These are the levels to watch if you’re scalping the Solana price this month

- Solana coils in between a critical congestion zone.

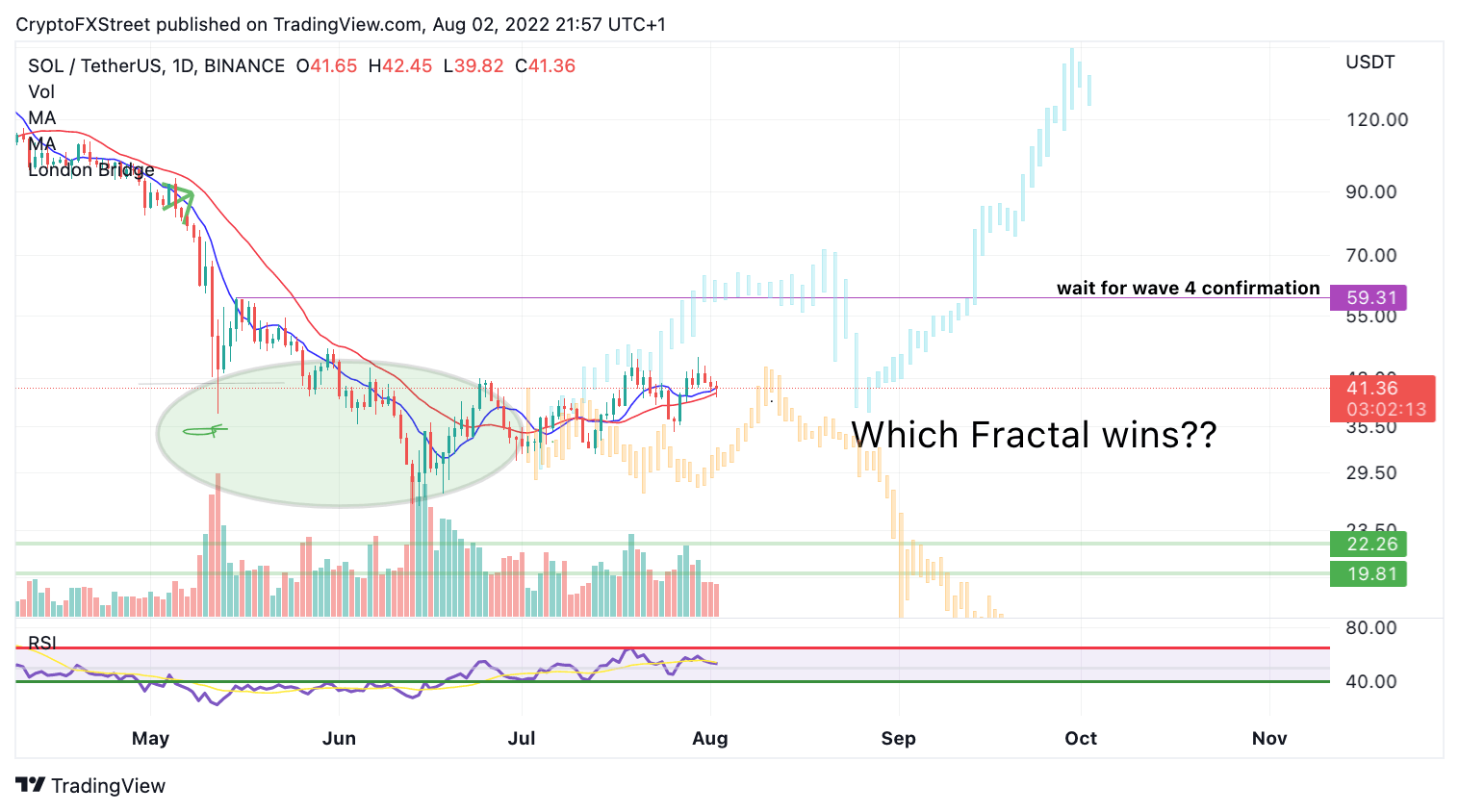

- A fractal has been put in place to forecast a bearish or bullish scenario in advance.

- Invalidation of the downtrend is a breach above $60.00

Solana price continues to face resistance, yet the bears cannot make much profit from suppressing the price.

Solana price has a decision to make

Solana price shows extreme turbulence to start the month of August. The bears have been unable to conquer any grounds as the Solana price continues to hover in the congestion $40 zone. Still, the bulls remain in jeopardy according to the Relative Strength Index on the daily time zone.

Solana price currently trades at $41. A fractal has been implemented to forecast a possible resolution for the mundane price action. A breach of $35 could be the catalyst maker bears are looking for to target the $30 and $25 price levels.

SOL/USDT 1-Day Chart

Invalidation of the bearish thesis remains above $60. Traders should remember that a breach above the invalidation point would promote a bullrun targeting $80, resulting in a 100% increase from the current Solana price.

In the following video, our analysts deep dive into the recent price action of Solana analyzing key levels of interest in the market. -FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.