Tezos Price Prediction: XTZ on track to $5 despite stiff resistance ahead

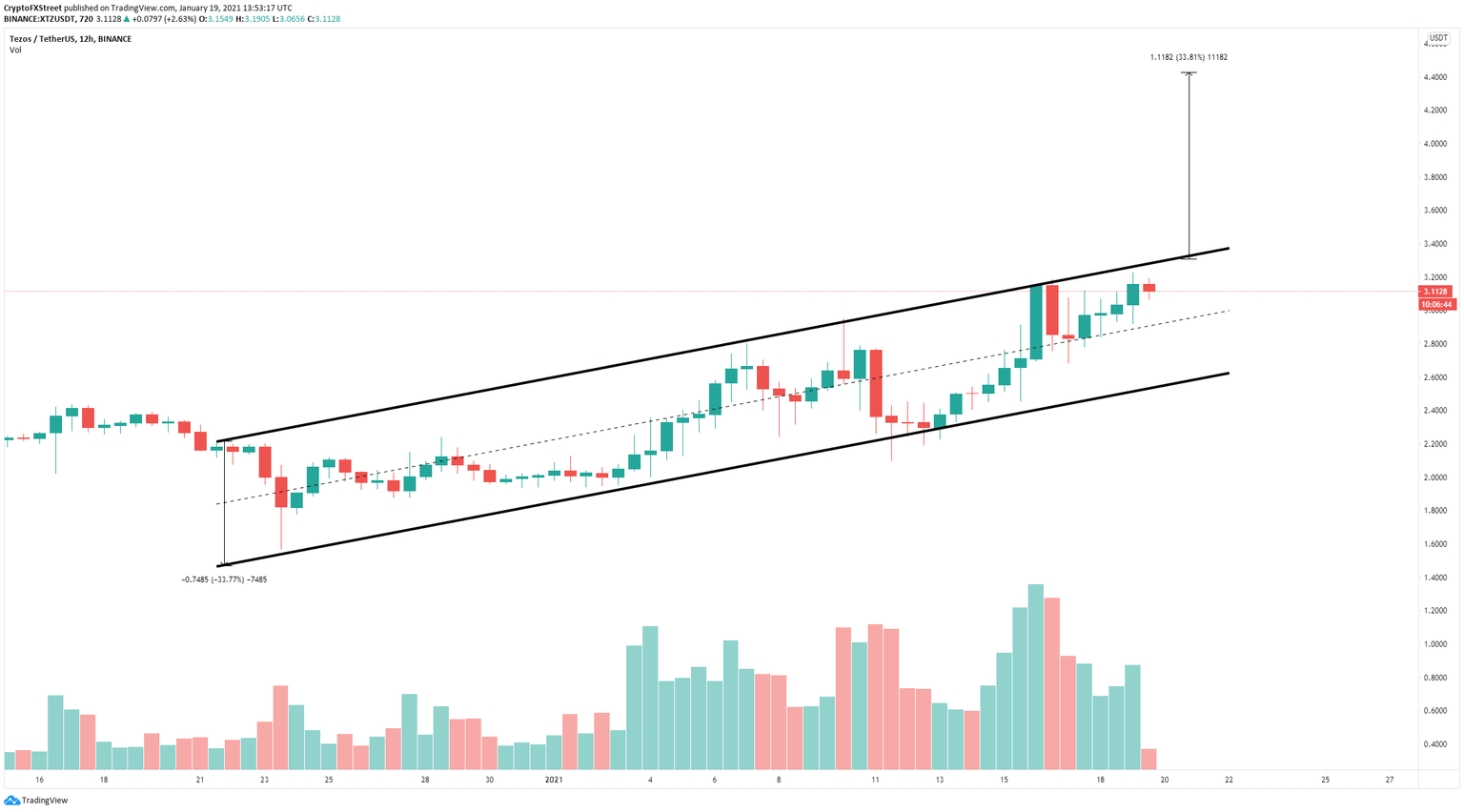

- Tezos price seems to be contained inside an ascending parallel channel on the 12-hour chart.

- XTZ has been trading inside an uptrend since December 23, 2020, and aims for higher highs.

It looks like Tezos is trading under a significant resistance trendline which stops the digital asset from rising towards $5. Additionally, XTZ faces a strong short-term selling pressure according to a crucial indicator.

