Token unlock worth $330 million could impact these four cryptos

- Four crypto projects, Optimism, Sui, ZetaChain and DYDX, will witness another round of token unlocks totaling $330 million this week.

- The unlocks of OP, SUI, ZETA, and DYDX tokens range between 1% and 7% of their circulating supply.

- Traders should be cautious as token unlocks frequently generate negative sentiment among investors, weighing down prices.

Crypto protocols Optimism (OP), Sui (SUI), ZetaChain (ZETA) and DYDX (DYDX) are set to unlock $330 million in scheduled events this week. These four cryptos unlock between 1% and 7% of their circulating supply. Traders should be cautious as token unlocks frequently generate negative sentiment among investors as they represent an increase in circulating supply, weighing down prices.

Token unlocks could bring volatility in OP, SUI, ZETA and DYDX

According to Tokenomist data, which provides solutions for supply-side tokenomics data for cryptocurrencies, key token unlocks worth $330 million are scheduled for this week.

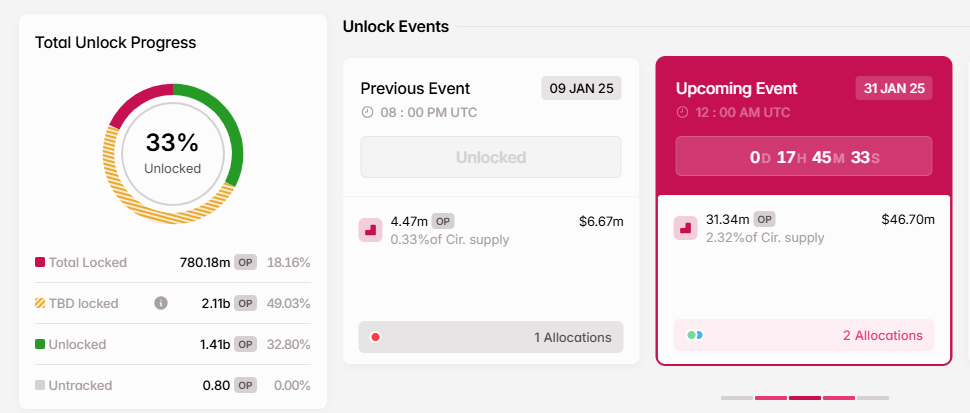

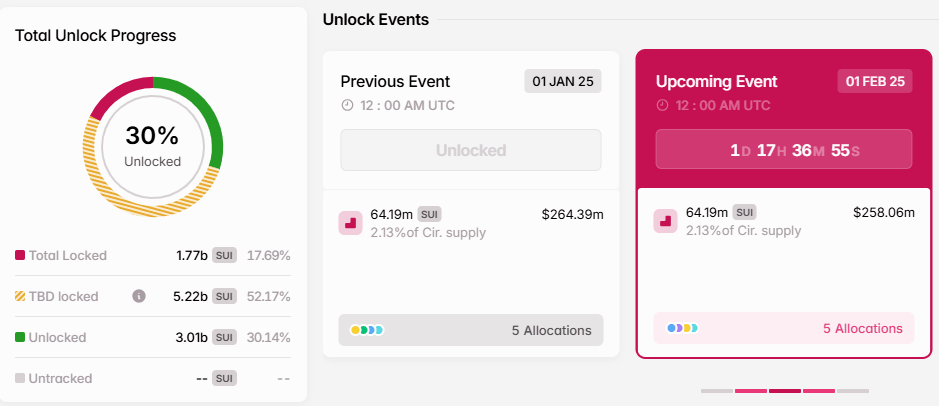

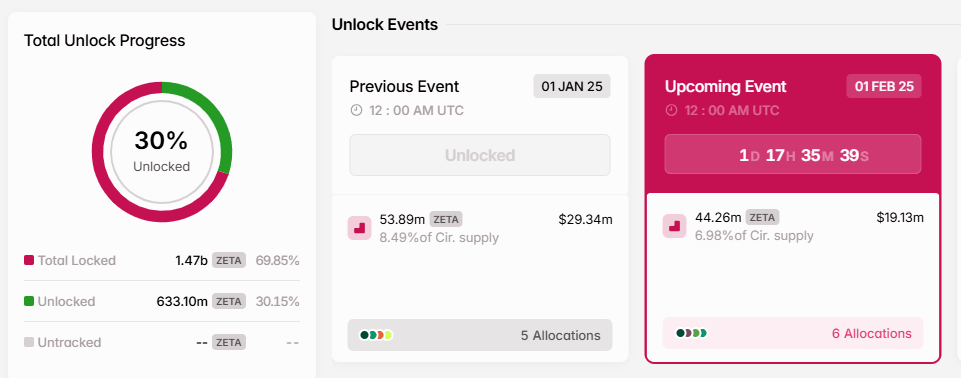

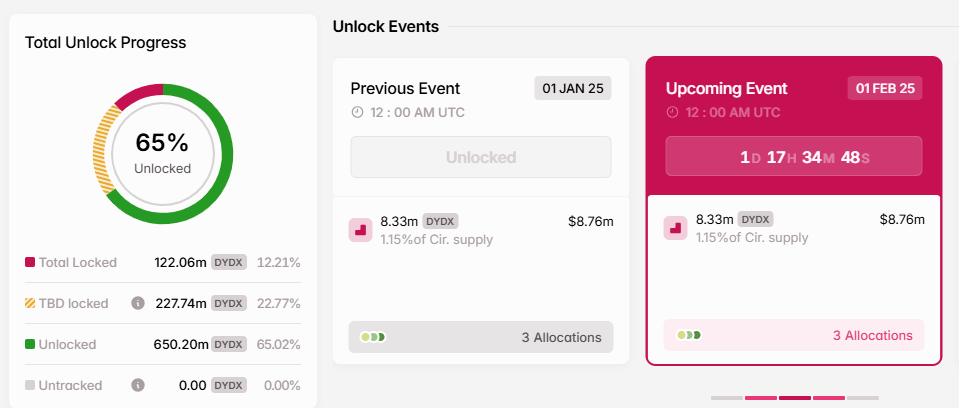

The charts below show that Optimism, Sui, ZetaChain and DYDX plan to unlock tokens worth $46.70 million, $258.06 million, $19.13 million and $8.76 million, respectively, on Friday and Saturday.

OP, SUI, ZETA, and DYDX tokens unlock 2.32%, 2.13%, 6.98% and 1.15%, respectively, of their circulating supply. These tokens will fund initiatives such as a user growth pool, an ecosystem growth fund, core contributor rewards, advisory roles, and liquidity incentives.

Traders should remain cautious as the increased supply from token unlocks frequently generates negative sentiment among investors, which can weigh down prices.

Optimism tokenomics chart. Source: Tokenomist

Sui tokenomics chart. Source: Tokenomist

ZetaChain tokenomics chart. Source: Tokenomist

DYDX tokenomics chart. Source: Tokenomist

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.