Solana price could continue the heartbreaking decline as bears target $30

- Solana price shows bearish control on the volume indicator.

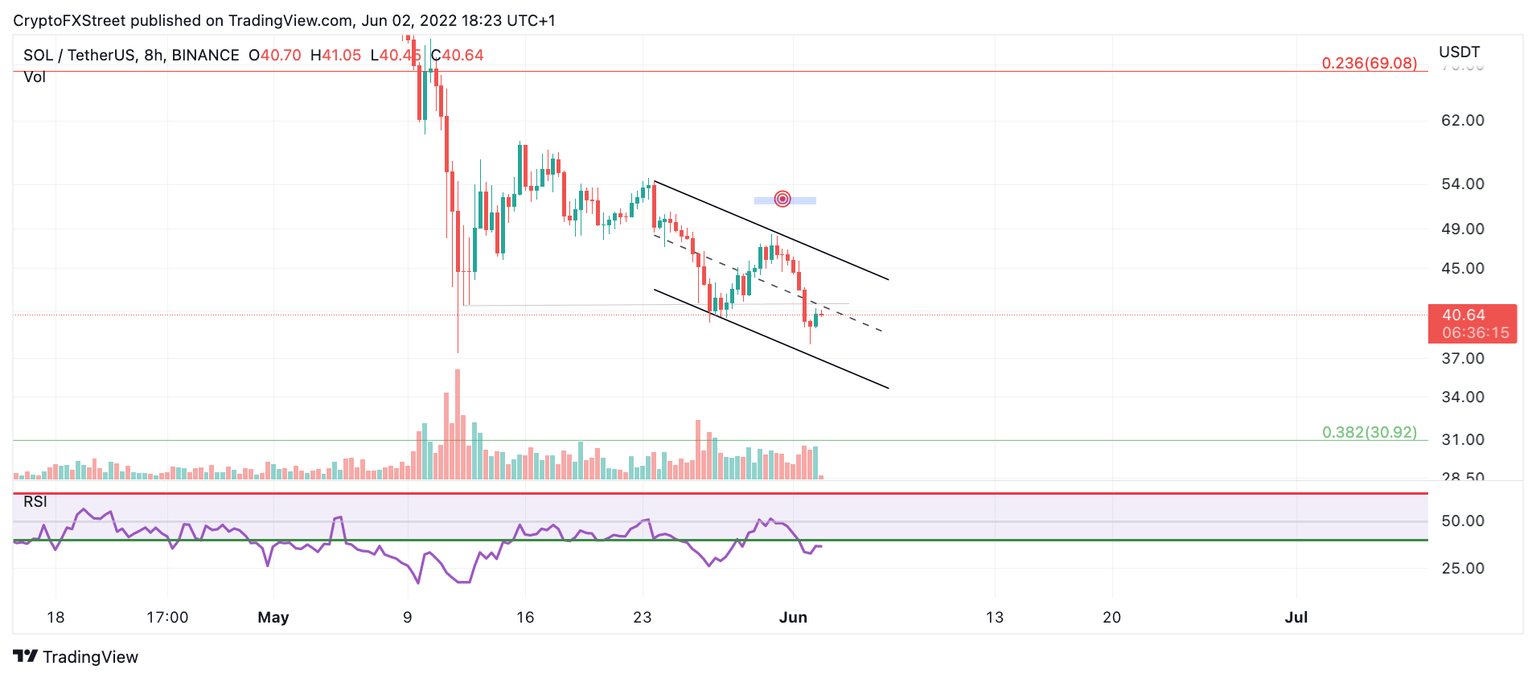

- SOL consolidated within a descending channel.

- Invalidation of the bearish thesis is a close above $45.

Solana price could fall towards $30 to grab liquidity established in 2021. Market makers could continue sideways price action before slaughtering early bulls to create a climatic downslide.

Solana price is submerged

Solana price is currently trading at $40 and consolidating below a descending channel’s median line. When analyzing the technicals, it appears the Solana price could commence a plummet into $30 as the bulls are losing support at the current price level. Buyers should avoid investing in the digital asset until more bullish confluence is established.

Solana price is still seeing new bears enter the market on the Volume Profile indicator. The 8-hour chart shows a decent ramping pattern which should be taken seriously. The SOL price is still submerged on the Relative Strength Indicator as well. When combined, there is not enough bullish evidence to support more gains at the time of writing.

SOL/USDT 8-Hour Chart

Traders should look for better opportunities in the market to avoid unnecessary losses. The Solana price does not forecast any large moves at the moment. Invalidation of the current bearish thesis is a close above $45. If this price breach occurs, there is a chance Solana price could climb to $52, resulting in a 30% increase from the current price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.