Solana now boasts more than 2,500 monthly active developers

The Solana ecosystem now touts more than 2,500 monthly active developers, according to recent data from the Solana Foundation.

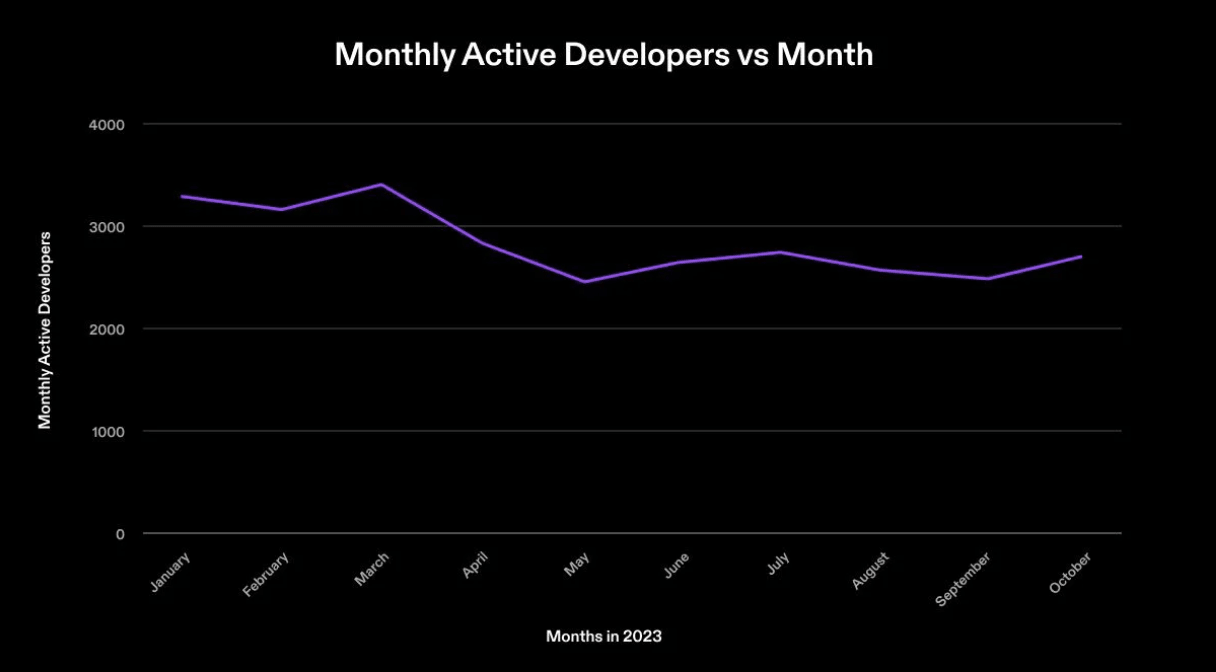

In a Jan. 9 report that assessed key network metrics throughout 2023, Solana claimed that its network had maintained somewhere between 2,500 and 3,000 monthly active developers over the last year.

“Sustaining a consistent amount of developers is an important indicator of a healthy ecosystem as it showcases the ecosystem’s ability to attract and retain new talent,” it said, while also noting that the measurement only accounts for developers contributing in public repositories.

Monthly active developers are down from January 2023. Source: Solana Foundation

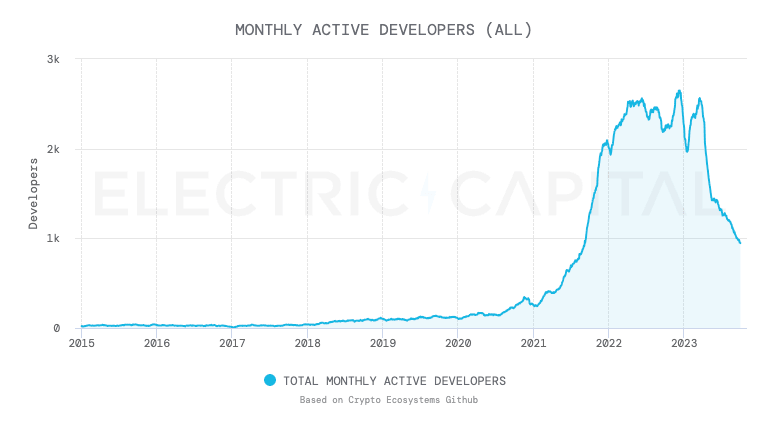

However, data from Electric Capital’s blockchain development tracker Developer Report shows that as of Oct. 1, 2023, Solana’s developer count was only 946, falling from an all-time high of 2,634 on Dec. 22, 2022.

Solana’s developer count tumbled throughout 2023. Source: Electric Capital

Developer Report cites data from GitHub to produce data points concerning blockchain developer activity. However, the statistics were only up to Oct. 1. An Electric Capital spokesperson told Cointelegraph the data for the fourth quarter would be updated by next week.

On the other hand, Ethereum’s total monthly active developer count stood at 5,769 on Oct. 1, 2023, down 22% from its peak count of 7,433 on June 16, 2022, per Electric Capital data.

2/ Solana has sustained a monthly active developer count between 2500-3000 through 2023, showcasing the ecosystem's ability to attract & retain talent.

— Solana (@solana) January 8, 2024

It’s important to note that only open source developers can be measured, resulting in an underestimation of total developers. pic.twitter.com/SV8N4iJLo4

Meanwhile, developer retention on Solana has increased by 50% over the last three months, coinciding with an ongoing boom in activity on Solana’s network, as well as upward price action for the native Solana (SOL $101) token.

Solana had seen an outsized 500% price rally between October and December — spurred on by a frenzy for SOL-based memecoins — leading to it briefly surpassing Binance’s BNB (BNB $305) token to become the fourth-largest cryptocurrency by market capitalization on Dec. 22, posting yearly highs of $122 just days later on Dec. 26.

The network also witnessed a drastic uptick in activity, briefly flipping Ethereum in 24-hour decentralized exchange volumes in the same month.

Cointelegraph contacted Solana for comment but did not receive an immediate response.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.