Solana price action hit a curb and got rejected at $145.20, with more correction to come

- Solana bulls are unable to get past the 38.2% Fibonacci level.

- With global market sentiment in a negative mood, expect a short-term dip lower.

- Bulls will be waiting for support at $121.67 before starting to defend SOL price action.

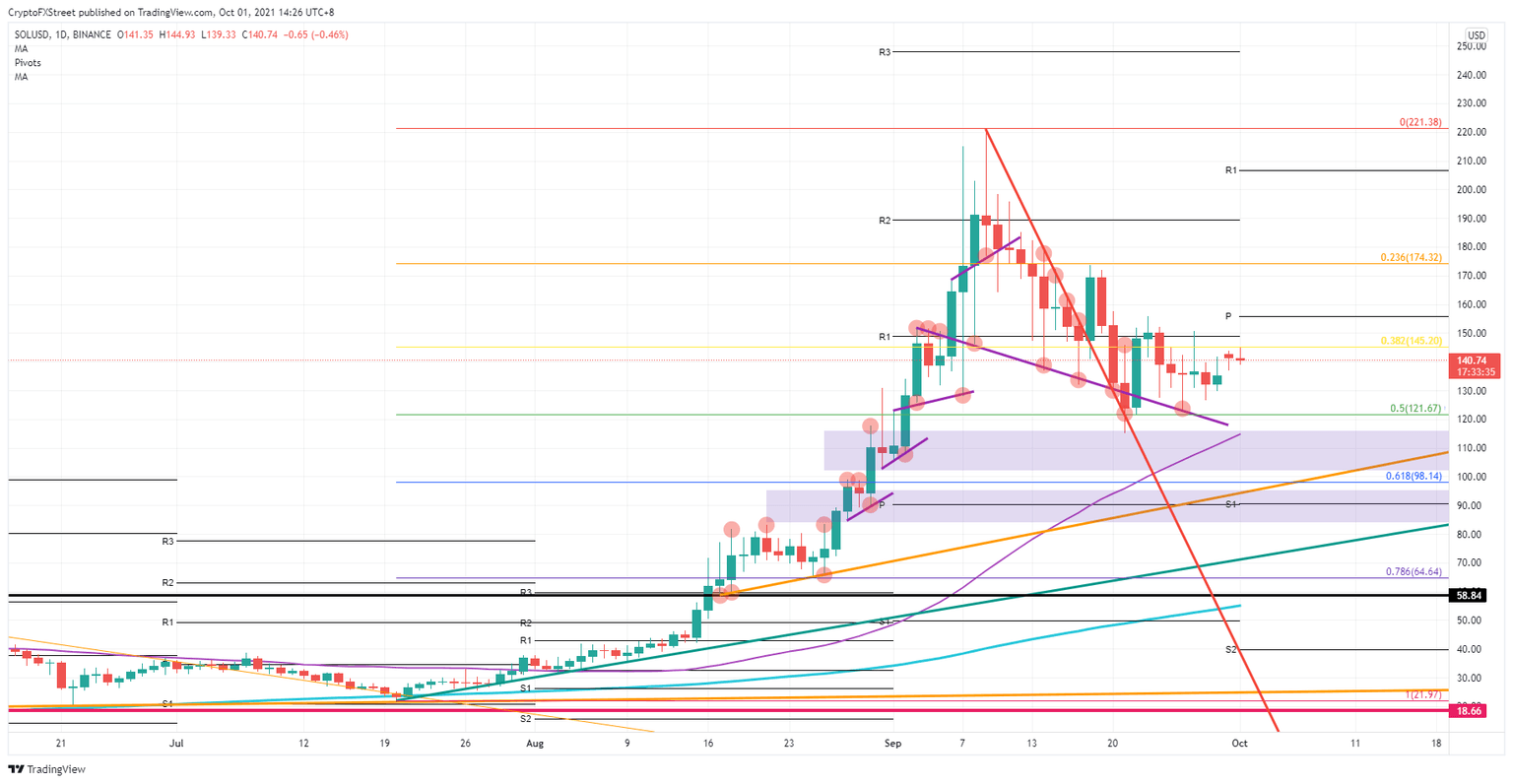

Solana (SOL) is in a rough spot as bulls have tried to break above the 38.2% Fibonacci level at $145.20. That rejection is happening with global market sentiment shifting to the downside as both US and Asian index futures are red. Bears will jump on the occasion to go for a short-term short in SOL toward $121.67 or the 50% Fibonacci level.

Solana price bulls waiting for brighter market sentiment to start run toward $220

Solana bulls entered on September 26 with a bounce off that purple descending trend line. In the pop that followed, both the 38.2% Fibonacci level and the monthly R1 resistance level for September at $150 got broken to the upside. With global market sentiment starting to fade this week, bears saw an opportunity to mute any further upside.

SOL price action now sees bears defending the 38.2% Fibonacci level at $145.20. With most of the index futures for Europe and the US already deeply in the red, it looks as if the week will be closed with a sour taste. This will help the bears to push price action back down toward the 50% Fibonacci level at $121.67.

SOL/USD daily chart

Expect bulls to back off for now as the general sentiment and overall downtrend this week is not the right environment to go long in a big way. Bulls will wait for that retrace to $121.67 and defend that with the purple descending trend line and the 55-day Simple Moving Average (SMA) in their corner at those levels.

Bears will want to get out as any further downtrend will be slim once the dust has settled this weekend, and markets will open with a renewed positive sentiment on Monday. Should, however, negative sentiment continue on Monday, expect the 61.8% Fibonacci level at $98.14 to do the trick.

Like this article? Help us with some feedback by answering this survey:

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.