Solana outperforms Ethereum since September, Coinbase led US market with 2.2 million in October SOL net buys

- The ratio between Solana and Ethereum jumped from 0.011 to nearly 0.025, breaking the ratio from just before FTX’s collapse.

- The two tokens are often compared, given they are both Layer 1 tokens.

- Net sales was led by Coinbase exchange in October, recording up to 2.2 million tokens in US sales, Kaiko research shows.

- South Korean exchange Upbit was the leader outside the US, recording nearly 4 million in net SOL token sales.

Solana (SOL) and Ethereum (ETH) tokens are often compared, considering their heft in the Layer 1 (L1) space. Their performance over the past two months has been significant, with both ecosystems rising along with the broader market as talks of an imminent bull market continue to trend.

Solana price outperforms Ethereum

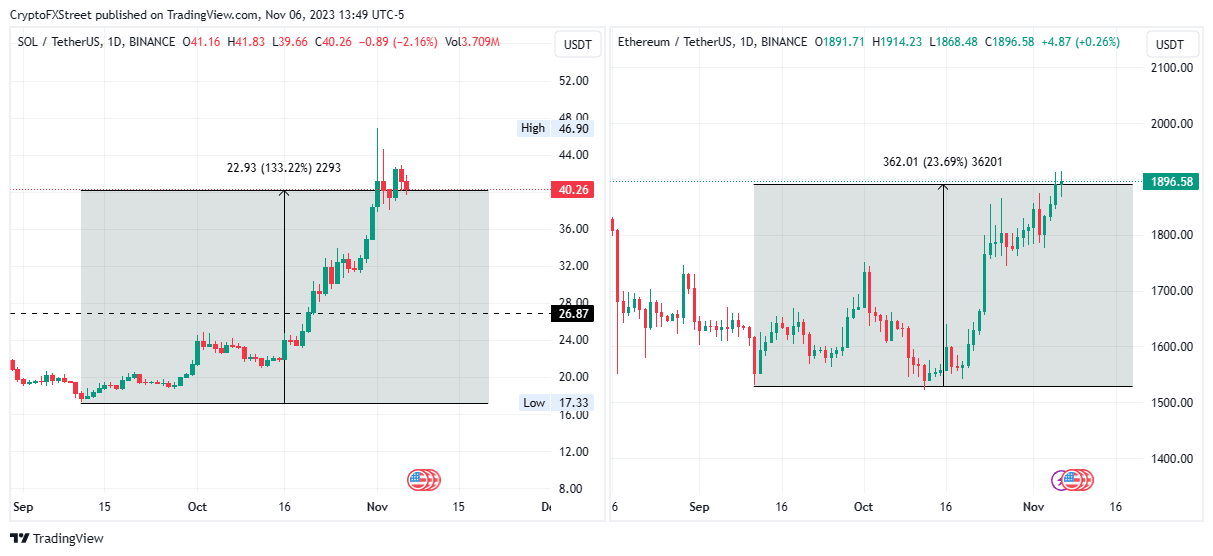

Solana (SOL) price has outperformed Ethereum (ETH) by a long way, recording almost 135% in gains since September relative to the latter’s 23%. This is almost a six-fold difference. With the move, the SOL price of $40.26 is testing levels last seen in August 2022, while ETH is revisiting the July 23, 2023 high of $1,894.

SOL/USDT 1-day chart, ETH/USDT 1-day chart

Data from Kaiko highlights the striking performance of SOL, with Solana price rising almost 115% since mid-October. It signifies a robust recovery from the FTX-infused depths around the $10.00 range in November 2022, with the research pointing to a significant growth in network activity, particularly where liquid staking token protocols such as Jito, the second liquid-staking Protocol on Solana, are concerned. Data shows that Jito has recorded up to $12 million in funding and a total value locked (TVL) of about $224 million.

SOL DeFiLlama

The research shows the ratio between Solana and Ethereum has more than doubled since October 18, jumping from 0.011 to nearly 0.025 and thereby breaking above the ratio from just before the collapse of Sam Bankman-Fried’s (SBF) cryptocurrency empire.

Coinbase exchange led the US market with a net buying of 2.2 million SOL tokens (worth approximately $88.57 million at current rates) since the rally began on October 18. Binance, the largest cryptocurrency trading platform by trading volume, followed behind Coinbase in the US until the onset of November when the broader market witnessed an acceleration in buying pressure.

