Solana price up 25%, expert says FUD is driving the rally

- Solana price is up 25% in the month, 135% in the year, outperforming the first 100 cryptocurrencies by market capitalization.

- The performance is striking, considering SOL bears the SEC’s security label that threatens its exchange listings.

- The unorthodox performance has experts like Tedtalksmacro evaluating the role of FUD in driving the rally.

Solana (SOL) price displays bullish resolute, recording higher highs despite negative tailwinds as regulatory clampdown in the cryptocurrency market continues. The Ethereum (ETH) killer continues to outperform the market, leading the first week of July in market gains.

Also Read: Ripple price suffers the aftermath of Hinman email failure as the XRP hype train dissipates

Solana price leads the weekly gainers

Solana (SOL) price is up a shocking 25% since July started, while crypto giants like Bitcoin (BTC) and Ethereum oscillate between abysmal gains and losses in the 0-3% range. Based on CoinMarketCap data, SOL is the highest weekly gainer, with its market cap rising 15% over the last 24 hours. Similarly, interest in the token continues to grow, indicated by a 10% increase in 24-hour trading volume.

This bullishness is unorthodox or unusual for the layperson, considering the US Securities and Exchange Commission (SEC) recently labeled SOL a security, alongside 11 other altcoins. The tag cast a shadow of Fear, Uncertainty, and Doubt (FUD) on SOL, causing it to lose its place on the Robinhood app and European exchange and payments company, Revolute.

Key players in the SEC’s list of 12 include Solana, Cardano, and Polygon. Notably, SOL has outperformed ADA and MATIC, which boast 0.10% and 3.42% gains over the last seven days, suggesting that the FUD is boding well for Solana alone.

It is worth mentioning that the Solana Foundation came out strongly to deny the SEC’s security label for SOL, saying it has utility in the ecosystem.

Trending #Solana News

— cryptowise.finance (@cryptowise_fin) June 9, 2023

Solana Foundation: SOL is 'Not a Security'#cryptonews #crypto #cryptocurrency $SOL #SOL

Follow for more pic.twitter.com/fvsvUxImLu

To tackle the SEC enforcement action, the Solana blockchain committed to fork with the proposal, garnering support from investors and influencers alike. For ease of understanding, a fork happens when a community alters a blockchain protocol to operate on different rules.

Bold but not a bad idea actually. Community fork solana will get rid of sec issue.

— HGE.ABC (@HGEABC) June 10, 2023

No bankruptcy will dump on you for next 3 years continuously.$ETH is a fork of $ETC and doing well.

Blink twice if you agree https://t.co/fWxbkMQ4aI

See community support for the proposal here.

Solana price and the role of FUD

Tedtalksmacro, an expert who covers insights into cryptocurrency markets with a focus on macroeconomic fundamentals, believes FUD is the main driving force behind the Solana price rally.

The more you all FUD, the higher it will go.$SOL pic.twitter.com/F2HKr9Vl1C

— tedtalksmacro (@tedtalksmacro) July 8, 2023

In his opinion, the more FUD builds up around SOL, the more it will increase in market value. Interestingly, other ecosystems like Binance actively fight off this concept with CEO Changpeng Zhao’s signature “4”.

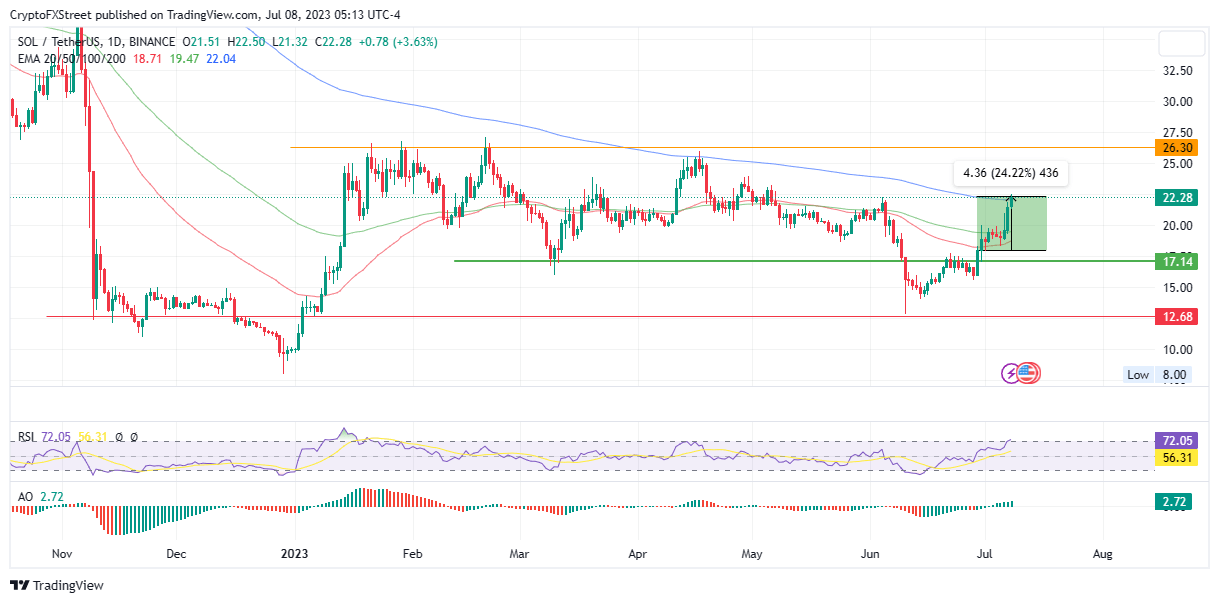

With analysts predicting a continued uptrend, Solana price could breach the $25.00 mark, or in a highly bullish case, revisit the range high at $26.30, levels last seen in February.

The Relative Strength Index (RSI) is moving north, suggesting a rising momentum. This is bolstered by the favorable position of the Awesome Oscillators (AO) above the midline.

SOL/USDT 1-Day Chart

Noteworthy, the RSI position at 72 shows SOL is overbought, meaning a pullback could be imminent, although not so extreme to correct recent gains. Bulls could revitalize right below 70 before a continued uptrend, but investors should wait for confirmation as Welles Wilder only describes an asset as overbought upon a decisive breakdown below the 70 level by the RSI.

Like this article? Help us with some feedback by answering this survey:

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.