Top 3 Price Prediction Bitcoin, Ethereum, Ripple: A consolidative phase before the bears return

- The crpyto bears taking a breather amid quiet Easter trading.

- Ripple outperforms the top 3 widely traded coins.

The world’s no. 1 digital coin, Bitcoin, continues to trade range bounce around 0.6850 heading into the weekly closing. Ethereum and Ripple also keep their recent trading range amid quiet Easter trading. Ripple, however, outperforms the top 3 most dominantly traded digital assets. The total market capitalization of the top 20 cryptocurrencies now stands at $198.85 billion, as cited by CoinMarketCap.

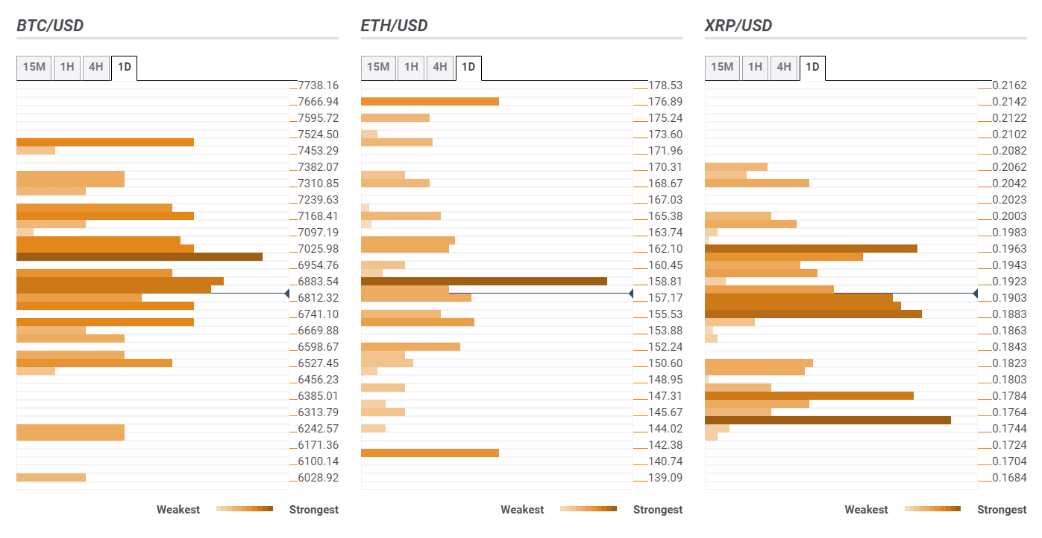

The top three coins could likely resume Friday’s corrective slide, with the FXStreet’s Confluence Detector tool suggesting key technical levels to watch out for in the week ahead.

BTC/USD: Remains vulnerable amid lack of healthy support levels

Amid a tug-of-war between the bulls and the bears so far this Easter, Bitcoin is likely to face the immediate resistance at 6883, the confluence of the upper Bollinger Band on 15-minutes chart, SMA 10 4H and previous high 1H. Further up, a minor next hurdle awaits around 6950, where the Fib 38.2% 1D and Bollinger Band 1H Upper coincide.

The buying interest will intensify above the latter, with the strong resistance at 7026 back in play. The barrier is the confluence of the Pivot Point 1D R1 and Fib 61.8% 1W.

Having said that, the downside appears more compelling amid a lack of substantial levels. The immediate support is aligned at 6741, the previous week low and Pivot point 1D S2.

A failure to resist above the 6740 area will expose the next support at 6527, Pivot Point 1 Week S1.

ETH/USD: Bearish bias still intact while below 158.58

At the current level of 157.80, any further upside attempts in Ethereum are likely to face a stiff resistance at 158.58, a cluster of Fib 38.2% 1D, SMA50 4H and SMA50 1H.

Only a sustained move above that level would revive the recovery momentum from Friday’s sell-off.

To the downside, the next support is the Fib 61.8% 1W at 153.88 below which a test of the Fib 38.2% 1M at 152.24 is likely on the cards.

XRP/USD: 0.1963 is the level to beat for the bulls

Ripple is on track to conquer the symmetrical triangle pattern target near 0.1960, which also marks the key hurdle for the bulls. That level represents the Fib 61.8% 1M.

On its way to that target, a minor resistance at 0.1943 needs to be taken-out, the intersection of Fib 38.2% 1W and SMA50 1D.

Any pullbacks will likely remain shallow, as a number of support levels are stack up, with the immediate one seen at 0.1900, the Fib 38.2% 1D and SMA50 4H intersection. A break below the last would call for a test of 0.1883, where the Fib 61.8% 1W and 1D meet.

If the sellers regain complete control below the latter, a test of the strong support of the previous year low at 0.1754 will be inevitable.

See all the cryptocurrency technical levels.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.