Solana price rallies 35% in three weeks despite declining interest from market participants

- Solana price is recovering from the SEC clampdown on cryptocurrencies.

- SOL price is $20.17, unlike the $250 level seen with similar development activity in 2021.

- The Ethereum-alternative token SOL has low development activity and social dominance, despite its price rally.

Solana price recovered from the US financial regulator Securities and Exchange Commission’s (SEC) clampdown on crypto. SOL price is in an upward trend, yielding double-digit gains for holders over the past three weeks.

Moreover, Solana’s price recovery is not dependent on on-chain metrics like development activity and social dominance. The asset price has consistently moved higher despite the SEC’s label of “security."

Also read: Shiba Inu price recovery is likely, on-chain metrics suggest

Solana price recovers from SEC crackdown

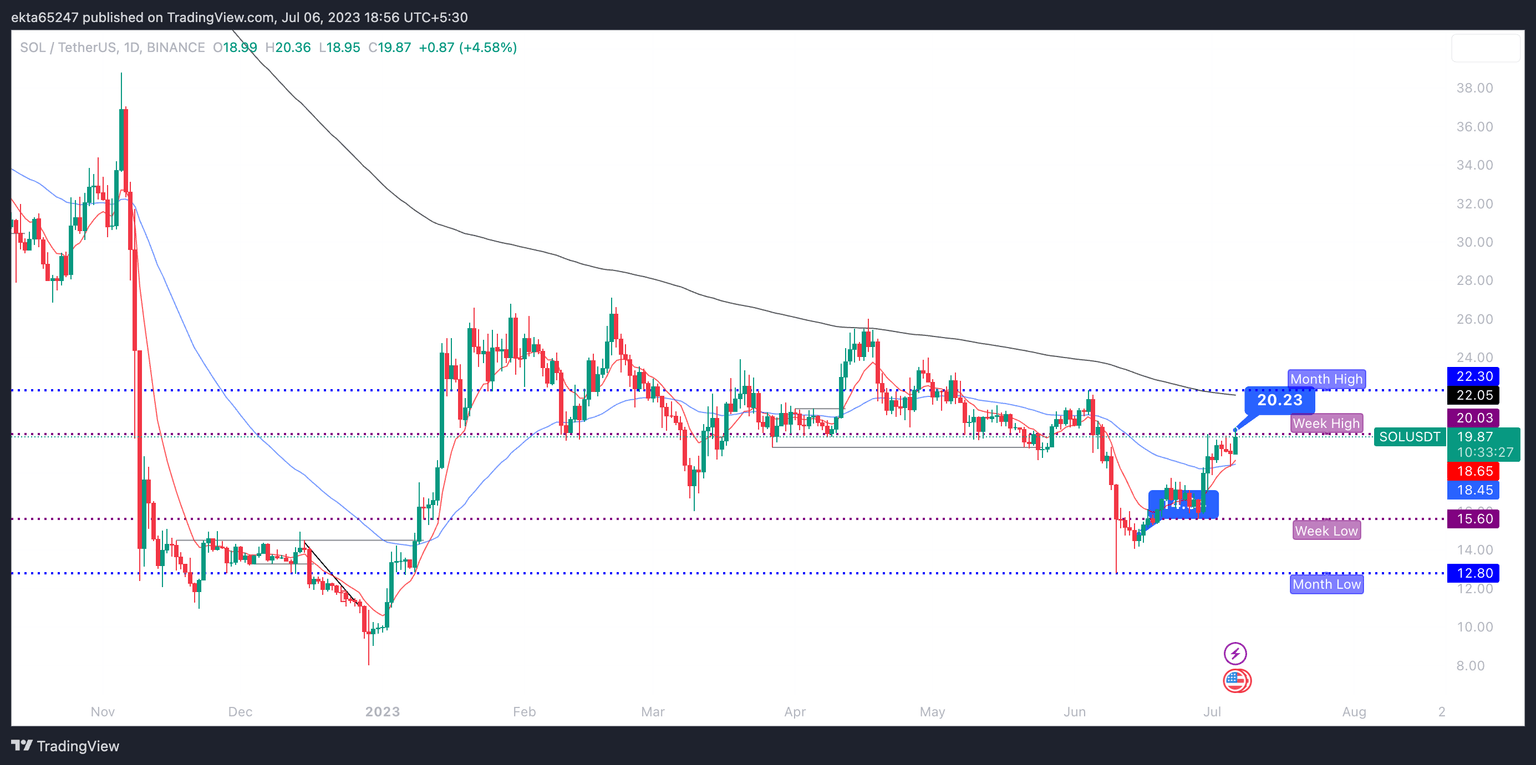

Solana, popular as the Ethereum-killer among crypto market participants, observed a rally in its price over the past three weeks. SOL price climbed from $14.84 to $20.23 in this timeframe, over 35% gains for holders.

SOL/USDT one-day price chart Binance

Interestingly, analysts at Santiment noted that on-chain metrics like social dominance and development activity did not negatively impact SOL price. The development activity in SOL network is similar to 2021, where the asset rallied to the $250 level, as seen in the chart below.

However, price is yet to catch up with development activity.

%2520%5B17.18.25%2C%252006%2520Jul%2C%25202023%5D-638242485691396328.png&w=1536&q=95)

Solana development activity, social dominance vs price

Similarly, social dominance is below the levels seen in March and June. This implies SOL has failed to garner relevance among market participants. The SEC’s crackdown on crypto and the regulator’s labeling of SOL as a “security” are the leading causes of the same.

Analysts at Santiment published a report on Solana, suggesting that SOL holders watch out for a rally in the altcoin in the short term as on-chain indicators slowly flip bullish and trends repeat themselves.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.