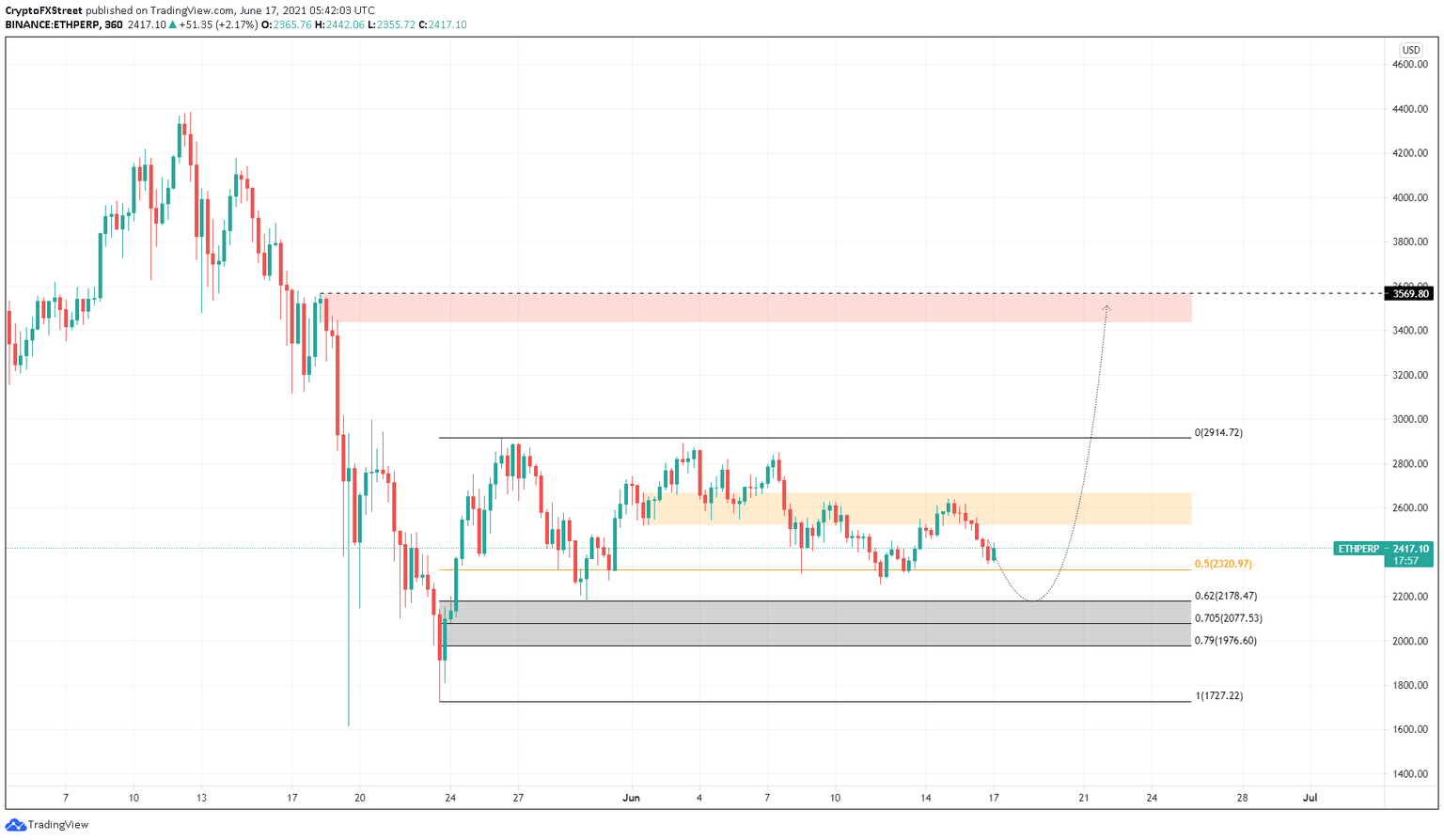

Etheruem Price vies a higher high

Ethereum price formed equal highs at $2,650 as it entered the supply zone, ranging from $2,524 to $2,668. A failure to breach through this barrier led to a 10% sell-off. This correction did not tag the 50% Fibonacci retracement level at $2,321 as ETH set up higher lows.

Although unlikely, the upswing could begin after a retest of $2,321 or $2,178, especially if Bitcoin price gets rejected at $39,450.

Such a move would not affect the bullish thesis.

The bulls will push Ethereum price to produce a decisive close above the supply zone’s upper trend line at $2,668. This development would indicate buyers’ resurgence and open up the path toward the range high at $2,915.

In a highly bullish case, ETH might tag the next resistance area that stretches from $3,438 to $3,570.

ETH/USDT 4-hour chart

On the flip side, a breakdown below the 79% Fibonacci retracement level at $1,977 will invalidate the bullish thesis and kick-start a potential 12% crash to $1,727.

