Top 3 Coins Price Prediction Bitcoin, Ethereum and XRP: Bulls hold at threshold, ready for takeoff

- Bitcoin could resume the uptrend targeting $10,800 amid an increase in buying pressure from the whales.

- Ethereum is on the verge of a breakout to $360, as observed from both technical and on-chain perspectives.

- XRP holds above the crucial level at $0.22 after another slump below the former support at $0.23.

The cryptocurrency market has had an eventful week, with most actions resulting in losses. The bleeding was not selective; hence major cryptos, altcoins and decentralized finance (DeFi) tokens explored levels below key support areas. According to the data provided by CoinMarketCap, the cryptocurrency market has lost about $27 billion of the total capitalization since September 21. Many analysts believe that cryptocurrencies led by their king, Bitcoin are ready to rebound and correct the downtrend printed in the last few days.

Bitcoin price rebound eyes $10,800

The bellwether cryptocurrency is trading above a substantial demand area between $10,000 and $10,200. Apart from the dips under $10,000, which extended to $9,800 earlier in September, this support zone has been intact. Following the rejection from $11,100, Bitcoin embarked on a painful downtrend with a descending channel, as seen in the 4-hour range.

An initial reversal failed to overcome the resistance at $10,600, sending the flagship cryptocurrency back to the drawing board ($10,200). At the time of writing, BTC/USD is doddering at $10,305. If the ongoing bullish momentum holds, the descending channel could confirm a bull flag breakout, likely to launch Bitcoin on a path towards $10,800.

BTC/USD 4-hour chart

Resistance is anticipated at the 100 Simple Moving Average (SMA) around $10,600. A close above the 50 SMA in the 4-hour range would cement BTC’s position above $10,800, in turn, shifting the focus to $11,000.

According to Santiment, a popular on-chain data analytics platform, whales are currently increasing their holdings. For instance, the number of wallets with 10,000 – 100,000 BTC has been on an uptrend from 104 on September 17 to 107 on September 24. If BTC's buying pressure continues to surge, the price is bound for an incredible move upwards.

Bitcoin holder distribution chart

%20%5B08.19.05%2C%2024%20Sep%2C%202020%5D-637365267441554973.png&w=1536&q=95)

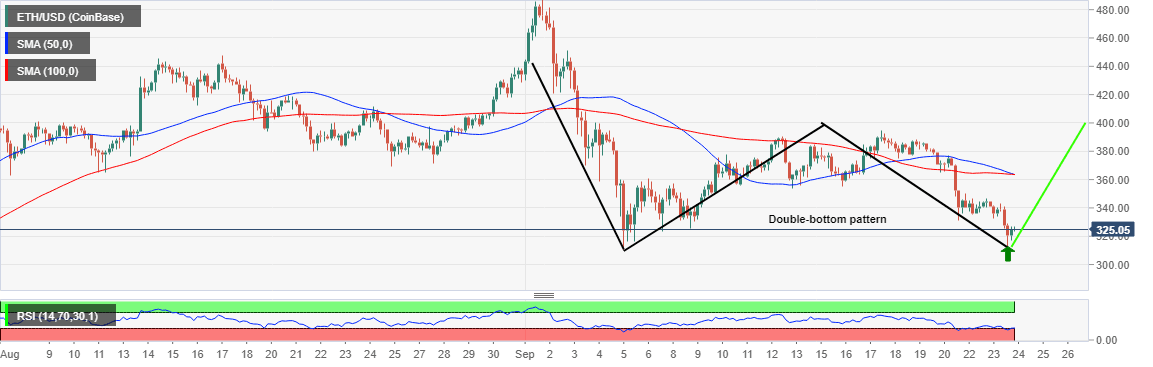

Ethereum $360-bound rocket on the verge of launching

As discussed earlier, the smart contract token refreshed lows at $310 for the second time in September. However, it is essential to spot a potential double-bottom pattern that could tremendously impact the recovery above $360. For now, selling pressure cannot be ignored, especially with the Relative Strength Index (RSI) struggling to exit the oversold region. Moreover, resistance is anticipated at $340, while a breakout to $360 must be ready to face the seller congestion at $364 (a zone converging the 50SMA and the 100SMA in the 4-hour range).

ETH/USD 4-hour chart

IntoTheBlock’s IOMAP model reveals the likelihood of a smooth ride to $360. The on-chain metric suggests that a significant area of resistance lies between $363 and $374. The zone is hosting a high number of investors who previously bought Ether. Roughly 668,000 addresses are holding 10.42 million ETH. The selling pressure in this zone has the potential to absorb some of the anticipated bullish momenta. However, if ETH can make it through the zone, it will close in on $400.

Ethereum IOMAP chart

On the downside, the IOMAP reveals the lack of a substantial support area for Ether. It is worth mentioning that the range between $296 and $306 comes up as an area of interest. Here, around 765,000 addresses previously bought 1.81 million ETH. This means that buyers must defend the support at $310 at all costs to ensure that declines do not progress below $300.

XRP holding above a crucial support level

Ripple was not spared by the bearish wave that continues to ravage through both major and minor cryptocurrencies. Amid the downtrend from highs of $0.3055 traded at the beginning of the month, XRP found initial support at $0.23. A reversal was built gradually, with the price stepping above $0.25, but the bullish camp was weighed down by exhaustion before tackling the hurdle at $0.26.

XRP/USD 1-hour chart

Support established between $0.23 and $0.2350 caved earlier this week, paving the way for another retreat to the current support at $0.22. The cross-border crypto is teetering at $0.2243 as buyers strive to enforce another reversal. The RSI in the hourly range made it above the oversold region. If the indicator holds onto the midline uptrend, we can expect XRP to close in on the support turned resistance at $0.23. A close above the 50 SMA in the hourly range would give the token a boost, perhaps one with the potential to cause a spike above $0.2350.

Data by Santiment shows that the dwindling prices do not shake XRP whales, hence the increase in their holdings. The wallets with 100,000 – 1 million XRP have maintained an incredible uptrend in the last three months. An almost similar trend has been recorded regarding whales holding more than ten million XRP. As the buying pressure behind XRP mounts, the price is bound to resume the uptrend.

XRP holder distribution chart

%20%5B09.49.24%2C%2024%20Sep%2C%202020%5D-637365269749519289.png&w=1536&q=95)

It is worth mentioning that Bitcoin could revisit the support between $10,200 and $10,000 if it fails to climb above the 50 SMA in the 4-hour range. On the other hand, Ethereum is not done with the downside. In case the bullish scenario to $360 fails to materialize, declines may refresh support at $310 and $300. Lastly, XRP must target to close above the 50 SMA in the hourly range. Otherwise, the ongoing bullish momentum may be invalidated, culminating in a dive back to $0.22 support.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%20(36)-637365266967936177.png&w=1536&q=95)

-637365268792733656.png&w=1536&q=95)