XTZ price might need to see a pullback before a run to $5

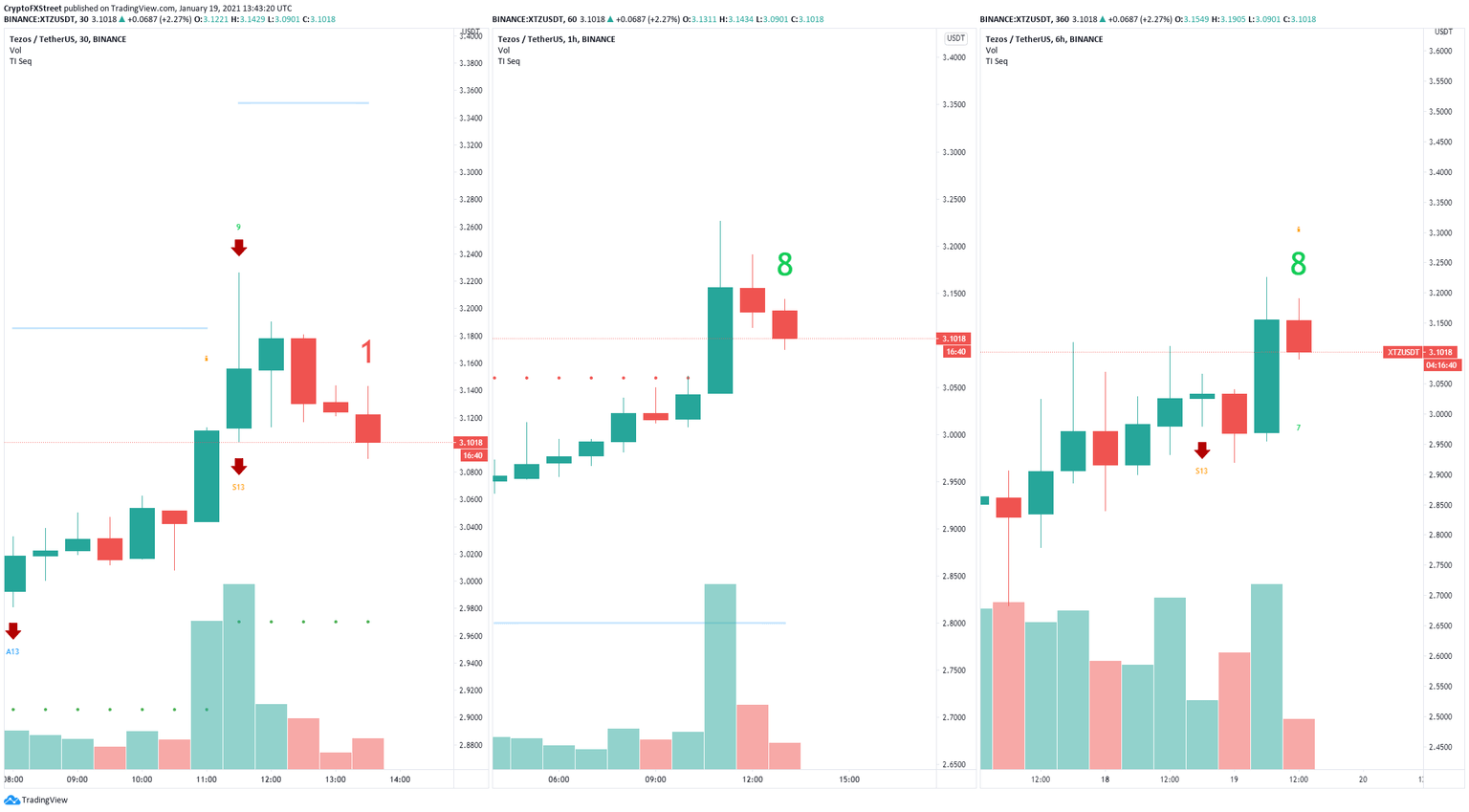

On the 30-minutes chart, the TD Sequential indicator presents a sell signal which had a continuation. On the 1-hour and 6-hour charts, a green eight candle can be seen and this one is often followed by a sell signal.

XTZ sell signals

Validation of all sell signals could quickly push Tezos price down to $2.6, a support level on the 12-hour chart. In this chart, Tezos has established an ascending parallel channel since December 23, 2020.

XTZ/USD 12-hour chart

However, Tezos price is closer to a breakout currently as it trades at $3.10 and the resistance is located at $3.3. Cracking this barrier would drive Tezos price towards $4.4 in the long-term before a potential run to $5.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.