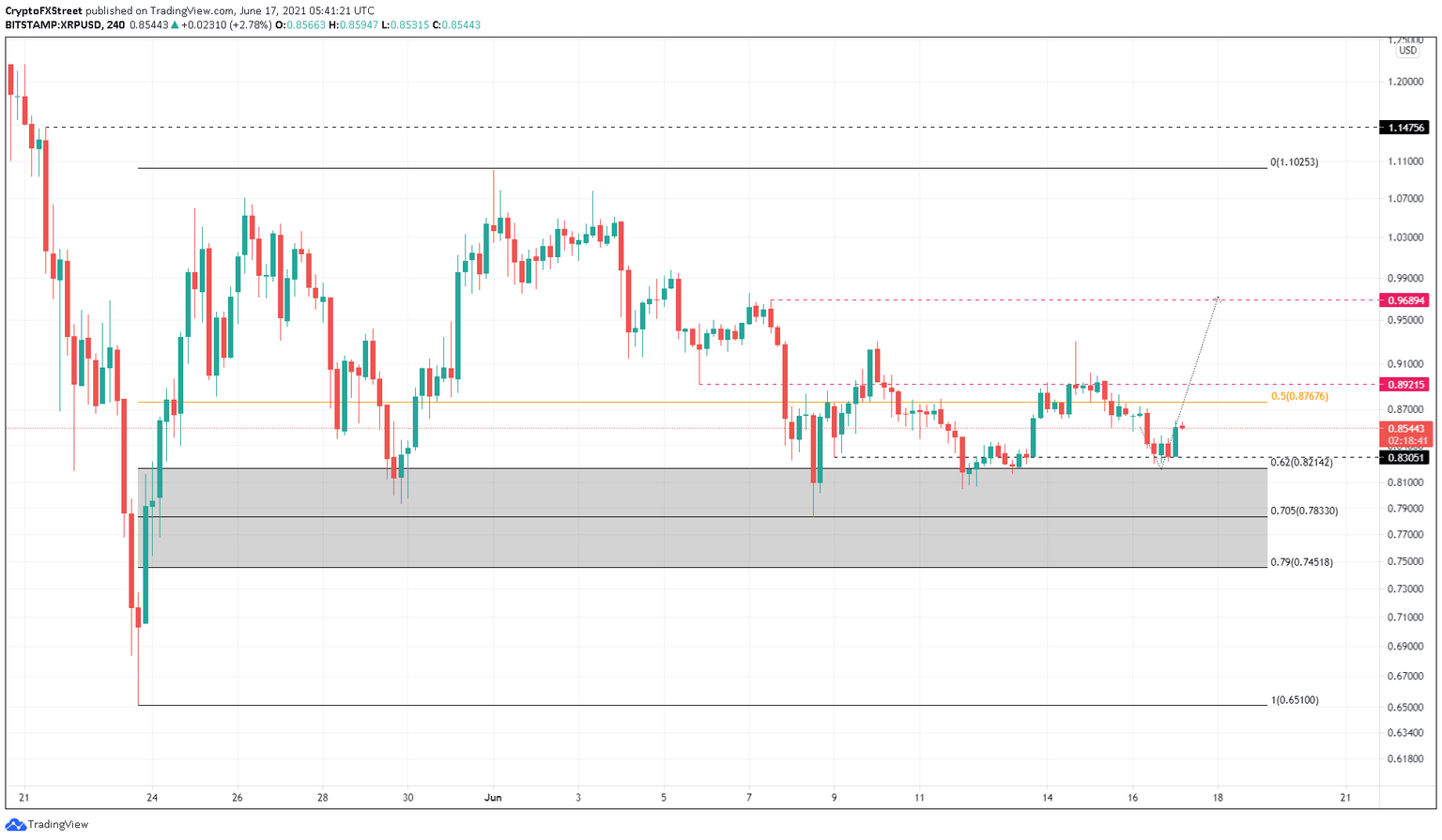

Ripple price awaits a trigger

Ripple price, unlike ETH, is hovering just above the 62% Fibonacci retracement level at $0.821. As mentioned above, if the flagship cryptocurrency tumbles, XRP price is likely to do the same and tag $0.824 or $0.783.

However, the overall structure for BTC, ETH and XRP remain the same – bullish. Therefore, investors can expect the XRP price to rise 13% to $0.969. The confirmation of this upswing will arrive after the remittance token slices through the 50% Fibonacci retracement level at $0.877.

If the buying pressure continues to hold, there is a high chance that XRP price will take a jab at the range high at $1.103.

XRP/USDT 4-hour chart

Invalidation of the bullish thesis will occur if Ripple price shatters the 79% Fibonacci retracement level at $0.745. This move would further invoke a potential12% sell-off to the range low at $0.651.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.