Stellar scraps XLM inflation in the latest protocol update

- Stellar releases a new version of its protocol that does not support the inflation feature.

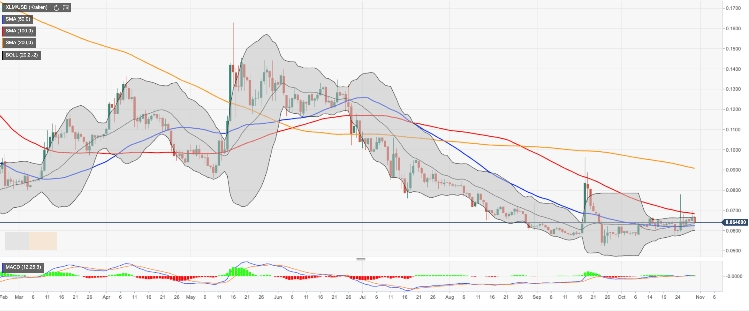

- XLM/USD is moving within a short-term downside trend.

Stellar network finished the scheduled protocol update to v12. The new version disabled the inflation mechanism for XLM tokens, according to the announcement made by Stellar Foundation in the official blog post.

The Test Network (Testnet) reset is scheduled on Wednesday, October 30, 2019.

The proposal to eliminate inflation was made in October 2018. After lengthy discussions, the team decided to do just that, because inflation " isn’t benefiting projects building on Stellar".

The inflation was conceived as an incentive mechanism, "whereby account holders would collectively direct inflation-generated lumens toward projects built on Stellar." However, it failed to live up to expectations.

What's going on with Stellar (XLM)

XLM/USD is changing hands at $0.0640, off the recent high of $0.0780 hit on October 25. The coin's movements are limited by SMA50 (Simple Moving Average) daily ($0.0624) on the downside and SMA100 daily ($0.0682) on the upside. We will need to see a sustainable move outside this narrow channel to build a clear trend.

Stellar (XLM) is now the 11th largest digital asset with the current market value of $1.2 billion. The coin has lost nearly 4% on a day-to-day basis amid global downside correction on the cryptocurrency market.

XLM/USD, daily chart

Author

Tanya Abrosimova

Independent Analyst