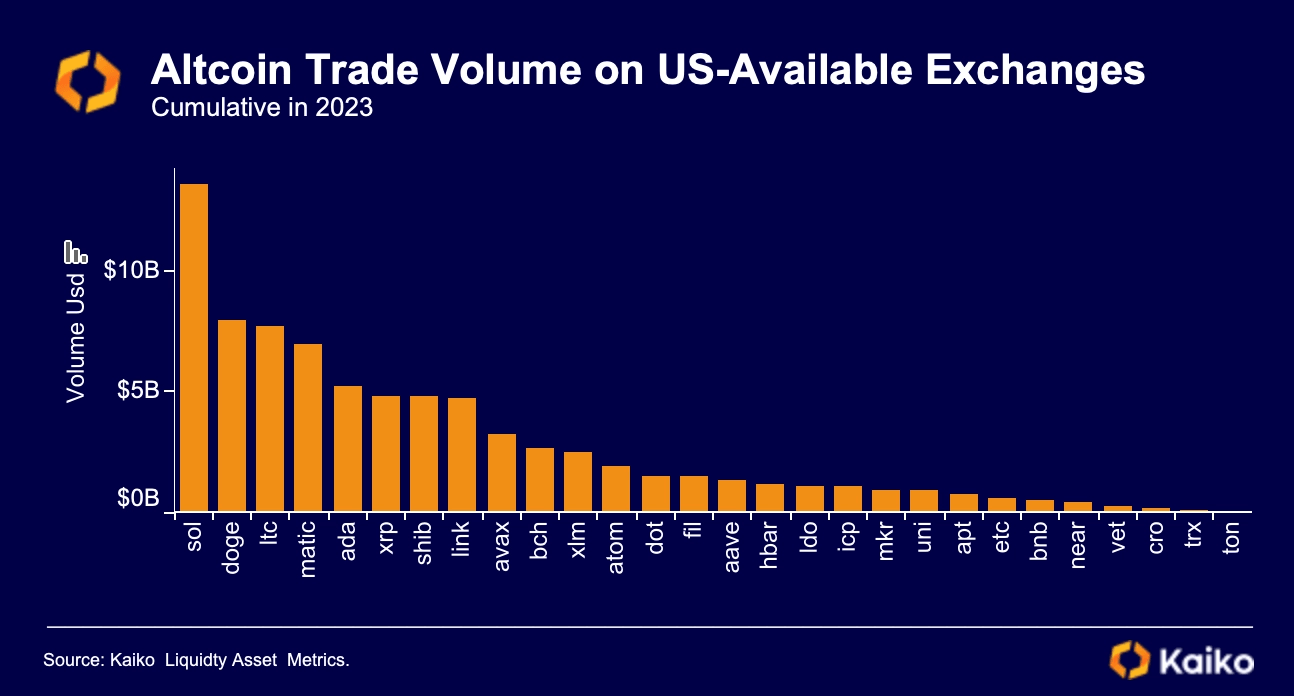

SOL is also at the very top of the list for the most-traded altcoins on US-based exchanges in 2023, outpacing Dogecoin (DOGE), Litecoin (LTC), Polygon (MATIC) and Ripple (XRP).

SOL trading volume relative to other altcoins in US-based exchanges

Meanwhile, Korea’s leading exchange, Upbit, has bucked the trend when considering the expansive crypto industry outside the US, recording almost 4 million SOL tokens in net sales in October.

Nevertheless, it is worth mentioning that Upbit has frequently been a controversial platform owing to the characteristic tendency of Korean traders to pump and dump trades. CryptoQuant CEO Ki Young Ju at some point in 2021 acknowledged that Korean traders favor pumping and dumping altcoins specifically, attributing the habit to the region's "very strict capital controls, blocking arbitrage opportunities between global exchanges."

Fun Fact 3.

— Ki Young Ju (@ki_young_ju) March 30, 2023

Korean crypto traders love pumping & dumping altcoins, ironically. Got this clip from my Korean friend. pic.twitter.com/63Ewssu5VO

Overall, however, the Kaiko research concludes that what started as a tough year for altcoins in the US has improved significantly across October, especially beginning on the 18th.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.