THETA Price Analysis: THETA abandons mission to new all-time highs as declines linger

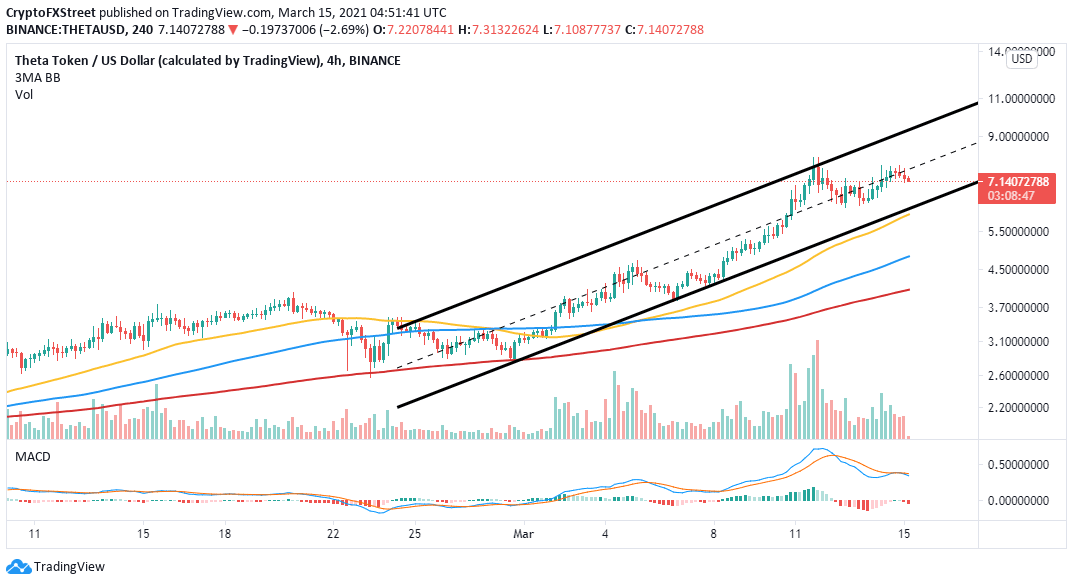

- THETA loses crucial support at the ascending parallel channel's middle boundary.

- Short-term technical analysis based on the MACD suggests that a breakdown is around the corner.

- A spike in social volume shows that THETA's persistent uptrend may be unsustainable.

- Higher support, preferably above $7, would keep bulls focused on new record highs above $10.

THETA has maintained the uptrend since the beginning of March. The bulls' insistent push has spurred speculation within the community that the altcoin is ready to make the ultimate liftoff to new record highs above $10. However, technical levels are flipping bearish fast; thus, sabotaging the uptrend and bringing losses into the picture.

THETA bulls lose traction as overhead pressure mounts

THETA is trading at $7.25 toward the end of the Asian session on Monday. The bullish formation over the weekend failed to break above the recent all-time high of around $8. The correction that came into the picture saw THETA lose essential support provided by the ascending triangle's middle boundary.

At the time of writing, THETA is trading at $7.15 amid an increasing overhead pressure. If support at $7 fails to hold, the bearish leg could extend toward the channel's lower edge.

The Moving Average Convergence Divergence (MACD) has reinforced the bearish formation with its negative gradient. Besides, as the MACD line (blue) crosses under the midline, massive declines will come into play.

THETA/USD 4-hour chart

According to Santiment, THETA is receiving a lot of attention from the social media communities. The spike in the chatter around the token is perhaps reminiscent of the uptrend witnessed from MAR 1. However, a high social volume is not a bullish signal and often is followed by a significant correction. As the price rises, social sentiment grows positively but starts to flip as the mentions reduce, culminating in losses.

THETA social volume

Looking at the other side of the fence

Support at $7 remains critical to the uptrend, first above the all-time high, secondly the liftoff to $10. However, to sustain the uptrend, THETA must reclaim the ground above the ascending channel's middle boundary level. Trading above this zone will encourage bulls to push toward $10.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%2520%5B08.10.11%2C%252015%2520Mar%2C%25202021%5D-637513818207985673.png&w=1536&q=95)