Terra’s LUNA 2.0 price explodes 50% as Binance, Gate.io, KuCoin, Kraken list the token

- Terra’s LUNA 2.0 price jumped 50% overnight in response to listing on cryptocurrency platforms Binance, Gate.io, KuCoin, Kraken and others.

- LUNA 2.0 price surge started hours before listing on world’s largest cryptocurrency exchange, Binance.

- Terra users received lower quantity of LUNA 2.0 airdrop than expected, developers actively working on solution.

Terra’s LUNA 2.0 price recovered from its slump with new listing announcements from cryptocurrency exchanges, wallets and futures platforms. Luna Classic (LUNC) and TerraUSD (UST) holders have raised concerns about receiving less LUNA from the airdrop than expected, and the Terra team is currently investigating the issue.

Also read: Terra’s LUNA 2.0 airdrop: its starting price in exchanges like Binance

LUNA 2.0 price explodes after listing across exchanges

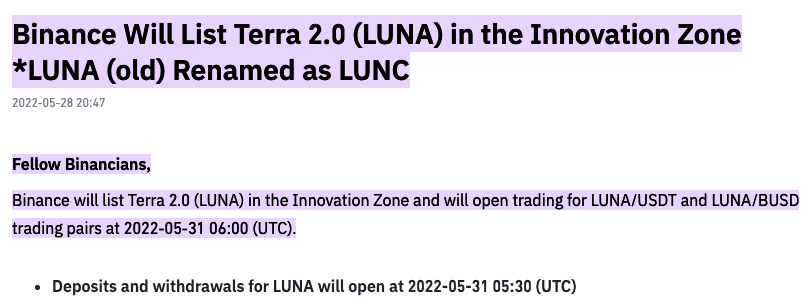

LUNA 2.0 price is nearly 54% away from its debut price of $17.80 on May 28. Following the initial slump, LUNA made a massive comeback after listing announcements across exchange platforms and spot and futures markets. LUNA 2.0 posted 50% gains overnight, as Do Kwon retweeted listing announcements from Bybit, Gate.io, Binance, Kucoin, Huobi, Kraken and OKX. On Binance, LUNA 2.0 is listed in the Innovation Zone, a space for tokens that pose a higher risk than others.

Binance announcement for LUNA listing in Innovation Zone

After the colossal crash of Terraform Labs’ sister tokens LUNA (now Luna Classic, LUNC) and TerraUSD (UST), the CEO and co-founder of Terra unveiled a revival plan to salvage the ecosystem. LUNA 2.0, the revamped version of the LUNA coin, was launched and linked to a new blockchain. LUNA 2.0 price plummeted after its airdrop, with a consistent drop in the token’s price since the hard fork, before it rallied nearly 23% in the last hours.

Binance and leading cryptocurrency exchanges support Terra’s LUNA 2.0

Major cryptocurrency exchanges pledged support for Terra’s LUNA 2.0 airdrop and listing across their platforms. Perpetual futures, spot and derivatives trading in LUNA 2.0 is live on several platforms.

Together with crypto heavyweights like Binance and Kraken putting their weight behind LUNA 2.0, Leap wallet, Guarda wallet and Atomicwallet.io also support the token. Large players in the crypto wallet space, like MetaMask and Trust wallet, are yet to announce support for LUNA 2.0.

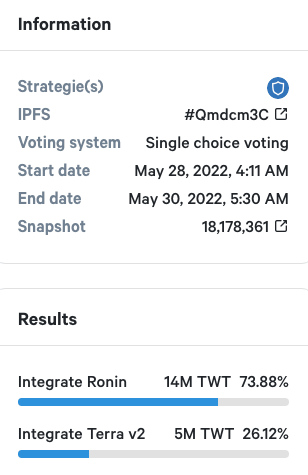

Trust wallet, which supports 66 blockchains, recently called its community to vote on a governance proposal, choosing between the Ronin chain and Terra. Since both blockchains have suffered from an attack of different magnitudes that have negatively influenced their token prices, Trust wallet asked the community to identify the chain where the positives outweigh the cost of prioritizing integration.

Governance proposal on Trust wallet

The result of the proposal was a higher (73.88%) demand for Ronin integration, over Terra’s LUNA 2.0 token.

Terra’s LUNA 2.0 airdrop lower than expected

Eligible Terra’s LUNA (now LUNA Classic, LUNC) and UST holders have raised concerns regarding a lower airdrop of LUNA 2.0 than expected. The team behind LUNA 2.0 is gathering more information from the relevant snapshots and the blockchain, and revealed that the issue is currently being investigated.

Attention $LUNA airdrop recipients

— Terra Powered by LUNA (@terra_money) May 30, 2022

We are aware that some have received less $LUNA from the airdrop than expected & are actively working on a solution.

More information will be provided when we have gathered all of the data, so stay tuned.

The Terraform Labs team is aware that some users are awaiting an actively working solution for receiving lower LUNA 2.0 tokens that they are eligible for. Terra’s team has asked users to stay tuned for more information on the issue.

Is it good to buy Terra’s LUNA 2.0?

Analysts at FXStreet have evaluated the Terra LUNA 2.0 price chart and the token’s potential after its relaunch. In the following video, Akash Girimath, a leading cryptocurrency analyst at FXStreet reveals whether it is profitable to buy Terra’s LUNA 2.0 tokens.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.