Terra price enjoys the ride but LUNA uptrend is questionable

- LUNA has had a drastic rise at the beginning of August.

- Price action is starting to get out of control with no real fundamental explanation for the move.

- New buyers will need to wait patiently for good entry levels before getting in.

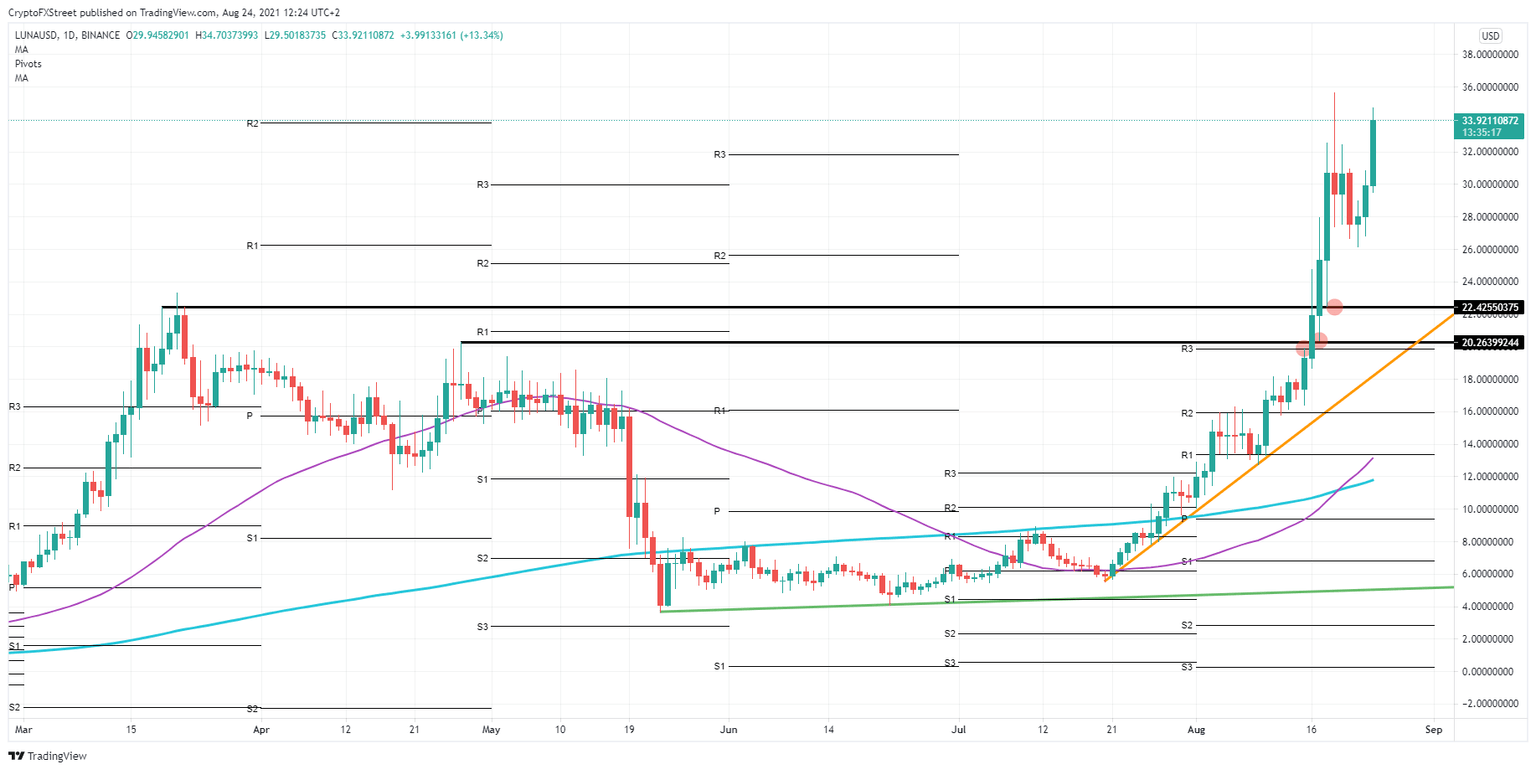

Patience remains a virtue for LUNA, with price action still very much elevated from the entry levels first at $22.42. Terra jumped higher, bouncing off that level on August 17. The days before, LUNA was able to break above, but price action each time had to dip to attract buyers back into the rally.

Since then, price action added another 58% of gains. There is an issue with that rally after August 18 though. The issue is that no new buyers are being added to the rally. And those who do are brave souls taking a plunge into the unknown deep, not knowing if their entry will play out in profit.

LUNA needs new buyers or this rally will start to fade

On August 22, that one correction unfolded already. Buyers who stepped in the day before around $30 stopped out on their longs at approximately $26. Smarter buyers were brave enough to step in at that level. Looking back on the chart, that level holds no historical importance. It is not forming a double top. There is no moving average nearby, no trend line providing any support. The second issue is that prices vary daily from 10% to 17% or even 18%. Imagine that as a buyer, you step in just at the high of the day. You stand to lose a possible 10% or 18% of your buy-in. Any sane trader will tell you that those odds are not an excellent risk-reward ratio and the way to trade or invest.

Experienced traders and investors will still wait for a return to proven levels. Around $22.42 and $20.26 are perfect technical entry levels with proven support and historical importance. These are the levels where the significant volume will step in and make it safer for entry.

For the buyers who are still in, expect a problematic move toward $36. Any further push upwards will be short-lived as few new traders and volume have entered because of the lack of entry points. xpect this rally to fade relatively soon and correct back toward $22.42.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.